(Bloomberg) — The resurgent dollar cut a swath through global currencies Tuesday, weakening many in Asia through closely watched levels that forced some officials to step in to stem the losses.

Most Read from Bloomberg

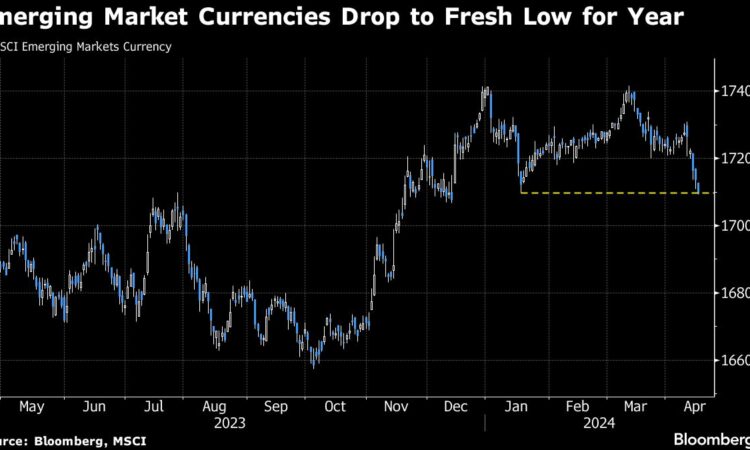

A key intervention from China — weakening its daily reference rate for the yuan — only served to ramp up the pressure with the Indonesian rupiah, India’s rupee and the South Korean won being particularly hit. But the dollar impact was broader, with a global gauge of emerging-market currencies falling to fresh lows for the year. Asian stocks also extended their losses, with a benchmark of the region’s emerging-market equities sliding roughly 2%.

Geopolitical tensions and US data suggesting the Federal Reserve will delay interest-rate cuts have helped the US currency extend gains into a fifth day. Iran’s attack on Israel added to the impetus for haven buying as conflict between the two countries entered into a perilous new phase.

China Loosens Grip on Yuan by Weakening Fixing as Dollar Gains

“Most Asian currencies will have to capitulate to the strength of the dollar,” said Mitul Kotecha, head of FX and EM macro strategy for Asia at Barclays Plc. “The move in Asian FX is being driven by a broadly stronger dollar, fueled by rising US yields and intensifying market risk aversion. Weakness in the yen and the weaker China yuan fixing today add another layer of pressure on the currencies.”

The move forced Bank Indonesia stepped in to support the rupiah after the currency weakened past 16,000 per dollar for the first time in four years, as onshore markets reopen after a holiday that was more than a week long. Malaysia’s central bank on Monday signaled that it stood ready to support the ringgit, which is hovering close to a 26-year low.

“The undesired mix of geopolitics, higher-for-longer US rates and volatility in the yuan and yen may continue to undermine sentiment in Asia ex-Japan currencies,” said Christopher Wong, a currency strategist at Oversea-Chinese Banking Corp. in Singapore.

Stronger-than-expected US economic data has damped bets on Fed rate cuts, suggesting the battle against dollar strength isn’t going to end anytime soon. That has led to an increase in currency intervention across emerging markets, especially Asia, as the dollar strength piles pressure on officials to act.

Meanwhile, any weakening in China’s managed currency can have an outsized impact as it is seen as an anchor for its regional peers. Most under threat are the currencies of Asian neighbors such as South Korea and Thailand, where China is the number one trading partner but a suddenly weaker yuan may have a much wider effect.

The Indian rupee slid to a record low while South Korea’s won dropped to the closely watched psychological level of 1,400 per dollar for the first time since late 2022. Malaysia’s ringgit is close to the lowest since 1998. The Taiwanese dollar declined to the weakest since 2016.

The MSCI EM Currency Index has fallen 1.8% this year. In Asian stocks, Korea and Taiwan led the declines, with their gauges slumping about 2.5% each.

–With assistance from Matthew Burgess, Hooyeon Kim and Shikhar Balwani.

(Updates with analyst comment, Taiwan dollar, Indian rupee)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.