In global foreign exchange markets, particularly in developing economies, it is often dubbed a “wrecking ball”. The US dollar, the world’s dominant reserve currency, is living up to its formidable reputation.

Third, any unilateral action to devalue the dollar would be highly costly and risky given the size and liquidity of global currency markets.

A report by Deutsche Bank on July 22 noted the US dollar would need to drop by as much as 40 per cent to close the trade deficit. If Trump set up a foreign exchange reserve fund, it would need to buy a staggering US$2 trillion worth of foreign assets, requiring heavy issuance of US debt at a time when the government is at risk of a fiscal crisis. Even bigger sums would be needed to drive down the US dollar. “The market is far too big even for the US federal government to take on,” Deutsche Bank said.

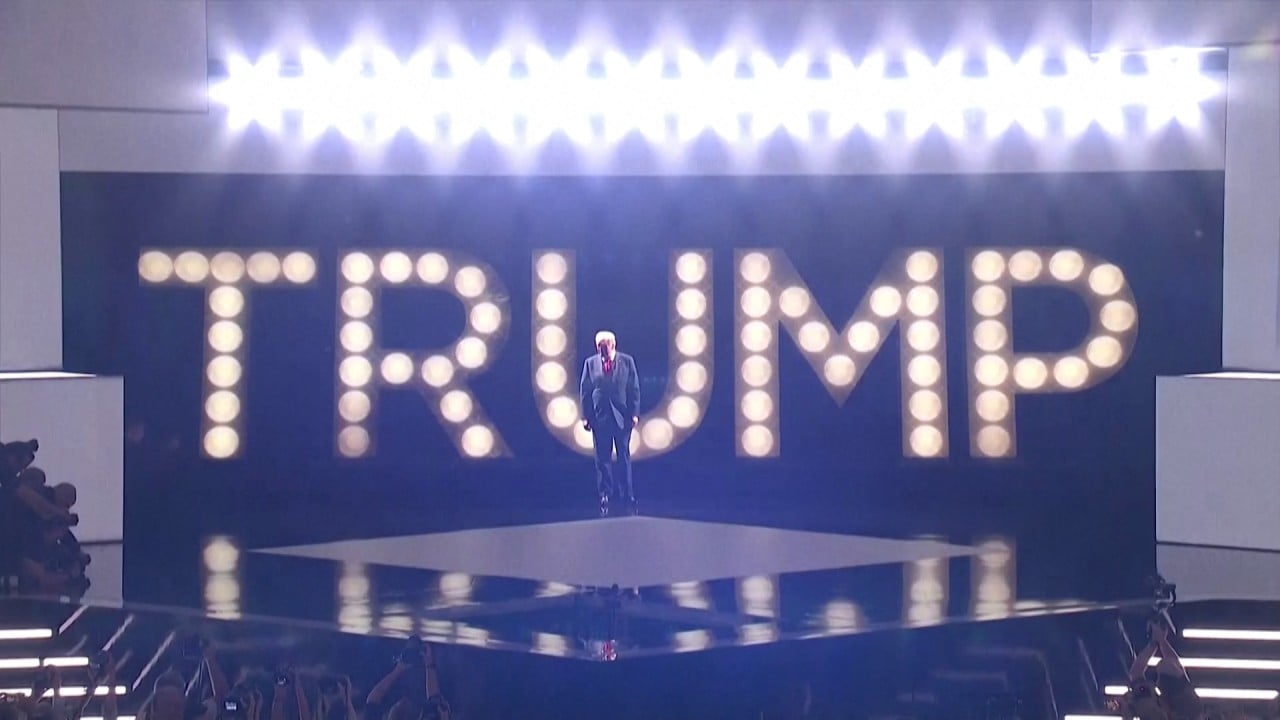

The best hope for Asian policymakers is that the Fed starts lowering interest rates in September, putting downward pressure on the US dollar. A second Trump presidency that wreaks more havoc and undercuts the dollar’s safe haven appeal is in nobody’s interest.

Nicholas Spiro is a partner at Lauressa Advisory