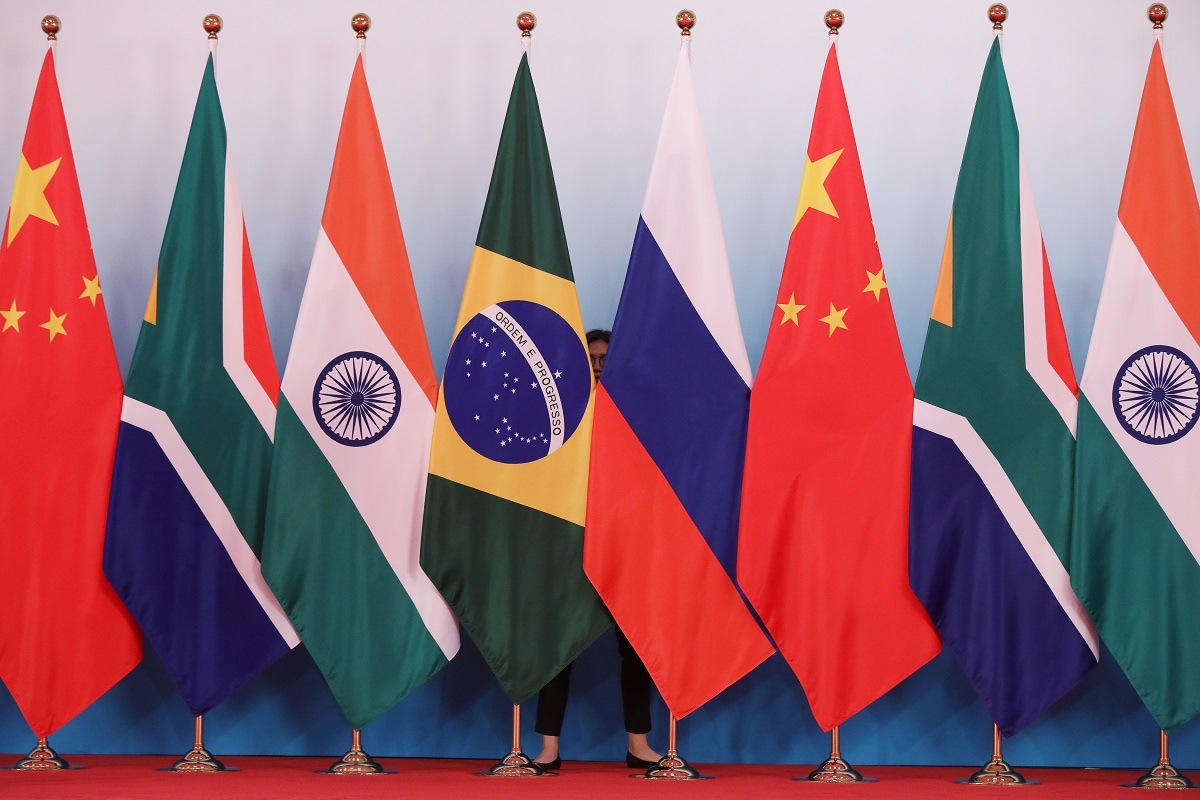

There has been increasing talk of the BRICS nations (Brazil, Russia, India, China and South Africa) developing a new currency that will rival the US dollar as the global reserve standard. This month, the leaders of BRICS will meet in South Africa for further discussions on the matter. Growing pressure for a new global currency comes after continued weaponisation of the US dollar in the form of sanctions and trade wars. Many countries are seeking greater independence from the US financial system. But what makes the US dollar today’s world reserve currency?

During the 2022 BRICS summit, Russian President Vladimir Putin announced that the bloc was working to create an “international reserve currency”.

Following the end of the Second World War, the Allies gathered at Bretton Woods and anointed the US dollar as the world’s principal reserve currency. It was pegged against gold at an exchangeable rate of $35 an ounce. However, in 1971 the dollar was decoupled due to insufficient US gold reserves rendering the dollar fiat money. A few years later, US Secretary of State Henry Kissinger visited King Faisal of Saudi Arabia to broker the petrodollar system. The United States agreed to provide military support and, in return, the Organisation of the Petroleum Exporting Countries (OPEC) would denominate oil globally in US dollars. This created synthetic demand – countries buying oil would need US dollars – which in turn enabled US dollar primacy.

However, the dollar dominance may be coming to an end. In 2021, Saudi Arabia and Russia signed a military cooperation agreement. The United States was no longer the sole protector of the Saudi Kingdom. Moreover, at this year’s World Economic Forum in Davos, Saudi Arabia’s Finance Minister Mohammed Al-Jadaan announced that the country was open to trading in other currencies in addition to the US dollar – something they haven’t done in nearly 50 years. The signals of de-dollarisation were emerging.

During the 2022 BRICS summit, Russian President Vladimir Putin announced that the bloc was working to create an “international reserve currency”. This will again be on the agenda for the 15th annual BRICS summit this month. It is speculated that the BRICS currency will be backed by gold – this would be a historic return of the gold standard and bring stability to the new currency.

Indeed, central banks are already stockpiling gold reserves. According to the IMF World Gold Council, the first two months of this year saw the largest purchases of gold from Singapore (51.4 tonnes), Türkiye (45.5 tonnes), China (39.8 tonnes), Russia (31.1 tonnes) and India (2.8 tonnes). It seems clear that BRICS countries are accumulating gold in preparation for their new currency (noting Türkiye, among many others, has applied for BRICS membership). Meanwhile, we see a declining share of US dollars held by central banks, according to the IMF Currency Composition of Official Foreign Exchange Reserves (COFER). Countries are positioning themselves for a new international system.

As the reliance on US dollars diminishes, central banks will begin dumping their dollar reserves.

For decades, the United States has been considered the global hegemon. However, BRICS nations now account for more than 40 per cent of the world’s population and have an aggregated global GDP of 31.5 per cent. This surpasses the G7’s (United States, Canada, France, Germany, Italy, Japan and the United Kingdom) GDP of 30.7 per cent. It’s conceivable to see BRICS nations entirely self-sufficient, trading among themselves without any reliance on the United States. This may well be China’s plan, given the extent of its Belt and Road Initiative (BRI) – the largest infrastructure development project in history aiming to connect Asia and Africa, Europe and South America. The United States is noticeably excluded.

Despite China–India relations alternating between détente and antagonism, both countries seem willing to cooperate to some extent, with India participating and investing in the BRI on a proxy basis through the Asian Infrastructure Investment Bank, New Development Bank and Shanghai Cooperation Organisation. Additionally, seven of the 13 OPEC countries have also joined or applied to join the BRICS, and all OPEC countries are connected in the BRI. The future geopolitical and economic environment is being shaped, and the United States appears not to be a part of it.

As the reliance on US dollars diminishes, central banks will begin dumping their dollar reserves. This will result in hyperinflation, a spike in interest rates to compensate for the loss of purchasing power, and falling asset prices, further accelerating US decline. The trend of de-dollarisation is occurring – but it is not something unique. The rise and fall of empires and reserve currencies are apparent throughout history – from the Dutch Empire and the guilder to the British Empire and the pound sterling, and now the US Empire and the dollar. There will inevitably be a shift in the world order, and it may well be the BRICS’ time.