- EUR/CAD trades plum in the middle of a multi-week range as both constituent currencies face similar negative fundamentals.

- The central banks of Canada and the Eurozone are expected to slash rates at the end of 2024 – a negative for both EUR and CAD.

- CAD also faces downside pressure from US election risk and the lower Crude Oil prices.

EUR/CAD lengthens its range-bound price action on Friday, trading at 1.5000 after edging higher on the day. The pair is plum in the center of an 11-week range and unable to gain directionality due to the similar monetary policy outlook of the two currencies’ central banks.

Both the European Central Bank (ECB) and Bank of Canada (BoC) are in the process of cutting interest rates as inflation pressures from the Covid-19 crisis ease.

The relative level of interest rates set by central banks is a major driver of the exchange rate because it impacts the flow of money. Capital tends to flow to where it can earn more and so favors currencies with higher interest rates, all other things being equal. As such neither the CAD nor EUR are particularly outperforming since both their central banks are expected to lower rates aggressively.

EUR/CAD 4-hour Chart

In its recent October meeting the BoC surprised markets by slashing its official interest rate (that which sets the interest rates of commercial banks) by 50 basis points (bps) (0.50%), bringing the official overnight rate down to 3.75%, from 4.25% previously.

Many analysts had expected a more cautious 25 bps (0.25%) reduction. The decision had negative repercussions for the Canadian Dollar (CAD) which weakened in most of its pairs although the effect was muted against the Euro, with EUR/CAD actually closing marginally higher on the day.

The reason CAD did not fall against the Euro on the day (Wednesday) was partly because of the publication of a story by Reuters which reported that the ECB was considering cutting interest rates to below the “neutral” rate. The neutral rate, also known as the “equilibrium level” of interest rates, is a theoretical level at which inflation should remain unchanged. For the ECB the neutral rate is said to be between 1.5% and 2.0%. Given the ECB’s key interest rate is 3.40% this would imply a radical reduction on the horizon.

