(Bloomberg) — Emerging market currencies gained as investors braced for a pivotal week of global interest rate decisions that could impact the carry trade.

Most Read from Bloomberg

MSCI’s index for developing-world currencies is eking out only its second gain in nine sessions, reflecting heightened market volatility. The stocks gauge fell 0.3%, led by a drop in tech shares including Tencent and Taiwan Semiconductor.

Market moves have been more unpredictable than usual due to election surprises around the globe, with volatility hammering the carry trade, according to Barclays strategists. After a brief respite, renewed pressure has emerged as slowdown concerns spread due to disappointing US equities earnings.

“While it’s true that volatility could fall into August after the slew of central bank meetings,” the “case for carry is weaker,” Barclays strategists including Themistoklis Fiotakis wrote in a note. “With noise expected down the road, we think investors are unlikely to pile into carry beyond tactical expressions when moves look extended.”

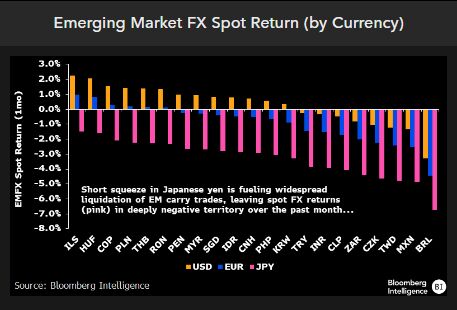

Carry trades funded in yen and dollars have suffered the most as traders weigh monetary policy in each of those economies. All yen funded trades in emerging markets have made losses with Chile’s peso and the Taiwanese dollar most affected. Both the Bank of Japan and the Federal Reserve will decide on interest rates on Wednesday.

There’s uncertainty in markets about what the Bank of Japan will do after years in which it rarely touched rates. The assumption that further policy tightening is possible sent the yen racing to an almost three-month high last week.

Investors will scour the Fed’s policy announcement and Chair Jerome Powell’s remarks on Wednesday for anything that supports expectations for a first interest-rate reduction in September.

In news, Venezuela’s opposition can prove that Edmundo González won Sunday’s election, according to María Corina Machado, who led the campaign against President Nicolás Maduro.

India will shield more of its bonds from foreign ownership, in a sign it’s uncomfortable with the billions of dollars of inflows linked to the inclusion of its debt in a key global index.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.