JHVEPhoto

Introduction

Fiserv (NYSE:FI) was the first stock I covered for Seeking Alpha. I laid out how growth at their merchant acceptance business will drive share price performance and rated it a buy. I followed up with several reports you can find here and here if you are unfamiliar with the company. However, my last article on FI was over a year ago when the share price was around $115. With FI now trading at $150 I feel it is time to revisit the company again and see if it still warrants a buy rating. I will assume some general familiarity with Fiserv and its business units for the rest of this article. Otherwise please feel free to read up my prior articles linked above.

I will first discuss Q4/23 and FY 2023 results as well as their outlook for 2024. This will be based on their 10-k, their Q4 presentation, earnings release and conference call transcript.

I will then talk about how organic growth figures get distorted by currency movements, specifically Argentina.

Finally, I will also present my updated model for Fiserv, explain where I made changes and why before coming to my conclusion.

FY 2023 Performance

Fiserv initial guidance for 2023:

Fiserv initial FY2023 outlook (Fiserv Q4/22 result presentation)

Fiserv 2023 results:

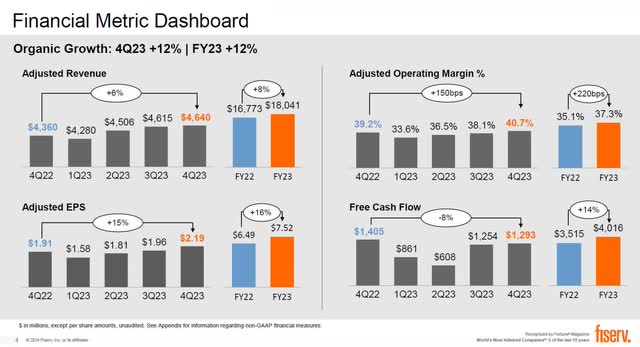

Fiserv FY2023 actual results (FI Q4/23 earnings presentation)

As one can see, Fiserv had a very good 2023. They were beating their 2023 guidance from the start of the year in every aspect. Higher organic growth, higher adjusted EPS, much better margin improvement and most importantly a good beat on free cash flow. That said, their original guidance was based on the expectation of a mild recession in 2023. As that did not happen it is hard to tell how much of the beat was due to benign macro conditions and how much was operational outperformance.

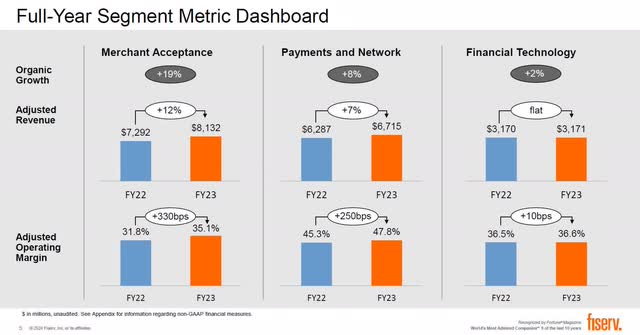

Fiserv FY2023 segment performance (Q4/23 earnings presentation)

Key driver of the beat was their merchant acceptance division and here specifically clover, their small and medium business solution. For the full year clover showed 25% growth and in the fourth quarter that accelerated to an amazing 30% revenue growth. Carat, their enterprise solution within merchant acceptance, was a tad disappointing with only 9% growth for the full year but also showed some positive trend by growing 11% in Q4. As these businesses scale up their margins also increase sizably. However, the shown 330bps in margin improvement are somewhat overstated as the company explained in their Q4/23 conference call:

Full year adjusted operating income improved 23% to $2.9 billion and margin grew 330 basis points to 35.1%. Over the last couple of quarters, some of you have noted that our revenue includes anticipation in LatAm, but the cost of that anticipation interest is not included in operating margin, as it is reported as interest expense below the operating income line on the income statement.

If we were to take that interest from anticipation and pro forma it back to operating income, merchant margins would still have expanded a very strong 220 basis points for the quarter and 260 basis points for the year.

Their second division, payments, performed also above expectations but is not as much of a driver of Fiserv’s performance as merchant acceptance.

