The euro may have run out of reasons to go higher as incoming inflation data anchors ECB rate cut expectations.

- The euro has rebounded vs. the U.S. dollar amid easing rate cut bets.

- Incoming German, Eurozone CPI data likely to reaffirm ECB outlook.

- Locking in adverse rate differentials might put pressure on the euro.

The euro has enjoyed a two-week recovery against the U.S. dollar. The currency has reclaimed a foothold above the 1.08 level and is now attempting to muster the momentum needed for a test of 1.09 after touching a three-month low near the 1.07 figure mid-February.

The recovery seems to have been aided by an improving outlook for European Central Bank (ECB) monetary policy. At the start of February, benchmark ESTR interest rate futures were pricing in the expectation of 141 basis points (bps) in rate cuts in 2024. That has now dropped to 85bps, an upgrade of the single currency’s yield-bearing profile.

Eurozone CPI data: steady slowing

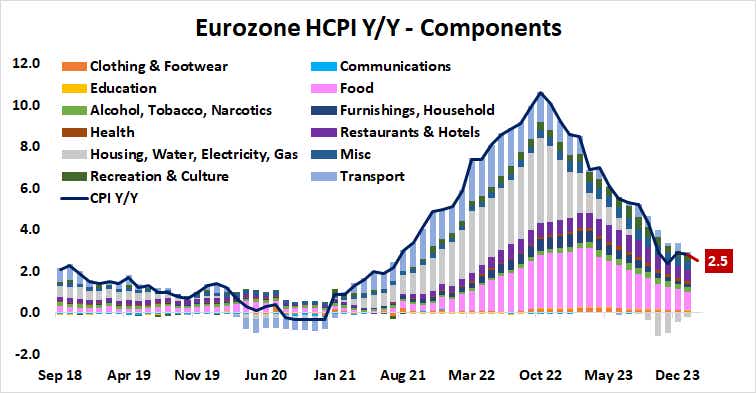

The spotlight now turns to consumer price index (CPI) data tracking inflation trends in Germany and the broader Euro Area to see if the rise has staying power. Price growth is expected to slow to 2.7% year-on-year in the currency bloc’s largest economy. The region-wide measure is seen ticking down to 2.5%. Both outcomes would mark a three-month low.

Progress toward hitting the central bank’s 2% inflation target seems to be on track. Base effects diminishing deflationary drag from energy seems to account for slowing progress since November as the impact of now-expired subsidies falls out of year-on-year calculations.

Meanwhile, upside pressure from food costs – the biggest contributor to lingering price pressure – continues to ease as lower global food prices feed into CPI.

Also, anemic economic activity looks likely to beat back pricing power in discretionary spending areas like hospitality and recreation.

Euro at risk as the ECB makes progress on inflation

The markets have caught on. Two-year German breakeven rates – a market-based measure of near-term inflation expectations backed out from bond prices – have drifted lower since topping at the beginning of the month. That is despite purchasing managers index (PMI) data showing the pace of economic contraction has eased since October.

On balance, this seems to imply that recent stabilization is not expected to evolve into the kind of brisk recovery that reanimates price pressures and leads the ECB away from stimulus. The first 25 bps interest rate cut is now priced in for June, with at least two more to follow from September to December.

Absent an improbably sharp upside surprise, incoming CPI data looks likely to underpin this baseline. This would effectively lock in that ECB rates will have the lowest hiking cycle peak among the major central banks. What’s more, it will stay on track to deliver more 2024 rate cuts than its main peers as well. The euro may stumble against this backdrop.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.