(Bloomberg) — Egypt devalued its currency for the fourth time since early 2022, following a massive interest-rate hike by the central bank.

Most Read from Bloomberg

The pound plunged about 26.5% to a record low of 42 per dollar as of 10:35 a.m. in Cairo on Wednesday, having traded at about 30.9 for the past year. Minutes earlier, the central bank raised rates at an unscheduled meeting and said it will allow the market to determine the exchange rate.

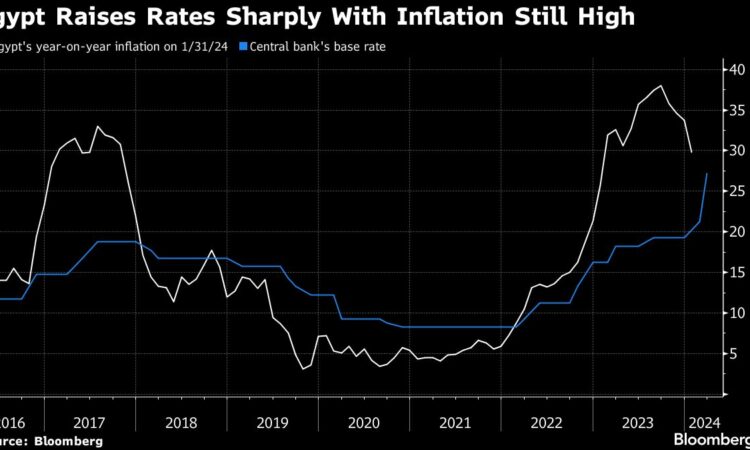

The move on Wednesday raises the key rate by 600 basis points to 27.25%, according to a statement by the central bank, which also said that unifying the nation’s exchange rates is “crucial.” Authorities are looking to ease a dire shortage of hard currency and get a new multi-billion-dollar loan from the International Monetary Fund.

The devaluation takes the pound closer to its value on the local black market, where it changed hands for around 45. The IMF has encouraged Egypt to tighten monetary policy to counter inflation of almost 30% and adopt a more flexible official exchange rate.

The Monetary Policy Committee said it had “decided to accelerate the monetary tightening process in order to fast-track the disinflation path and ensure a decline in underlying inflation.”

–With assistance from Srinivasan Sivabalan.

(Updates pound’s depreciation in second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.