Finally, in contrast to the strong showing in merchant acceptance their fintech division disappointed in 2023. There was zero growth and only a 10bp margin improvement for the year and in Q4 the division actually shrank on lower margins. Part of that is actually due to them moving to a more recurring revenue model vs. one-time sales. This is similar to what many other tech companies have gone through before with large success and Fiserv also claims this is more profitable for them. But overall it is still a low growth division. Luckily, with the rest of Fiserv growing so much its importance is reduced each year.

Looking at the numbers one might wonder how Fiserv managed to grow adjusted EPS by 16% when revenue only grew by 8%. While margin expansion is part of the story the main driver to close the gap were share buybacks. Fiserv has a long history of buying back shares and they did so very aggressively in 2023. They repurchased 8.6m shares and reduced shares outstanding by 5% thereby accelerating EPS growth. Free cash flow was also very good at $4bn. This is important as they disappointed on the cash flow front in the past years. Therefore it was crucial to see a decent beat here.

Fiserv 2024 Outlook

2023 was a good year but what about 2024? Here is their outlook:

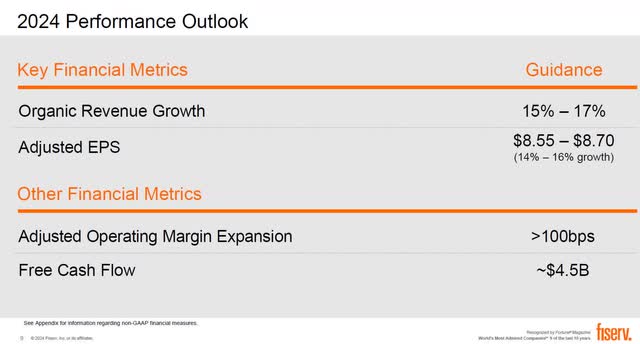

Fiserv FY2024 outlook (Q4/23 earnings presentation)

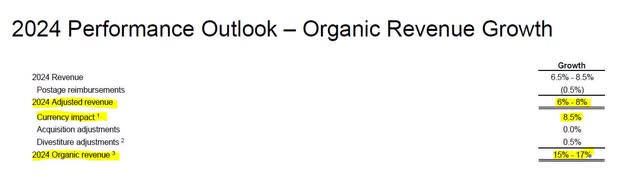

To make it short: Its more of the same and it is good. Although 15%-17% organic revenue growth means only 6%-8% actual growth. More on that below in a separate paragraph. But together with continued margin expansion and probably more buybacks this translates into 14%-16% adjusted EPS growth. Free Cash Flow is also forecast to grow by roughly 10% which is very good as that had been stagnating somewhat as they had to increase their capex and working capital to handle their growth.

Their 2024 guidance is not very surprising because what really separates Fiserv from many other companies is that they deliver good growth like a clockwork.

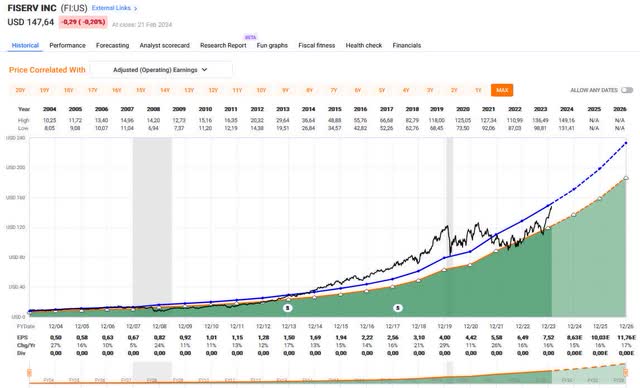

Fiserv 20 year performance (Fast Graphs)

As one can see by the smooth orange line Fiserv never had a year with declining earnings for 20 years. In fact, only in 2007 they had less than 10 percent earnings growth. This is a truly exceptional performance. Neither the financial crisis nor the Covid pandemic shows.

Fiserv’s 2024 guidance is therefore reassuring but also as expected.

Organic Growth Rates Are Distorted By Argentina Hyper-Inflation

Fiserv provides guidance for adjusted revenue growth rates as well as organic growth rates. This is generally a useful disclosure as organic growth rates are supposed to give investors a better understanding of underlying business trends. Organic growth rates tend to exclude effects from acquisitions or disposals as well as currency effects. By excluding those non-recurring non-operational factors organic growth rates are supposed to give a better picture of the true performance of a company. And normally it works just fine.

