All eyes are on the imminent drop in the US dollar as the Fed gears up to lower interest rates. Eyes turn to the euro and the British pound as contenders for currency supremacy. Let’s delve into the short and long-term prospects of the EURGBP pair.

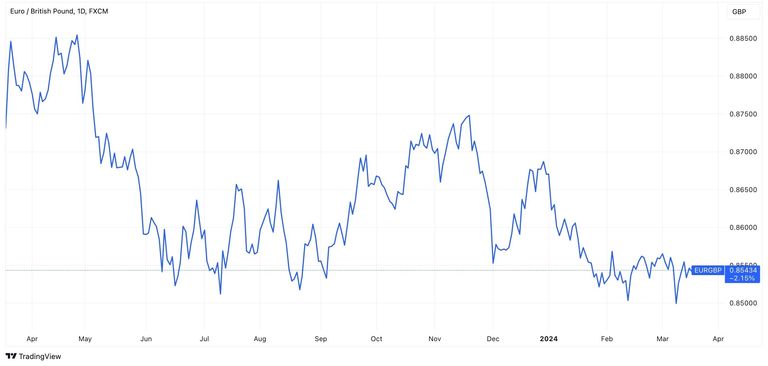

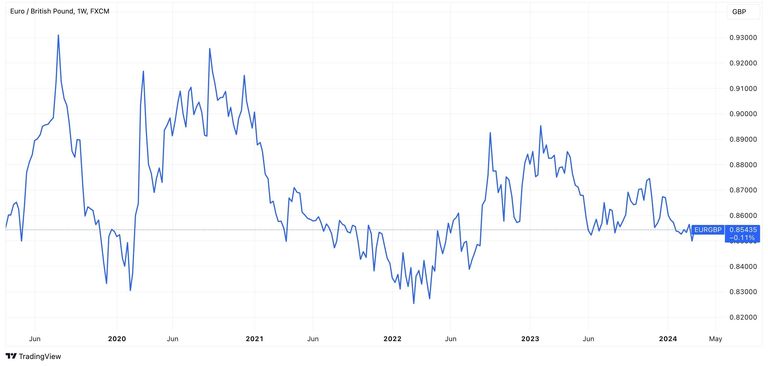

When thinking of the forex market, the pound and the euro come to mind straight after the US dollar. Recent trends show the euro ceding some ground to the pound over the past year, primarily influenced by central bank maneuvers. To stay ahead of such events and inform your trading decisions, most investors keep an eye on the economic calendar.

2024 looms as a pivotal year for EURGBP. Multiple factors sway the balance in favor of one currency over the other, with interest rates playing a significant role.

Many experts believe that the European Central Bank will act sooner, possibly in May or June, than the Bank of England. The BoE adhered to a more hawkish stance than most CBs in 2023. Therefore, it’s quite probable that they may delay until August.

This temporal disparity could lead to summer rate fluctuations favoring the pound. Yet, the pound’s performance remains tethered to internal economic metrics.

When considering the long-term perspective, we must also factor in the US dollar. While currently stable, all eyes are on the Fed’s potential rate cut trigger, poised to send the dollar downward. This shift will reverberate across currency pairs, with EURUSD positioned for significant movement given its popularity and the euro’s appeal as an alternative to the dollar.

Keep in mind market dynamics can swiftly evolve, so base your trading decisions on thorough analysis.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.