The U.S. dollar dominated the forex markets in June and outperformed all local currencies by a wider margin. The Indian rupee is losing balance against a strong U.S. dollar making the INR dip to new lows this month.

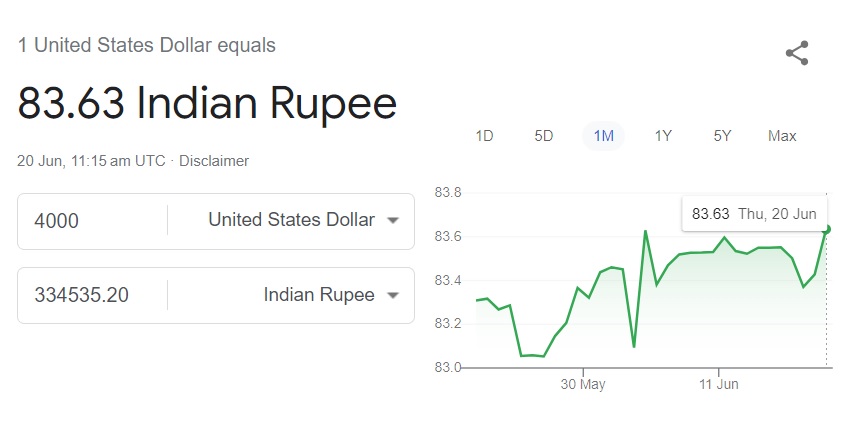

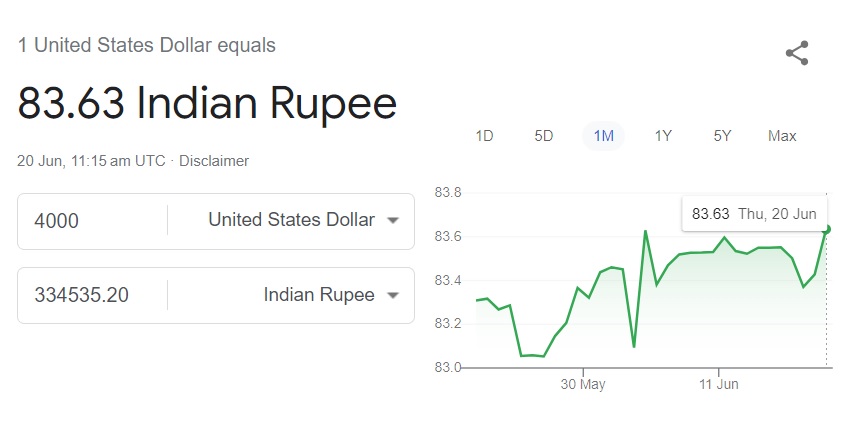

Despite India boasting of robust GDP growth and a revival of its economy, the rupee is unable to outperform the U.S. dollar. The INR fell to a new low of 83.63 last week but briefly recovered to 83.50 on Monday’s closing bell.

Also Read: Petrodollar: US Dollar in Jeopardy If Saudi Arabia Stops Accepting USD

In this article, we will discuss what’s next for the Indian rupee against the onslaught of the growing U.S. dollar. Local currencies are dipping to new lows while the USD is climbing up the stairs in the forex markets.

Also Read: BRICS: China Warns of Trade War With European Union

Currency: What Next For the Indian Rupee vs the U.S. Dollar?

The DXY index, which tracks the performance of the U.S. dollar shows the currency touching the 105.45 mark. The USD has outperformed 22 out of 23 local Asian currencies this month making the majority of them fall to new lows. While the USD pushed the Japanese yen to 1990 lows, the Chinese yuan has dipped to its seven-month low.

Also Read: Petrodollar: Chinese Yuan Can Rise Globally, Put US Dollar in Jeopardy

Only the Hong Kong dollar managed to resist the U.S. dollar’s rally and placed itself in a better position. Coming back to the Indian rupee, the currency is weakening as foreign institutional investors are exiting the stock market, the Senex and Nifty. An outflow of $2.6 billion worth of equities from the Indian stock market was initiated by FIIs.

The development added more pressure on the Indian rupee against a raging bull, which is the U.S. dollar. Currency experts are forecasting that the rupee could dip to as low as 83.80 against the USD. It will “be a matter of concern till it is holding above 83.80,” said Sajal Gupta, Head of Forex at Nuvama Institutional.