In the case of Fiserv however, using simply their provided organic growth rates gives a wrong impression about the business dynamics. Fiserv is not a business that is able to grow revenues by 15%+ each year. They tend to grow revenue in the high single digits and sometimes by low double digits. The organic numbers are strongly distorted by currency effects.

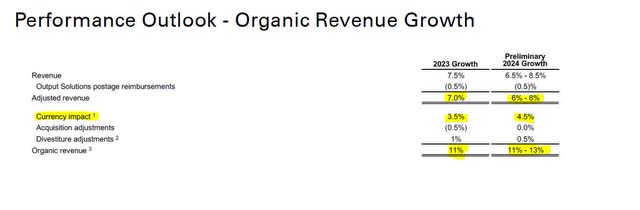

FY 2024 guidance from November 2023 (Fiserv Investor Day November 2023)

Last November they provided initial 2024 guidance during their investor day. Back then they guided for 11%-13% organic growth including a 4.5% currency effect.

But that guidance has changed dramatically since then in just a few months:

FY 2024 outlook as of February 2024 (Q4/23 earnings release)

Now Fiserv guides towards 15%-17% organic growth. A massive 4%-point higher growth rate after just a few months. The adjusted revenue however is still only forecast to grow by 6%-8%, i.e. unchanged. Why is that? Because the increased “organic” growth rate is canceled out by similarly sized FX moves. And this is not just coincidence. This effect is mainly due to Argentina as they explain during their conference call:

Turning to the outlook for 2024, we expect total company organic revenue growth of 15% to 17%, inclusive of an estimated 7 points of growth from excess revenue in Argentina, driven by significantly higher inflation and interest in the Argentina merchant business, following the government’s steep peso devaluation in mid-December. (Source: Fiserv Q4/23 conference call)

and

You can see from the spread between organic and adjusted revenue growth that currency headwinds from the devaluation of the Argentine peso offset the benefit of the country’s very high inflation and interest for the full year in adjusted revenue. (Source: Fiserv Q4/23 conference call)

What is at work here? Normally, FX movements are excluded when calculating organic growth rates and simply assumed stable. This is reasonable assuming that the FX movements are fairly small, random and unrelated to the operational performance. This is how Fiserv handles it:

Fiserv’s approach to handling FX in organic growth rates (Fiserv November 2023 Investor Day)

They basically keep FX constant and then look at what their revenue growth rate would have been had FX not changed. They then call this “organic”. This is fine under normal circumstances but here the underlying reason of the strong growth is the high inflation. This same inflation also impacts FX rates. And generally very high inflation rate countries experience a strong devaluation of their currency. Therefore both effects are not unrelated but have the same common cause which is why I have some problems with calling those growth rates “organic”.

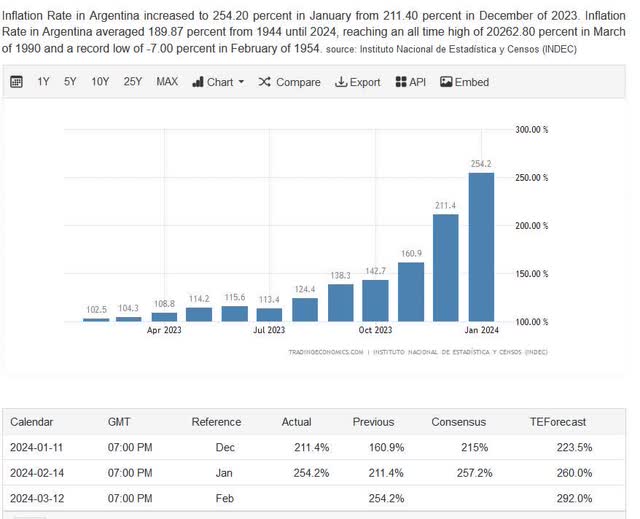

What is the situation in Argentina? Inflation is extremely high and currently running at over 250%.

