Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD stronger as Powell stays cautious

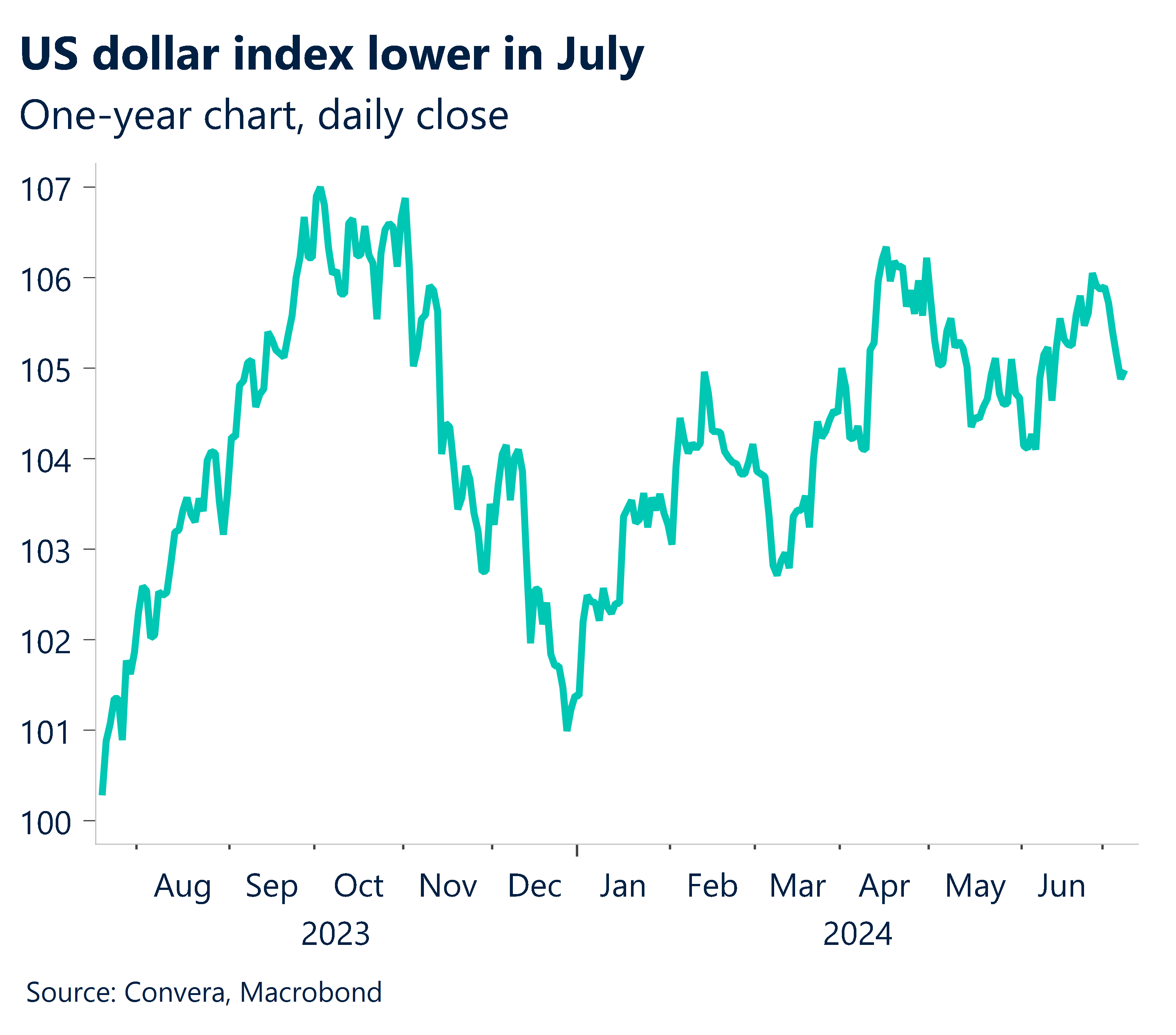

The US dollar was higher overnight as Federal Reserve chair Jerome Powell remained cautious around his next move on interest rates ahead of this week’s US inflation report.

Powell did say that he believes the US labour market is now “back in balance” and also said he expected the next move in rates will be lower but said the Fed still needs to see more falls in inflation before acting.

The US dollar has been mostly weaker so far in July but was moderately higher overnight.

