T-Joe’s Steakhouse and Saloon owner Sherry Lyle collects about $1,000 a month in a type of currency that at first looks like it must come from a foreign country or a board game.

The flashy golden bills capture attention around the dining room whenever they come out, but were actually designed and developed specifically around Wyoming.

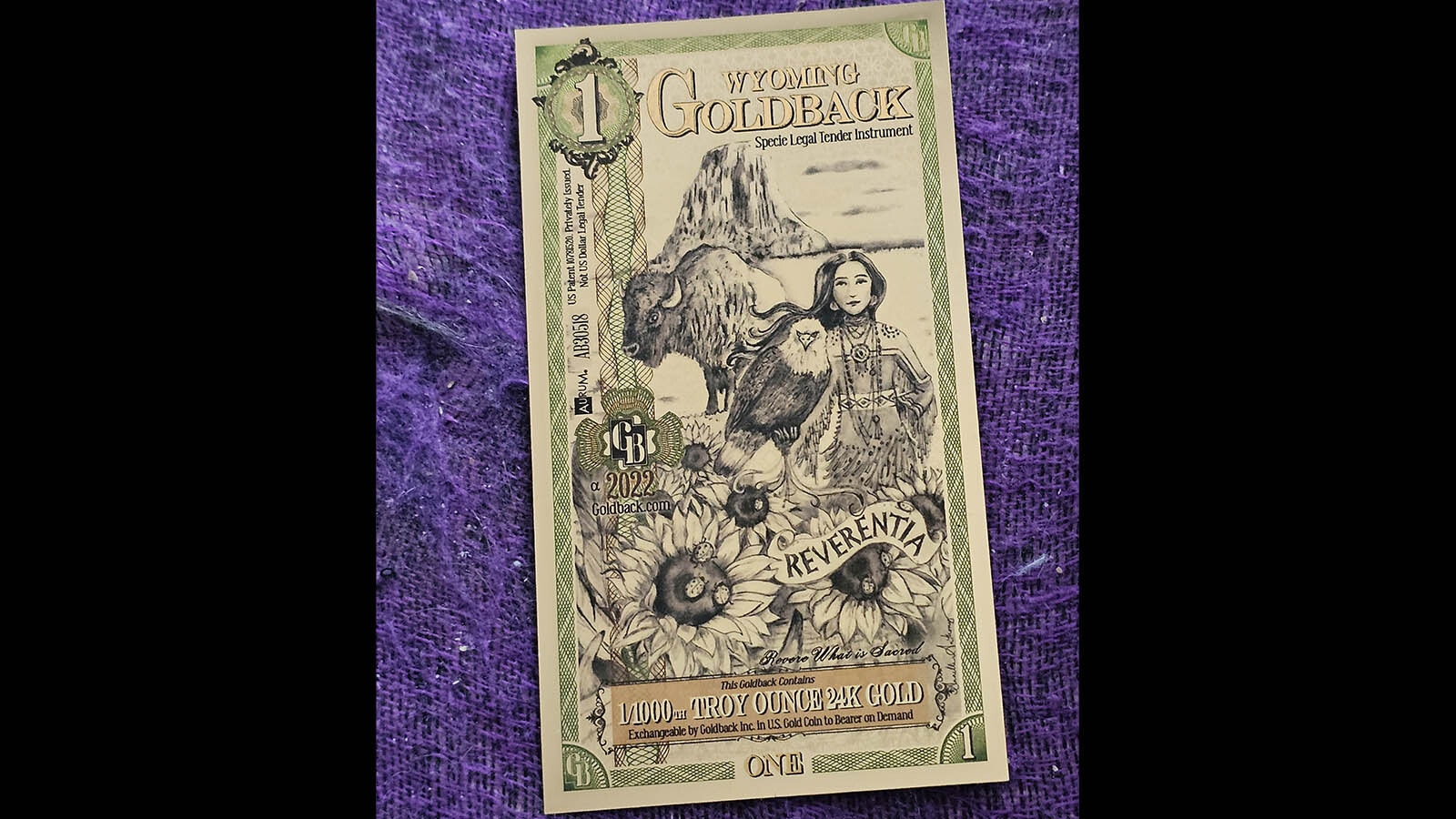

They’re called Wyoming goldbacks, and they are offered in denominations of 1, 5, 10, 25 and 50 online at wyominggoldbacks.com. Each denomination is decorated with art that showcases the Cowboy State while also highlighting a different virtue — liberty, loyalty, respect, and so on.