Argentina Inflation (trading economics (https://tradingeconomics.com/argentina/inflation-cpi))

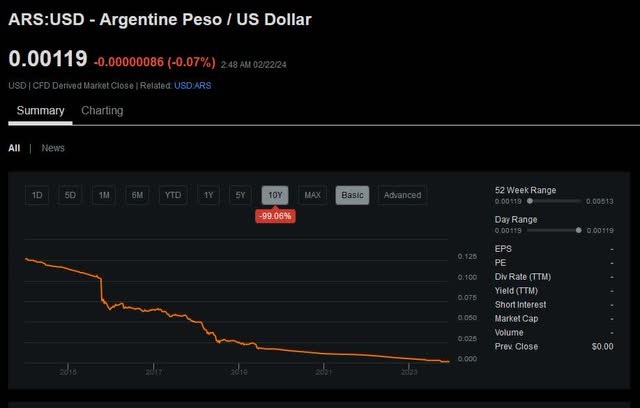

In such an environment one can easily double and triple sales volumes in local currency. However, as an investor one is only interested in what it contributes to the USD denominated bottom line. Ignoring the FX movements for the period is misleading as the value of the Argentinian Peso has cratered:

Argentina Peso 1 year chart (Seeking Alpha)

It has declined by 76% in just a year.

Argentina Peso 10 year chart (Seeking Alpha)

Over ten years it has lost 99% of its value!

It is clear that these kind of movements strongly distort the published growth rates. Mind you, I do not blame Fiserv for this as they are very forthcoming when it comes to discussing those impacts. But it is nevertheless something that one can easily overlook.

To sum it up: Don’t be fooled by Fiserv’s official high organic growth rate as it is an artifact of operating partially in a hyper-inflationary environment. To get a better view of the underlying revenue development one should ignore the currency impact from Argentina and focus just on the effects from acquisitions/divestures plus “normal” currency fluctuations. Adjusting the reported USD revenue growth rate of 6%-8% one would get a 0.5% uplift from divestures and 1.5% uplift from non-Argentinian currency effects to arrive at an updated organic growth rate of 8%-10% which seems much more in line with historic experience.

Updating My Model

I built a DCF model to better catch the impact of a smaller high growth business like Clover. I regularly update that model and have now incorporated their 2023 results, their 2024 guidance as well as some of their medium term targets from their November 2023 investor day.

What are my main changes besides rolling forward for a year?

I once again increased my near term cost of debt. Not only has the Fed increased rates further during 2023 but also Fiserv commented on the impact of some interest charges from Argentina. This reduces my fair value.

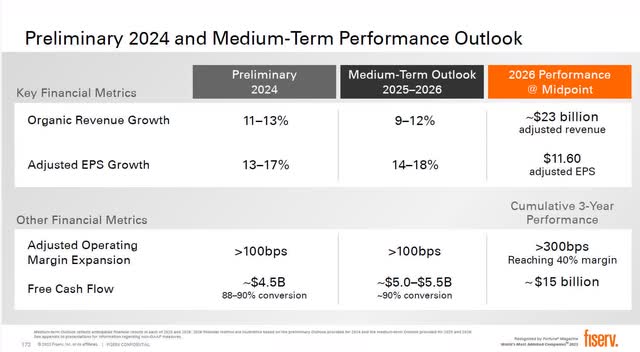

I modeled according to their medium term forecast until 2026 although I am a bit more conservative than they are.

Medium Term Outlook (Fiserv Nov. 2023 Investor day) Clover Outlook (Fiserv Nov. 2023 Investor Day)

I specifically upped my growth target for clover which I had trending down. But with Fiserv expanding into Brazil and Mexico this year they continue to have great growth opportunities in untapped markets. In addition I increased my margins a bit as they seem to be able to continue to benefit from scaling their business.

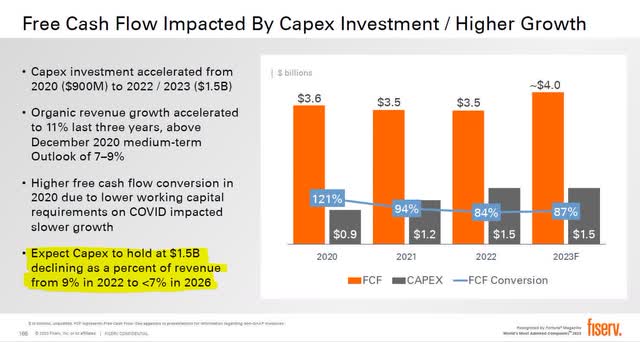

I did correctly forecast the need for increased capex which hampered free cash flow. I was surprised that management seemingly missed that in the past but now they have given specific capex guidance.