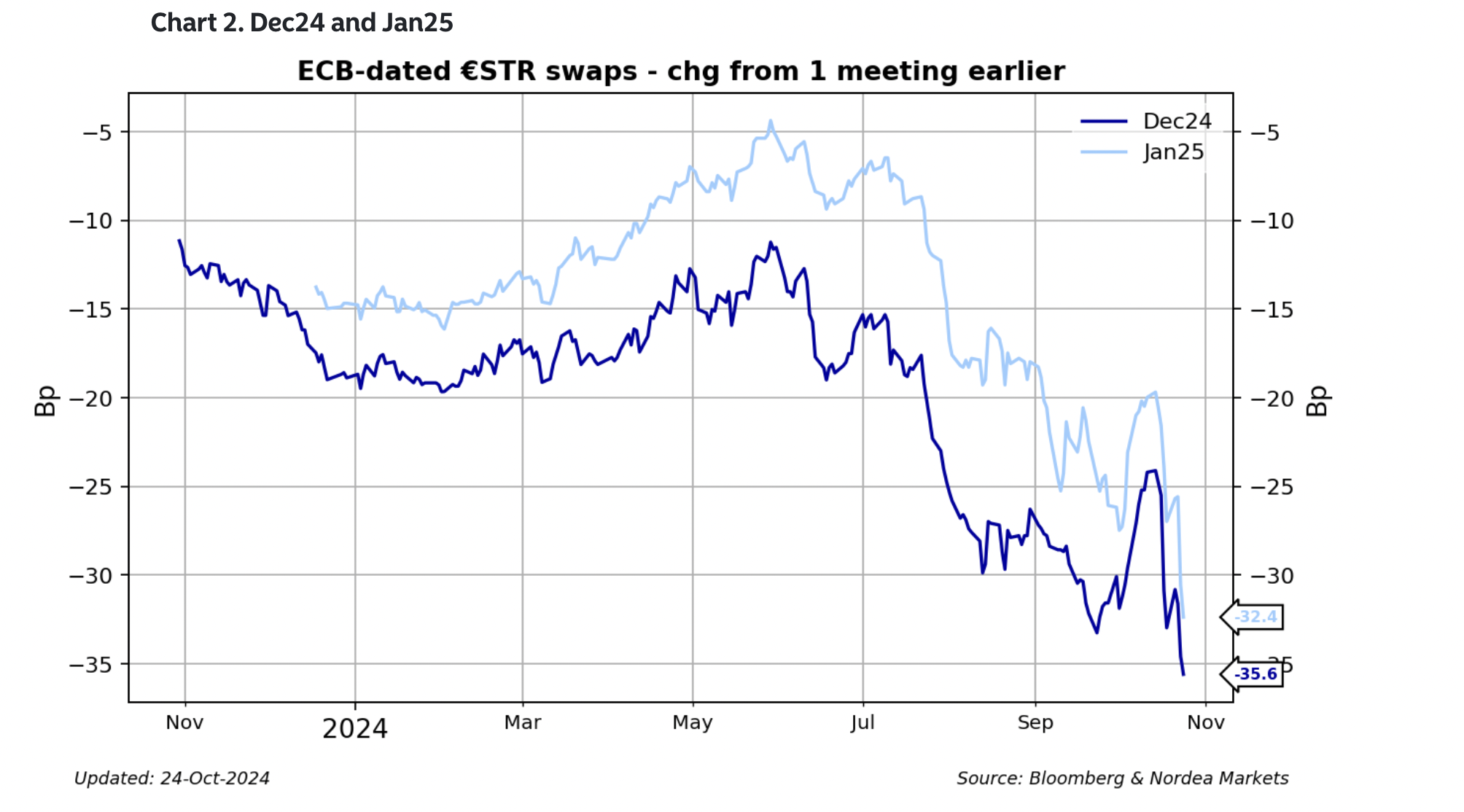

The story intensified speculation the ECB might be preparing to cut interest rates more aggressively at its last meeting of the year in December 2024, with swap rates, which are used to predict central bank decisions, pricing a healthy chance of a 50 bps reduction.

“Rates are falling significantly as markets are pricing a higher probability of the ECB going for a 50 bps rate cut in December,” said Andres Larsson, Senior FX Analyst at Nordea Bank, adding, “..and a higher probability of the ECB eventually cutting rates to below neutral,”

According to Larsson, the market is pricing in “-35.6bp for the December ECB meeting and -32.4bp for the ECB meeting on 25 January.” This is substantially higher than a few weeks ago.

Eurozone data out on Thursday failed to quell speculation after October Purchasing Manager Indexes – surveys that indicate economic activity for leading sectors of the economy – revealed Manufacturing activity in the region rose but was still in contraction territory (below 50) at 45.9 and Services PMI dipped to 51.2 from 51.4 in September.

“Today’s PMIs were more or less in line with expectations, although the employment component dropped below 50, pointing to the risk of rising unemployment ahead,” said Larsson.

