Dollar slumps as US faces loss of confidence – impact on Indian rupee, other currencies | Business News

US President Donald Trump may have hit the pause on his trade vacillations, but there seems to be a lingering deleterious effect on the American Dollar, which has slumped sharply. Reason: waning confidence in the American economy is leading to a huge flight out of the greenback to other safe haven currencies and gold.

This is reflective of a breakdown of a fundamental assumption underpinning global finance – that when there are serious bouts of volatility in the forex markets and a spike in the VIX (volatility index), it normally leads to a surge in demand for dollar assets. Over the last week, the trend has been exactly the opposite.

On Friday, the dollar slumped as investors ditched US assets in favour of other alternate safe havens including the Swiss franc, the Japanese yen and the euro, as well as gold. Gold recorded a new all-time peak, and the Swiss franc notched a fresh decade high, according to Reuters data.

Also, investors dumped Wall Street stocks overnight after the strong relief rally on Wednesday in the aftermath of Trump’s pause. Longer-dated US Treasuries are also selling off, putting 10-year yields on course for their biggest weekly jump since 2001, Reuters said.

Impact on the Indian Rupee

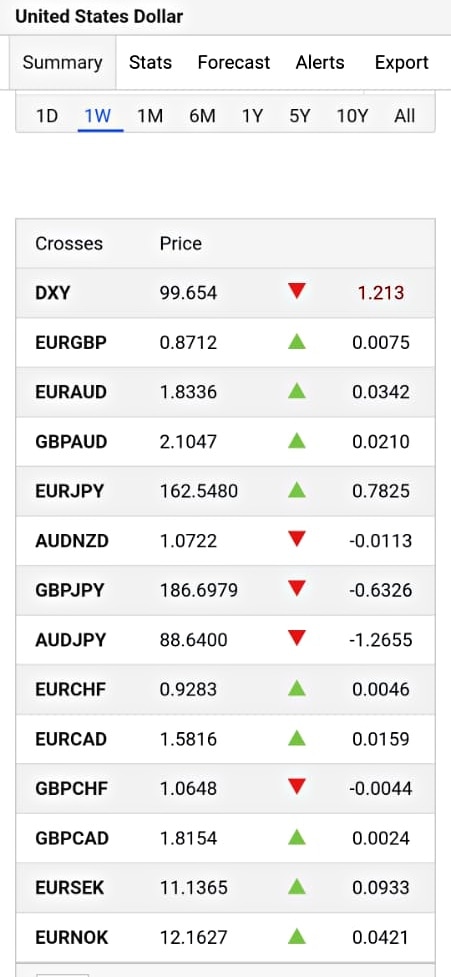

The rupee opened weak on Friday, even though it is projected to strengthen if the sharp decline in the dollar index and a slide in oil prices continue. The dollar’s slide “will obviously” lend support to the rupee at open, an FX spot trader at a Mumbai-based bank quoted by Reuters said, adding that it is unlikely that the rupee will move past 86. The dollar index, a tracker of the US dollar value relative to a basket of foreign currencies, was down over 3 per cent Thursday, falling to the 99.70 level – its biggest dip in over 12-months that took it below the 100 level for the first time since July 2023.

Bond Market Shock

Trump’s sudden climbdown on reciprocal tariffs is said to have been triggered by the selloff in American bonds, as confidence in the US economy plummeted and bond holders waned. Foreign holders, including Japanese and Chinese investors, are among those said to have dumped US government debt amid spiralling concerns over the impact of Trump’s tariffs.

A government bond is essentially a debt instrument, issued by a sovereign government to raise money from financial markets to finance public spending, in return for which interest is paid. Is there a relation between bond yields and the currency value of a country? Higher bond yields and lower bond prices typically attract investments from other regions, boosting a country’s currency. The difference in the interest rates between two countries then incentivises investors to borrow money in a low-rate environment and invest in the high yielding one. Also called carry trade, this strategy can be a major factor of currency movements.

Story continues below this ad

The US has bonds worth more than $35 trillion in circulation, much of which is in foreign hands. America does not normally see interest rates — or yield — spikes on its debt since its bonds are viewed as among the safest investments. That seems to be changing now.

The dollar index, a tracker of the US dollar value relative to a basket of foreign currencies, was down over 3 per cent Thursday, falling to the 99.70 level

The dollar index, a tracker of the US dollar value relative to a basket of foreign currencies, was down over 3 per cent Thursday, falling to the 99.70 level

Large-scale selloffs of American bonds could pose a problem for the world’s biggest economy, making it more expensive for it to raise the money to finance its budget gap. If the American government cannot sell its debt, it is then unable to pay for things such as social security or flagship programmes such as Medicaid.

The bond spike came after Trump escalated Washington’s trade war with China. Bloomberg reported on Tuesday that for the first time in 24 months, investors had started to demand a bigger premium to hold junk-rated American debt over European equivalent, reflecting fears of a slowdown in the world’s largest economy.

© The Indian Express Pvt Ltd