Ringgit strengthens further outperforming Asian peers, CIMB sees more potential upside in near term

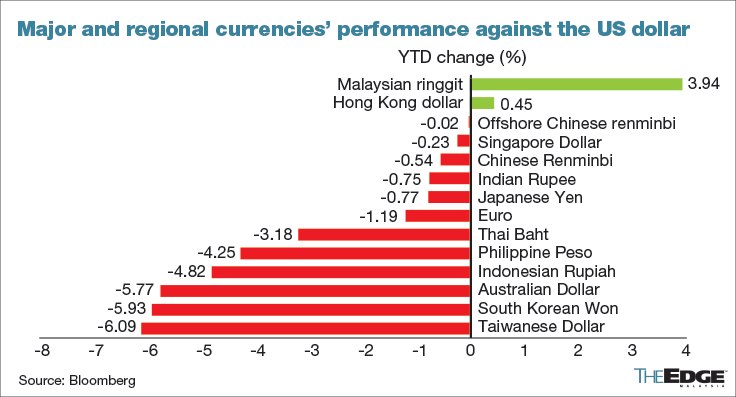

KUALA LUMPUR (Aug 5): The Malaysian ringgit continued to appreciate against the US dollar on Monday, making it one of the best performing Asian currencies year to date.

CIMB Treasury & Market Research expect the ringgit to regain its strength even further in the near term.

“We turned constructive on the ringgit in March and believe gains could persist in the near term, as net foreign exchange inflows rise,” CIMB said in a research note.

Its optimism hinges on the recovery in Malaysia’s electrical and electronics exports, which will bring in more foreign currency-denominated income to the country.

The bank believes that the appetite to hold the greenback would not be as strong moving forward, expecting Malaysian exporters to convert more of their foreign-currency earnings into the ringgit. This will lend support to the local currency.

“(Another factor) helping translate this into ringgit gains are moderating US dollar preferences due to shrinking yield differentials between the US and Malaysia,” the bank commented in the note dated Aug 5.

In addition, CIMB noted that the coordinated encouragement of flexible two-way flows that promotes easy movement of funds in and out of the country will also make exporters and resident investors to be more willing to hold the ringgit.

At the time of writing, the currency surged by as much as 2.28%, marking its largest gain in a single day since October 2015. It reached 4.4272 per dollar on Monday, its strongest level since April 2023.

“As of end-June, onshore business foreign currency deposits are estimated to have ‘excess’ unconverted proceeds of US$4.6 billion to US$6.8 billion compared to the pre-Fed tightening trend” it said. If converted, this would provide another boost to the ringgit.

Over the past month, the ringgit has appreciated by 6.2% against the US dollar. It has recovered 7.79% from its low of 4.7987 touched on February 20 this year.

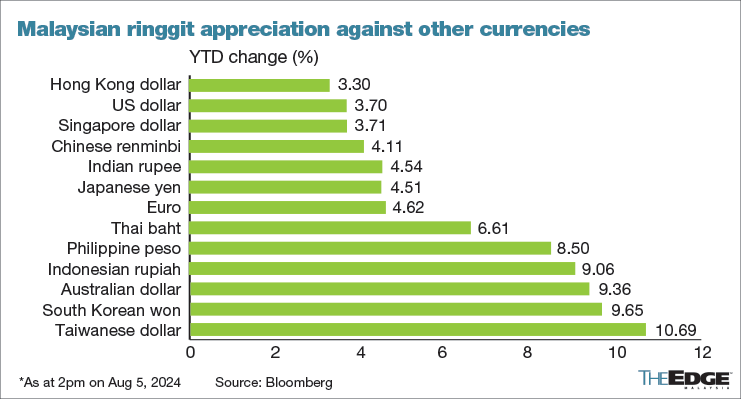

Year to date, the ringgit is up 3.64%. In comparison, the Indonesian rupiah is down 5.17%; followed by the Philippine peso which is down 4.47%; Vietnamese dong, down 3.47%; Thai baht, down 2.89%; Chinese Renminbi, down 0.55%; and Singapore dollar, down 0.2%. The only regional peer that showed appreciation against the greenback is the Hong Kong dollar that rose 0.41%.

It noted that the non-resident holdings in government bonds were 21.7% (compared with 25.2% in December 2019), and in equity markets, they were 19.6% (compared with 22.3% in December 2019).

“The combination of front-loaded US rate cuts, export and foreign direct investment prospects, the unwinding of long US dollar (positions) and normalising bond/equity non-resident exposure, presents a case for USD/MYR to overshoot our fair value of 4.30,” CIMB added.

Despite the ringgit’s continued gains, the Malaysian stocks otherwise extended their sharp decline. The country’s benchmark index is on course for its worst day in more than a year, as Asian stocks continued to tumble on fears over the health of the US economy.