But what’s really unique about these bills is that they’re made of pure gold that has been laid down inside a protective polymer using the latest, cutting-edge technology.

The smallest denomination — a 1 — is 1/1000th of a troy ounce of gold. That bill has Devils Tower as a backdrop, with a buffalo, an eagle and sunflowers framing a Shoshone woman named Reverentia (Latin for “respect”).

The caption below her translates that idea to “revere what is sacred.”

The Art Of Business

It’s a work of art, and the beauty is part of the reason Lyle started accepting goldbacks at her restaurant. She likes collecting different kinds of currency.

She also likes that these bills were designed specifically for Wyoming.

“They’re unique to Wyoming and a couple of other states,” she said. “And it kind of shows our independent spirit.”

Lyle estimates that she has a party wanting to pay a check or tip a server in goldbacks about every other week.

Sometimes, the transaction confuses those who are watching.

“One of our servers was like, ‘Oh, we can tip our bussers in pesos?” Lyle recalled, laughing. “That was kind of funny, but like, ‘No, you can’t.’”

Because the currency contains real gold, the bills can gain or lose value over time with the value of gold. And like the commodity, gold mostly goes up in value.

Over time, Lyle has watched the value of her goldbacks rise, and now she actually has some from every state with a series — Nevada, New Hampshire, South Dakota, Wyoming and Utah, the latter being where the series first began.

“It doesn’t go up a ton,” she said. “But it’s just been a neat thing, and it’s nice to support the businesses that sell these. We will use them eventually, but we’ll always keep a couple just for, you know, the collector value.”

Apocalypse Not

T-Joes isn’t the only Wyoming business accepting goldbacks.

Adam Mathes, owner of A-1 Tire in Casper, started taking them about a month ago after one of his customers showed him a few of the bills.

He wasn’t looking at it from any sort of apocalyptic perspective. He just sees goldbacks as another option to differentiate his store from corporate chains.

“It looks like we’re the only tire store that will accept something like that around here,” Mathes told Cowboy State Daily. “Being a locally owned small business, I don’t know if some of the corporations would even consider that. So, it’s another way for people to see our business and to be able to have a different form of payment.”

Tyler McCann, owner of Cowboy Cuts in Pavillion, thinks goldbacks might serve as a great hedge against inflation, in case there are any more price surges.

“I think gold is more stable,” he said. “Even though it’s going up and down, I just see so much inflation that I would like to have that available for our customers.”

So far, neither of them have had any takers, but McCann was particularly keen.

“I think they are fascinating,” he said. “You can feel the difference in the weight between different denominations. You can almost immediately tell the difference when you hold them in your hand.”

In all, about 160 Wyoming businesses now accept goldbacks in an incredible range — pet stores, restaurants, barber shops, carpenters, auto parts and more.

It Came From A dream

Goldbacks arose from a dream that the company’s founder, Jeremy Cordon, had about some sort of an apocalypse or emergency.

“There was some sort of national emergency,” Goldback Chief Operating Officer Kevan Mills told Cowboy State Daily. “He didn’t know what it was, whether it was a war, or an earthquake, or what. But he was at a grocery store trying to buy groceries and everyone in the store was trying to pay with credit cards and dollars.”

The store owner wasn’t having it.

“We don’t take that here, it’s no good anymore,” the dream grocery store owner said.

Someone else came up to the owner with an impossibly thin, rectangular piece of gold, and offered that to the owner instead.

“Would you take this?” the customer asked.

“Gold?” the owner replied. “Absolutely I’ll take gold.”

It was then Cordon woke up and immediately called his business partner to tell him about the dream.

“We have to do this,” Cordon told him. “It’s incredibly important.”

Making Gold More Practical

While the idea for goldbacks may have come from a dream, the bills do solve a practical, real-world problem for those who’d like to use gold for transactions.