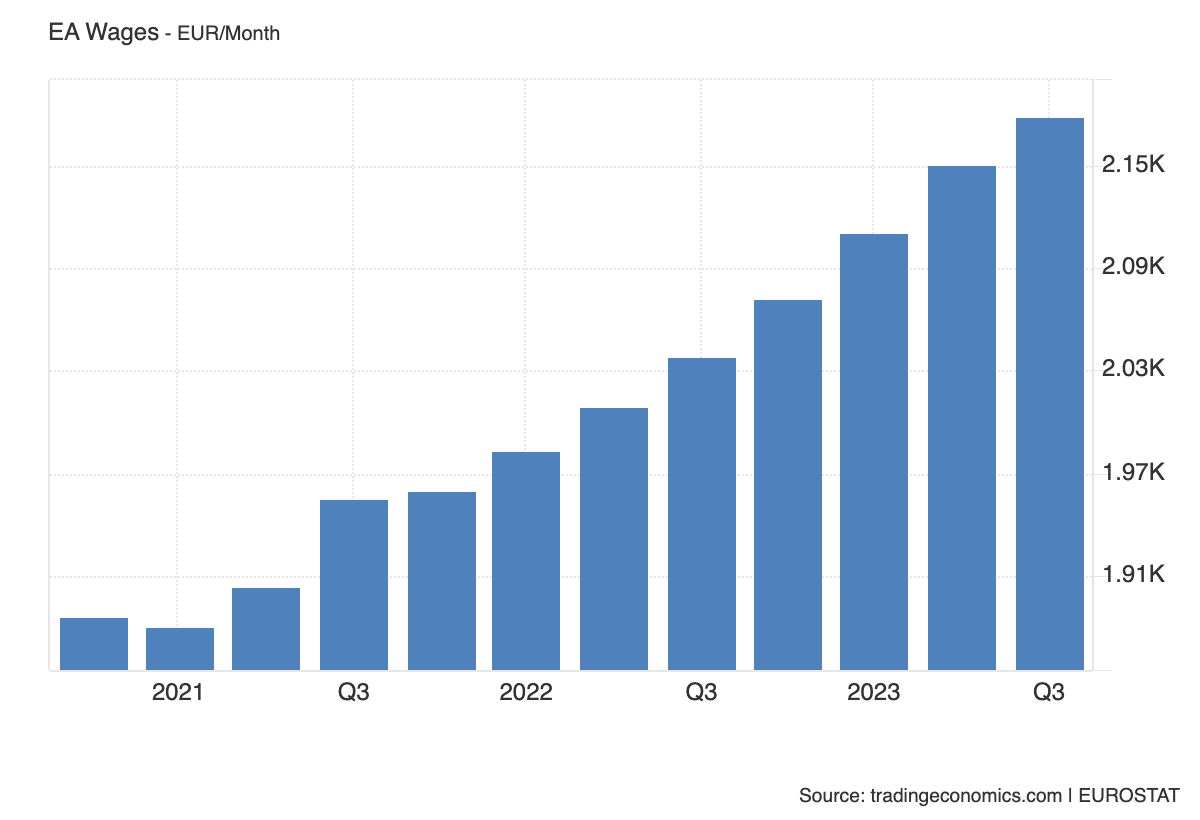

Employment and wages could be a key determining factor for whether the ECB decides to go for a “Christmas slasher” or not.

The ECB’s Chief Economist Martin Lane has said that wage inflation is likely to stay elevated in the second half of 2024 which is likely to prevent the ECB from making big cuts to interest rates before 2025. If true, this could inject some caution into ECB at the December meeting and suggest the bank might opt for a softer 25 bps cut instead. Such a move would provide upside for EUR/CAD.

According to official Wage Growth data, Eurozone wages rose 4.5% in the second quarter which, though lower than the 5.2% in the previous quarter, remained high. There is still no data for Q3, however, but the Eurozone Average Monthly Wage continues to rise quite strongly, reaching EUR 2,180 in September.

On Friday, the German IFO Business Climate Index showed a higher than expected reading, providing some reassurance regarding the outlook for the German economy, which has been seen as a weak link in the Eurozone despite historically being its engine house. This may have helped EUR/CAD nudge higher into the end of the week.

“The headline German IFO Business Climate Index rebounded to 86.5 in October from 85.4 in September. The data came in above the estimated 85.6 print,” said Dhwani Mehta, Senior Analyst at FXStreet.

From Canada, meanwhile, data on Friday showed shoppers reigning in their spending after data showed it rose by only 0.4% MoM in August, from 0.9% in July and below estimates of 0.5%.

EUR/CAD might also be biased to rise due to other factors weighing on the Canadian Dollar, which include the increased chance of Republican nominee Donald Trump winning the US presidential elections, and lower Crude Oil prices, since Oil is Canada’s largest export.

Former President Trump has vowed to impose tariffs on foreign imports in order to kickstart a recovery in US manufacturing, and if he targets Canadian imports this would reduce demand for CAD, weakening it. At the moment Canada, the US and Mexico enjoy a free trade deal, however, a Trump presidency might result in the US’s withdrawal. The deal is up for renegotiation in 2026.

According to the model of leading election website FiveThirtyEight, Trump now has a slightly higher 51% chance of winning. That said, the website’s master poll, which aggregates, averages, and weights polls according to recency, shows Vice-President Kamala Harris still in the lead with 48.1% versus Trump’s 46.4%.

Most betting websites offer better odds of Trump winning than Harris. The former President is also nudging ahead in key marginal seats that could decide the outcome of a too-close-to-call vote.

“Polls in the battleground states have remained very tight and within the margin of error,” says Jim Reid, Global Head of Macro Research at Deutsche Bank on Friday. “For instance, an Emerson poll of several swing states yesterday had Trump very marginally ahead, including a 1pt lead in Pennsylvania and Wisconsin, and a 2pt lead in North Carolina,” said Jim Reid, Global Head of Macro Research at Deutsche Bank in a note on Friday.