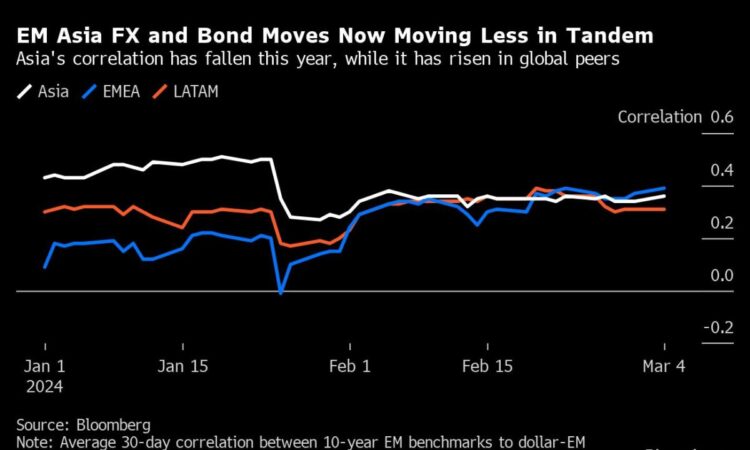

(Bloomberg) — Currencies and bonds in emerging Asia are moving less in tandem with each other, as domestic forces begin to outweigh offshore influences.

Most Read from Bloomberg

The 30-day correlation between the region’s 10-year yields and dollar-Asia currencies fell to 0.35 Wednesday from 0.43 at the end of last year, according to data calculated by Bloomberg. In comparison, the correlation rose in Europe, Middle East and Africa and Latin America during the same period.

Recent hawkish rhetoric from policymakers in the US and Europe have kept the dollar range-bound, reducing the degree of tandem moves. This has allowed internal factors, such as regional bets of policy easing, to weaken local currencies and boost bond prices.

In China, Thailand and South Korea, domestic rates are influenced more by local economic cycles as “in these places, central banks are signaling more willingness to diverge from the Federal Reserve and other major central banks,” Goldman Sachs strategist including Kamakshya Trivedi wrote in a note last week.

The region’s currency correlation with local yields climbed in January amid the initial surge in hawkish re-pricing for the Fed. This was due to local over US-rate spreads being narrower compared to global peers, making the region’s bonds and currencies more vulnerable.

In South Korea, a dissenting voice at the February policy meeting calling for a rate cut in the next three months has raised expectations of a dovish stance by the central bank. Similarly, bets for rate cuts have also been building in Thailand after the government upped its pressure on the central bank to ease amid prolonged deflation and a sluggish post-Covid economic recovery.

Elsewhere, China has been easing monetary policy to counter deflationary pressures. It cut the reserve requirement ratio late January in a surprise move and last month announced a 25-basis point reduction in the five-year loan prime rates.

To be sure, the risk of sticky prices continues to weigh on policy decision making, with some analysts seeing the region being more watchful.

“I think inflation will continue to fall this year, but more slowly,” said Alvin Tan, head of Asia FX strategy at RBC Capital Markets in Singapore. “At the same time, Asian central banks will be looking to start easing policy, though most of them will likely wait for the first Fed rate cut.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.