A single gold coin weighing an ounce is worth just over $2,000 — a bit hard for most grocery stores, restaurants, beauty shops and the like to break down.

But a single goldback with a thousandth of an ounce of gold — worth about $4.66, according to Tuesday’s exchange rate — is a much easier denomination to work with.

“For perspective, a thousandth of an ounce, if you took a BB from a BB gun and cut it into 12 pieces, one of the pieces of that BB would be 1,000th of an ounce,” Mills told cowboy State Daily. “So how do you carry that around? If you’re going to carry that little teeny — I mean it’s not much bigger than few grains of sand.”

But gold is highly malleable, so a small amount of it can be spread very thinly.

“A 50-cent piece of gold, hammered to as thin as you can possibly make it would cover an entire football field,” Mills said. “That’s how thin you can make gold.”

Then, it’s just a matter of something to protect the integrity of such a thin sheet of gold, keeping it all intact so that every bill has exactly what it says it has regardless of trades.

That’s where the polymer comes into play. It both protects the thin layer of gold and makes it easy to carry around.

“Now you can put it in your wallet and carry it safely,” Mills said.

Goldbacks are also what’s called “fungible,” which means they are available in readily interchangeable denominations. Five 1s, for example, can be traded for a 5 goldback, which is 1/200th of a troy ounce, or 10 ones could be traded for a 10 goldback, which is 1/100th of a troy ounce. Denominations of 25 and 50 are also available, which are 1/40th and 1/20th of a troy ounce respectively.

At First Utah Was It

Although goldbacks can be used anywhere that a business is willing to trade in gold, the bills started out initially as strictly a Utah series. There was never any intention of doing goldbacks that highlighted other states, Mills told Cowboy State Daily.

But once the Utah goldback series started circulating, they almost instantly attracted interest from investors who wanted to see their states highlighted with a goldback series.

Soon, there were even sponsors willing to help front the cost of that.

Wyoming was actually the fourth state to get its own series, and the sponsor was Natrona County state Sen. Bob Ide, R-Casper.

Ide was not a state senator at the time he sponsored the development of the Wyoming goldback, just someone who Mills said was interested in seeing it happen.

Wyoming may have been the fourth state to get its own series, but it’s been tops when it comes to embracing goldbacks, according to investor Abram Taylor.

“Whenever I check Google trend reports, Wyoming is usually the top one or two every day of people looking them up,” he told Cowboy State Daily. “And whenever we have gone up to Jackson Hole to, you know, have lunch and get out of town, I always tip with goldbacks and they’re always very well received. The waitresses are always like, ‘Oh my, what is this? This is cool.’”

Taylor even recalls buying his wife an expensive fur coat in Wyoming, and was pleasantly surprised when the shop’s owner was willing to take goldbacks for the purchase.

Not only that, the shop owner seemed really eager to get them.

The Midas touch

Goldbacks have had something of a Midas touch so far, trading in all 50 states and on every continent in the world except Antarctica.

Everyone who touches them seems to fall in love with them.

“So, our first year in business we did $250,000 in goldbacks,” Mills told Cowboy State Daily. “Our second year, we did $1 million dollars in goldbacks. Our third year, we did $6 million and our fourth year, we did $12 million. Last year, we did $34 million.”

Mills credits the exponential growth in part to the way gold can work as a hedge against inflation.

“In the two years since we released the Wyoming goldback in September 2022, the value of goldbacks has gone up by 28%,” Mills said. “So, if someone bought gold two years ago and then sold them to Alpine Gold for 5% under the daily rate today, they would have made 23%.”

Inflation rates from October 2021 to October 2022, by comparison, were 7.7%, according to the Consumer Price Index, making Goldbacks a clear winner for that particular time frame.

Mills said one important distinction to make with goldback bills is that they’re not meant to replace the U.S. dollar. They are what is called a local currency, of which there are about 3,000 in the United States.

“The federal government issues all the currency and there’s actually in the Constitution it’s written that states cannot produce their own currency and that nothing shall be used as money unless it be gold or silver,” he said. “So that’s what we do. We’re just giving people an alternative currency.”

Renée Jean can be reached at Renee@CowboyStateDaily.com.