Ghana’s cedi has moved from being the world’s best-performing currency in the second quarter of 2025 to the worst in the third, according to Bloomberg data sighted by GhanaWeb Business.

This development comes in the wake of a surge in dollar demand by businesses rushing to settle import bills ahead of the year-end holiday season.

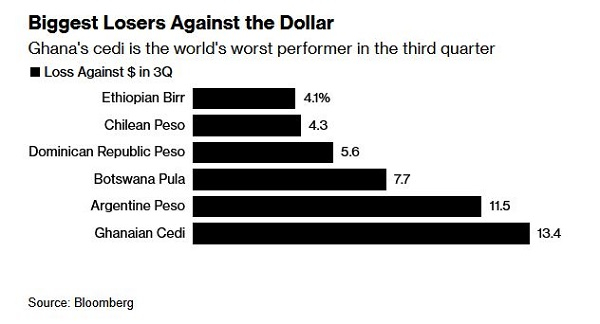

According to Bloomberg, the local currency has depreciated by 13% so far this quarter [Q3 2025], making it the steepest decline globally.

The cedi’s weakened performance has also erased part of its earlier 50% gain, which was driven by stronger gold prices and positioned it as the world’s best performer between April and June this year.

Ghana cedi’s world-beating performance weakened by imports surge

Some analysts who spoke with Bloomberg attribute the current weakness of the cedi partly to the Bank of Ghana’s inability to supply sufficient foreign currency to the market.

Head of market-risk management at UMB Bank Ltd., Hamza Adam, explained, “As at last week, banks that filed dollar needs on behalf of their clients to the Bank of Ghana got about half of their requests,”

“This week the central bank is trying to meet all demand,” Hamza Adam is quoted to have said.

As of September 3, 2025, the local currency was trading 0.1% weaker at 11.9507 per dollar as of 1:50 a.m. in Accra. However, despite the decline in the third quarter, the cedi remains up 23% year-to-date.

Cedi continues to depreciate, now trading at GH¢11.90 to the dollar

The latest decline in the cedi’s value is largely due to import-driven demand, which often spikes ahead of the Christmas season.

Although Ghana’s gross international reserves increased to $11.1 billion by June 2025, the central bank has avoided deploying enough funds to fully meet dollar demand.

In an emailed statement to Bloomberg, the Bank of Ghana stressed that its role is to maintain orderly market conditions.

“The cedi should be stable within a reasonable range,” the bank said.

“Our role at the Bank of Ghana is to ensure that fluctuations remain orderly, that they reflect fundamentals and that they do not undermine confidence in the broader economy,” the BoG added.

With additional files from Bloomberg

MA