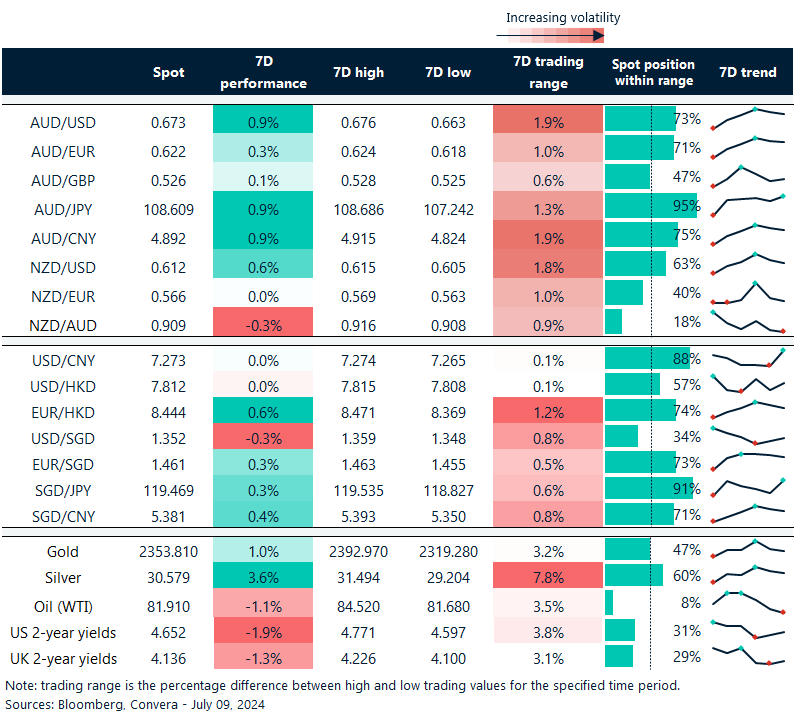

The EUR/USD fell 0.1% while GBP/USD lost 0.2%. The AUD/USD was flat.

In Asia, the USD/JPY gained 0.3%. The USD/SGD and USD/CNH both gained 0.1%.

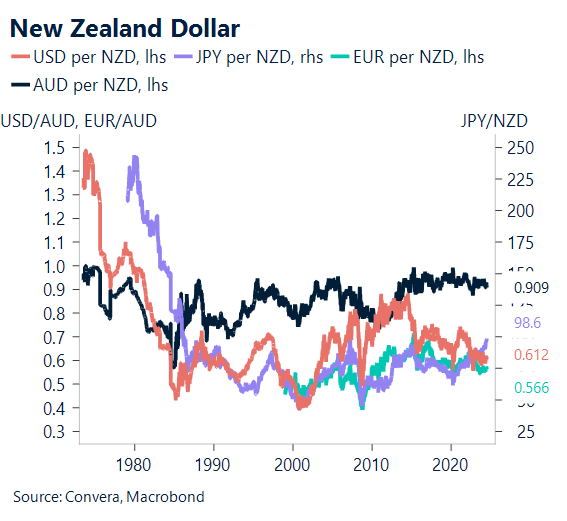

NZD weaker ahead of RBNZ

The NZD/USD fell 0.1% ahead of today’s Reserve Bank of New Zealand meeting, due at 2.00pm NZST (12.00pm AEST). We think the RBNZ will maintain its current cash rate of 5.50%.

The RBNZ may take note that most recent data points to declining activity and downward pressure on prices. Due to short-term tax cuts but longer-term expenditure constraint, we also see possible timing-related difficulties with the recent budget.

We do anticipate a significant, dovish turn, but we think it will happen later in the year—probably not now—as unemployment increases and inflation approaches its objective.

We anticipated that NZD/USD would remain stuck in a narrow range in the low 60s as the removal of unduly restrictive policies pulls on rate differentials while also providing growth with some much-needed respite.

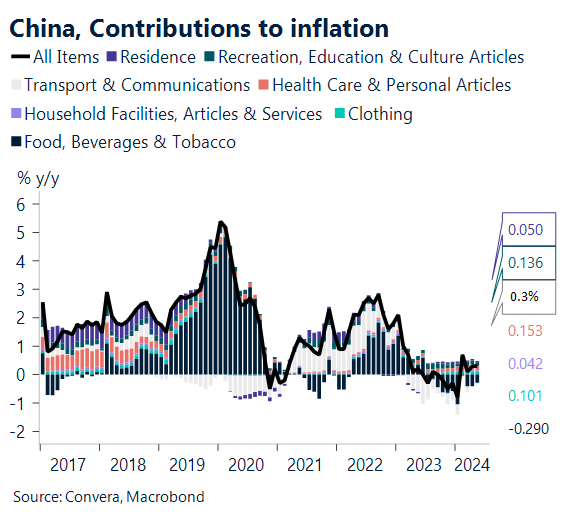

Yuan pressured with CPI due

The Chinese yuan remained weak ahead of today’s inflation figures due at 11.30am AEST.

With food prices down less than expected, we anticipate a minor uptick in CPI inflation to 0.4% y-o-y in June from 0.3% in May. Because of a low base, we anticipate PPI deflation to further narrow to -0.6% y-o-y in June from -1.4% in May.

Given the growing gap in interest rates between the US and China, we continue to believe that more weakening in CNY is probable.

USD/CNY back at highs

Table: seven-day rolling currency trends and trading ranges

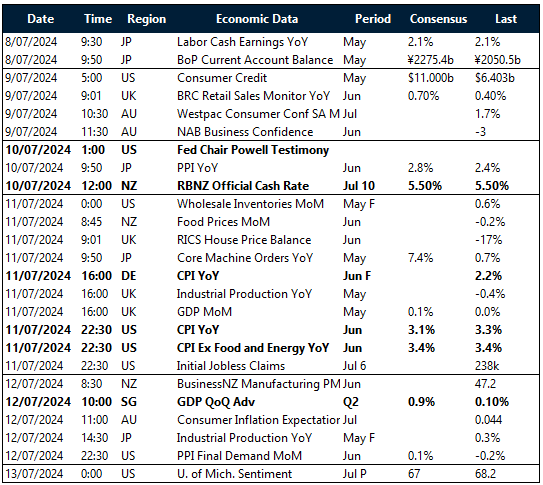

Key global risk events

Calendar: 8 – 13 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]