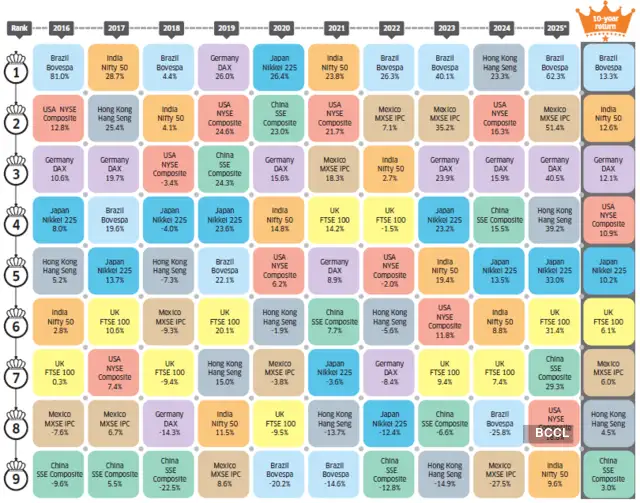

Source: Reuters-Refinitiv. *2025 returns are YTD based on 2 December 2025 closing values. Other years returns’ are calculated between the first and the last trading day closing values. Returns are normalised to the Indian rupee. The 10-year return is the compounded average return.

In 2025, equity markets in Brazil and Mexico outperformed global peers, driven by distinct domestic factors. Brazil’s Bovespa index advanced on the strength of attractive valuations and rising commodity prices, while Mexico’s rally was underpinned by robust corporate earnings, with banks and consumer-focused companies leading the way.

Brazil has also maintained leadership in long-term equity performance, supported by recurring commodity super cycles— spanning iron ore, crude oil, soybeans, and metals—alongside structural government reforms and several years of exceptional returns ranging from 40% to 81%. While India’s equity benchmark lagged in 2025, it is the second-best index over the past decade, underscoring its resilience and sustained appeal to investors.