aluxum

The emerging market currency complex is a good proxy for general risk sentiment. This is especially so as these currencies are very sensitive to the strength/weakness of the USD.

And as we all know, a strong USD is typically kryptonite for global equities, and vice versa.

Emerging market currencies bottomed in October 2022, the same month as US equity indices. Since then, they have risen as much as +16% against the USD.

However, they are now showing signs of near-term exhaustion, and this may adversely affect equities.

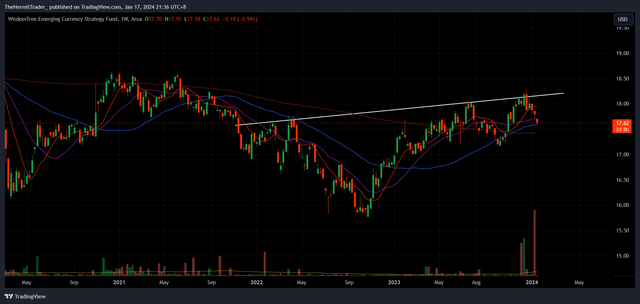

We may observe from the weekly chart of the WisdomTree Emerging Currency Strategy Fund (CEW) below that the ETF bottomed in October 2022, and was on the verge of breaking out higher from an inverse head and shoulders base in December.

Weekly Chart: CEW

However, CEW saw a sharp rejection at the breakout pivot and has since turned lower.

For reference, below is a snapshot of CEW’s FX positions. CEW is long a total of 14 emerging market currencies against the USD.

Some of these emerging market currencies look particularly weak against the USD. For example, the South African Rand looks weak, with USDZAR set to break out higher from a 6-month-long consolidative flag pattern.

Weekly Chart: USDZAR

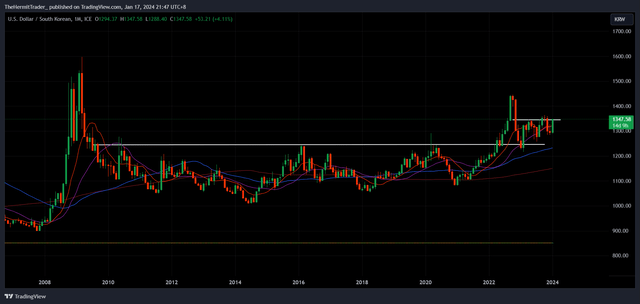

The Korean Won is trading weak against the USD too. USDKRW looks set to break out higher from a 14-month range. This looks like a continuation pattern, as part of the more assertive breakout from the 2009-2022 base.

Monthly Chart: USDKRW

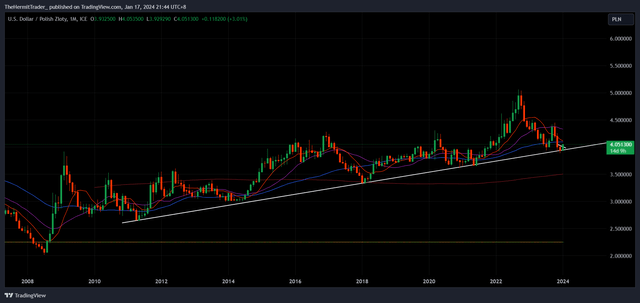

The USD is also trading at crucial multi-month uptrend support against some emerging market currencies – for example, the Polish Zloty. As seen from the monthly chart below, USDPLN is trading at support dating back to 2011.

Monthly Chart: USDPLN

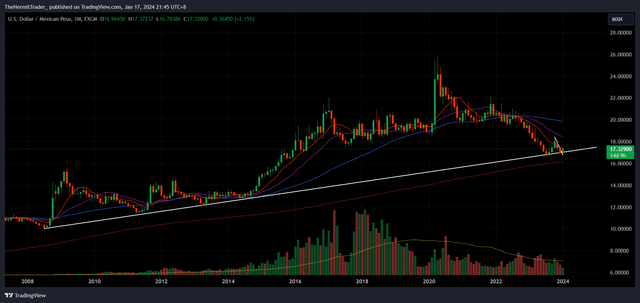

Same for the Mexican Peso. USDMXN is trading at uptrend support dating back to 2008.

Monthly Chart: USD/MXN

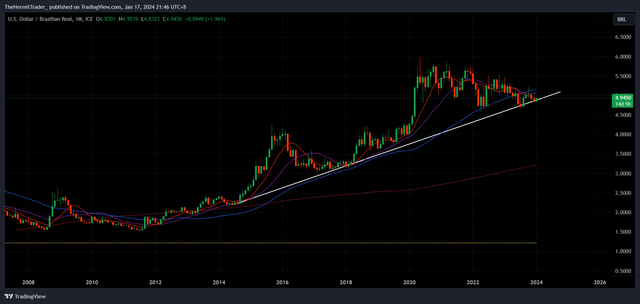

Similar to the Brazilian Real. USDBRL is now testing supports dating back to 2014.

Monthly Chart: USDBRL

Given all this confluence, there is a real distinct possibility that the USD gathers steam here.

The market is expecting a total of 6 rate cuts in 2024, so the market may not be expecting a stronger USD going forward.

If the emerging market currency complex takes a big hit, then we have to be cautious with equities. For now, indices are still holding up generally well near their highs, but things can change rapidly.

I am cautious on equities until USD weakness re-emerges.