China’s Social Credit Score System Expands to Central Bank Digital Currencies: A Cautionary Tale

In the evolving landscape of China’s societal control, a new chapter unfolds as the country’s Social Credit Score system extends its reach into the realm of Central Bank Digital Currencies (CBDCs). This recent development not only marks a significant shift in monitoring and regulating financial transactions but also tightens the grip on citizens’ daily lives through their social behavior. Among those affected is Leo Hu, a Chinese journalist whose low social credit score has led to severe repercussions, including prohibitions on flying, acquiring property, and enrolling his child in a private school. This narrative not only sheds light on China’s stringent control mechanisms but also serves as a cautionary tale for the rest of the world about the potential perils of a cashless society intertwined with social governance.

The Intricacies of Control: Social Credit Meets Digital Currency

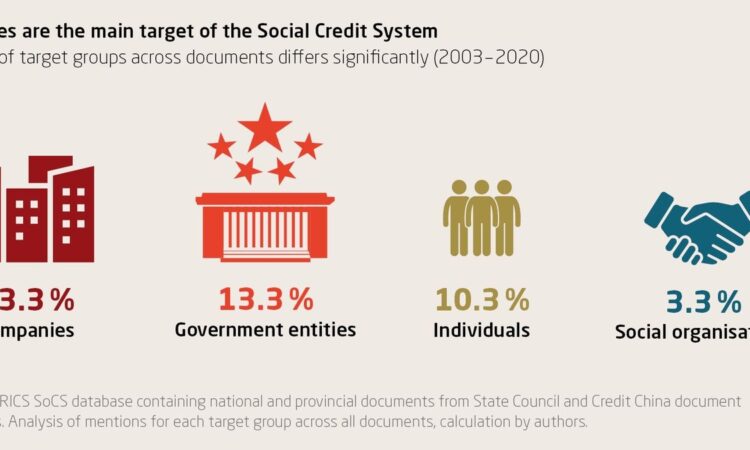

The integration of the Social Credit Score system with CBDCs represents a pioneering yet controversial approach to governance. By linking financial capabilities directly to a citizen’s social standing, the Chinese government has created a powerful tool for influencing behavior. Critics argue that this fusion of financial and social regulation poses a significant threat to personal freedom and privacy. The case of journalist Leo Hu exemplifies the system’s potential to drastically alter lives. With restrictions that extend beyond financial transactions to affect personal and familial opportunities, the stakes of maintaining a favorable social credit score have never been higher.

Behind the Veil of Secrecy

Despite its profound impact on society, the mechanisms and criteria of China’s Social Credit Score system remain shrouded in mystery. The government’s reluctance to disclose the specifics fuels speculation and concern among both Chinese citizens and international observers. This opacity is believed to be strategic, allowing the state to modify behaviors through a combination of anticipated rewards and fears of punishment. The lack of transparency raises critical questions about accountability and the potential for abuse within the system. It is a reminder of the delicate balance between technological advancement and ethical governance.

A Global Wake-up Call

The repercussions of China’s social credit and CBDC integration extend far beyond its borders, prompting a global reassessment of the move towards cashless economies. The plight of Leo Hu and countless others facing similar restrictions highlights the darker possibilities of such systems. In America and elsewhere, there is a growing realization of the need to tread carefully in the adoption of digital currencies, particularly when it comes to linking financial access with social compliance. The Chinese model serves as both a blueprint and a warning, igniting debates on privacy, freedom, and the role of government in the digital age.

As the world watches China navigate the intersection of social governance and financial technology, the implications are clear. The expansion of the Social Credit Score system to encompass CBDCs is a bold move that redefines the boundaries of state control and personal freedom. For individuals like Leo Hu, the consequences are personal and profound, serving as a stark reminder of the power of technology to shape lives. For the global community, it is a moment to reflect on the values that should guide the future of digital finance and social governance. In the balance lies the promise of innovation and the peril of overreach, a duality that will define the era to come.