(Bloomberg) — Options traders are positioning for further dollar losses amid bets that Federal Reserve Chair Jerome Powell will reinforce the case for interest-rate cuts during the central bank’s annual gathering in Jackson Hole.

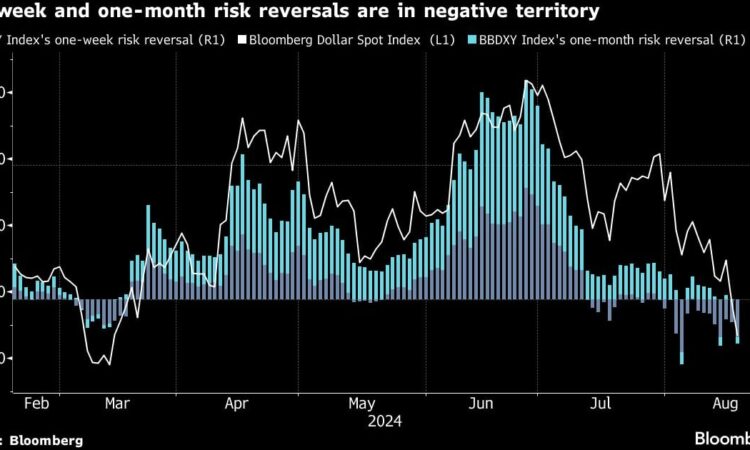

Traders are paying more for options that benefit if the dollar slumps over the next week and month than for those looking for gains, according to indexes of risk reversals on a basket of the currency’s major trading partners.

That implies traders are preparing for the currency to drop ahead of both the Jackson Hole symposium and the Fed’s September policy announcement. A Bloomberg gauge of the dollar has fallen 1.6% so far in August, touching the lowest level in five months on Monday.

Much of the greenback’s recent drop is tied to bets that Fed officials will lower US borrowing costs by at least 25 basis points next month. The US has one of the highest policy interest rates among developed nations, and a cut stands to narrow the rate differential with other currencies, helping lift non-dollar currencies.

–With assistance from Robert Fullem.

©2024 Bloomberg L.P.