Capex Guidance (Fiserv Nov. 2023 Investor Day)

I had capex at 9% for a couple more years during their high growth phase. They claim that they have reached a plateau now in terms of capex and from now on it will decline to just 7% by 2026. I now have a decline to 8% just to be on the safe side. But it certainly is a positive that they have identified this as an area that strongly impacts free cash flow and have a focus on keeping cost under control there.

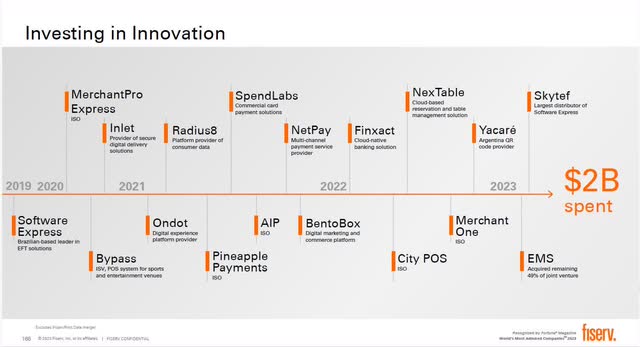

I had them additionally spend 50% of their free cash flow in the model on acquisitions to support growth during their high growth phase. This seems overly conservative at the moment as they only spent about $2bn in total since their merger in 2019. But then this does not include upfront payments for joint ventures or distribution agreements. Plus there could always be a large acquisition around the corner. I therefore leave it in for the time being.

Acquisitions (Fiserv Nov. 2023 Investor day)

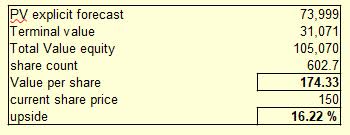

Together with the roll forward for a year these changes lead to an increased valuation. Here is the result of my DCF based on a 10% discount rate:

DCF Valuation (own calculations)

I do not model their extensive buybacks which should continue to add value while they are below intrinsic value. Furthermore, I do believe that my model is erring on the conservative side. I therefore believe that a $180 price target is justified which makes Fiserv a buy.

It is always good to check a DCF with some other methods. On a FCF multiple basis Fiserv trades around a 20x multiple which seems reasonable given the growth profile. Looking at the FAST graph chart I displayed earlier it seems that most of the undervaluation is now gone but this was a 20 year chart. The merger with First Data in 2019 has transformed Fiserv into a higher growth company that warrants a higher multiple in my opinion. Looking at the FAST graph from 2019 onward shows still undervaluation and gives a year-end price target of $185.

FAST graph Price target $185 (FAST Graphs)

And finally looking at growth rates it seems Fiserv can do 8-9%% revenue growth for some time plus 1%-3% from margin expansion as they gain scale and finally 3% from buybacks. That would indicate a 12-15% return as long as the valuation does not change which seems very healthy for such an entrenched and stable business.

Risks

There are always risks with any investment. But what entices me about Fiserv is their excellent history of performing even during challenging periods like the financial crisis or the Covid pandemic. They also have a very strongly entrenched market position.

That said, one obvious risk would be Argentina. As one could see it has some importance for Fiserv and yet it sails into totally untested water under the new President Milei. There is a risk of an even worse economic collapse than was before and possibly riots or coups. This could have a negative impact on Fiserv.

Their merchant acceptance and payment segments are dependent on economic growth and consumption. Increased protectionism and lower economic growth are therefore fundamental risks but hardly unique to Fiserv.

The number of banks decreases each year in the US due to mergers. This impacts their fintech division which will as of this year also no longer be shown separately.

Finally, regulatory changes are also always a risk in their line of business as Fiserv like all the other payment service providers takes a cut out of the volume they process and no one is happy about that. This might trigger negative regulatory action.

Conclusion

Fiserv is a very rare company that continues to deliver exceptional results every year. They had a strong 2023 and guide towards an equally strong 2024.

I believe they are well positioned for further growth for many years to come as they roll out their international business. While their undervaluation is not a strong as it was I still see sizable upside from current levels and rate Fiserv a buy. My model indicates a fair value of $175-180.