(Bloomberg) — New Zealand’s central bank kept interest rates unchanged for an eighth straight meeting but toned down its hawkish rhetoric, suggesting it could ease monetary policy sooner than previously signaled. The local dollar fell as traders increased bets on rate cuts.

Most Read from Bloomberg

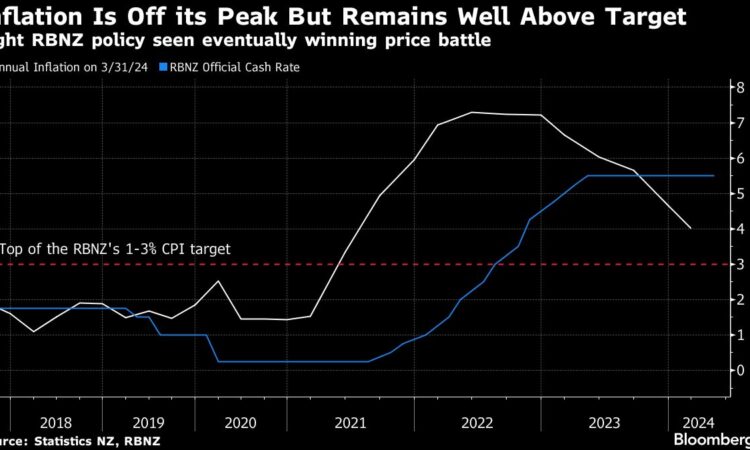

The Reserve Bank’s Monetary Policy Committee held the Official Cash Rate at 5.5% Wednesday in Wellington, as expected. It reiterated that policy needs to remain restrictive, but added that the extent of restraint will be tempered as inflation slows.

“A range of business and consumer surveys, and higher frequency spending and credit data, all point to declining activity,” the RBNZ said. Committee members “discussed the risk that this may indicate that tight monetary policy is feeding through to domestic demand more strongly than expected,” it said.

The comments are a marked departure from the RBNZ’s last meeting in May, when policymakers discussed the case to increase rates further while signaling that a cut was unlikely before the third quarter of 2025. Today’s record of meeting made no mention of a rate hike and expressed confidence that inflation will return to the bank’s 1-3% target band this year.

“The tone of today’s statement is a long way from the misplaced rate hike discussion in May,” said Sean Keane, chief Asia-Pacific strategist for JB Drax Honore. “August still feels too early for a cut, but November now feels near certain. It is quite possible that the OCR will be at 4.50% or lower by the end of March 2025.”

The New Zealand dollar fell about half a US cent after the decision to 60.80 cents at 3 p.m. in Wellington. The yield on policy sensitive two-year bonds fell 13 basis points to 4.62%, the biggest one-day drop since February 28. Investors have now fully priced two rate cuts this year, swaps data show.

New Zealand’s economy is showing signs of a deepening slump, with gross domestic product expected to have resumed its decline in the second quarter.

“There is now more evidence of excess productive capacity emerging, with measures of capacity utilization and difficulty finding labor easing materially,” the RBNZ said.

Central banks globally are focused on how quickly inflation is slowing and when they can begin easing. The US Federal Reserve is expected to start cutting before year-end. Australia’s central bank, on the other hand, continues to signal a possible rate hike, with inflation proving stickier than anticipated.

May Forecasts

The RBNZ’s latest forecasts in May show inflation falling below 3% in the final quarter of this year but not returning to its 2% goal until mid-2026. Inflation slowed to 4% in the first quarter, the weakest reading in almost three years, but a gauge of domestically generated inflation barely slowed to 5.8%.

“Some domestically generated price pressures remain strong,” the RBNZ said. “But there are signs inflation persistence will ease in line with the fall in capacity pressures and business pricing intentions.”

All economists surveyed by Bloomberg think the RBNZ’s next move will be a cut, though there is a wide range of views on the timing — from as soon as August this year to as late as the first quarter of next year.

“Although the RBNZ still sees the need for monetary policy to remain restrictive, it is making the duration a lot more conditional on data,” said Nick Tuffley, chief economist at ASB Bank in Auckland. “We continue to expect the RBNZ will cut the OCR by 25 basis points in November. However, the risks are for a sooner cut or a bigger cut.”

–With assistance from Matthew Burgess.

(Adds comments from analysts, economists.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.