Kira88

Fundamentals:

Holding fiat currency presents inherent risks due to the likelihood of devaluation and instability, and this situation isn’t expected to improve. The recent increase in the value of gold and silver can be attributed to currency risk, particularly highlighted by the U.S. threatening to seize Russian dollar assets, which is just one example of the factors undermining the stability of fiat currencies like the U.S. dollar. This instability stems from governments and central banks’ tendencies to print money excessively, leading to inflation, economic distortions, and increased debt, driven by political motives rather than economic stability.

Fiat currencies lack physical backing, enabling unchecked money creation to fund government spending. This behavior is exacerbated in times of crisis, as seen during the Covid-19 pandemic, when massive amounts of money were printed. Such practices perpetuate a cycle of debt and devaluation, posing significant risks to the currency’s stability.

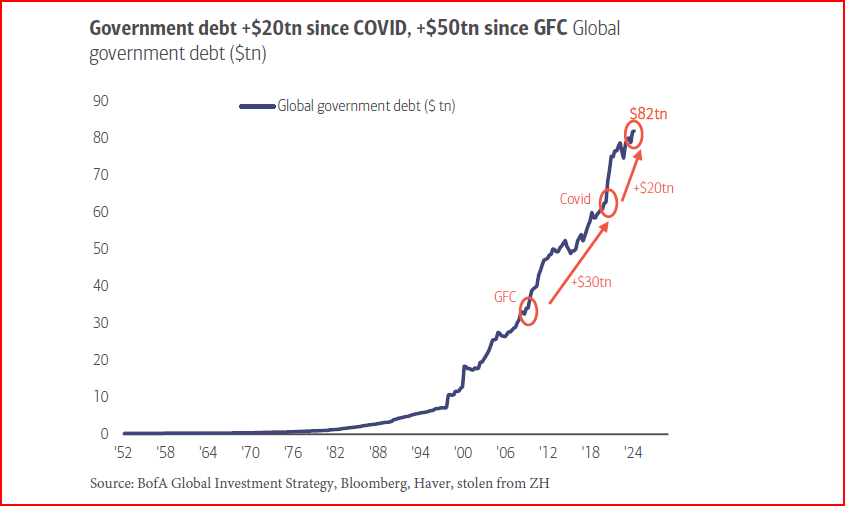

Government spending, facilitated by fiat money creation, leads to unsustainable debt levels, further destabilizing the currency. This spending habit, particularly in response to crises, creates a ratchet effect where expenditures continuously escalate without returning to pre-crisis levels. This phenomenon is evident in the U.S., where government spending now significantly outstrips revenue, contributing to a national debt exceeding $34 trillion, with global government debt reaching a staggering $82 trillion.

Goverment Debt (BOA)

In response to these currency risks, BMO Capital Markets has projected higher prices for precious metals, viewing them as a hedge against the increasing instability of fiat currencies. This perspective is reinforced by significant gold purchases by central banks worldwide, seeking to diversify and reduce their dependence on fiat currencies amidst fiscal irresponsibility, especially in the U.S. Central banks’ gold buying, aiming to safeguard against currency devaluation and economic crises, underscores the enduring value of gold as a reliable store of wealth.

In summary, the diminishing trust in fiat currencies, exacerbated by fiscal irresponsibility and excessive money printing, underscores the importance of gold and silver as stable, reliable stores of value.

How US Dollar Inflation Affects Dollarized Economies

When the US dollar experiences inflation, it can have significant implications for countries that use the US dollar as their official currency or have their economies heavily dependent on it. These countries are often referred to as “dollarized” economies. Here’s how inflation in the US dollar can affect such countries:

Import Costs: Dollarized countries heavily rely on imports, and when the US dollar inflates, it typically strengthens against other currencies. This means that imports become more expensive for dollarized countries, leading to higher costs for consumers and businesses.

Inflationary Pressure: Inflation in the US dollar can also lead to inflationary pressure in dollarized countries. As import costs rise due to the stronger dollar, domestic prices may also increase to compensate for higher input costs. This can erode the purchasing power of the local population.

Economic Stability: Dollarized countries often have limited control over monetary policy, since they cannot print US dollars. As a result, they are more vulnerable to external shocks, such as fluctuations in the US dollar or changes in US monetary policy. This lack of control can undermine economic stability in these countries.

Exchange Rate Risk: Dollarized economies may face increased exchange rate risk during periods of US dollar inflation. If their economies are heavily dependent on exports or have significant foreign debt denominated in US dollars, fluctuations in the exchange rate can pose challenges and increase financial instability.

Policy Response: In response to US dollar inflation, dollarized countries may need to implement appropriate policy measures to mitigate its impact. This could include fiscal measures to support domestic industries, regulatory changes to manage exchange rate risk, or seeking assistance from international financial institutions.

Let’s examine next week’s weekly standard deviation report and identify some high probability short-term trading opportunities.

GOLD: Weekly Standard Deviation Report

Mar. 29, 2024 10:37 PM ET

Summary

- Gold futures market showing strong upward trend, above 9-day SMA, indicating bullish weekly trend momentum.

- Closure above VC Weekly Price Momentum Indicator confirms bullish momentum.

- Traders advised to take profits on shorts during corrections, set stop orders, and consider entering long positions.

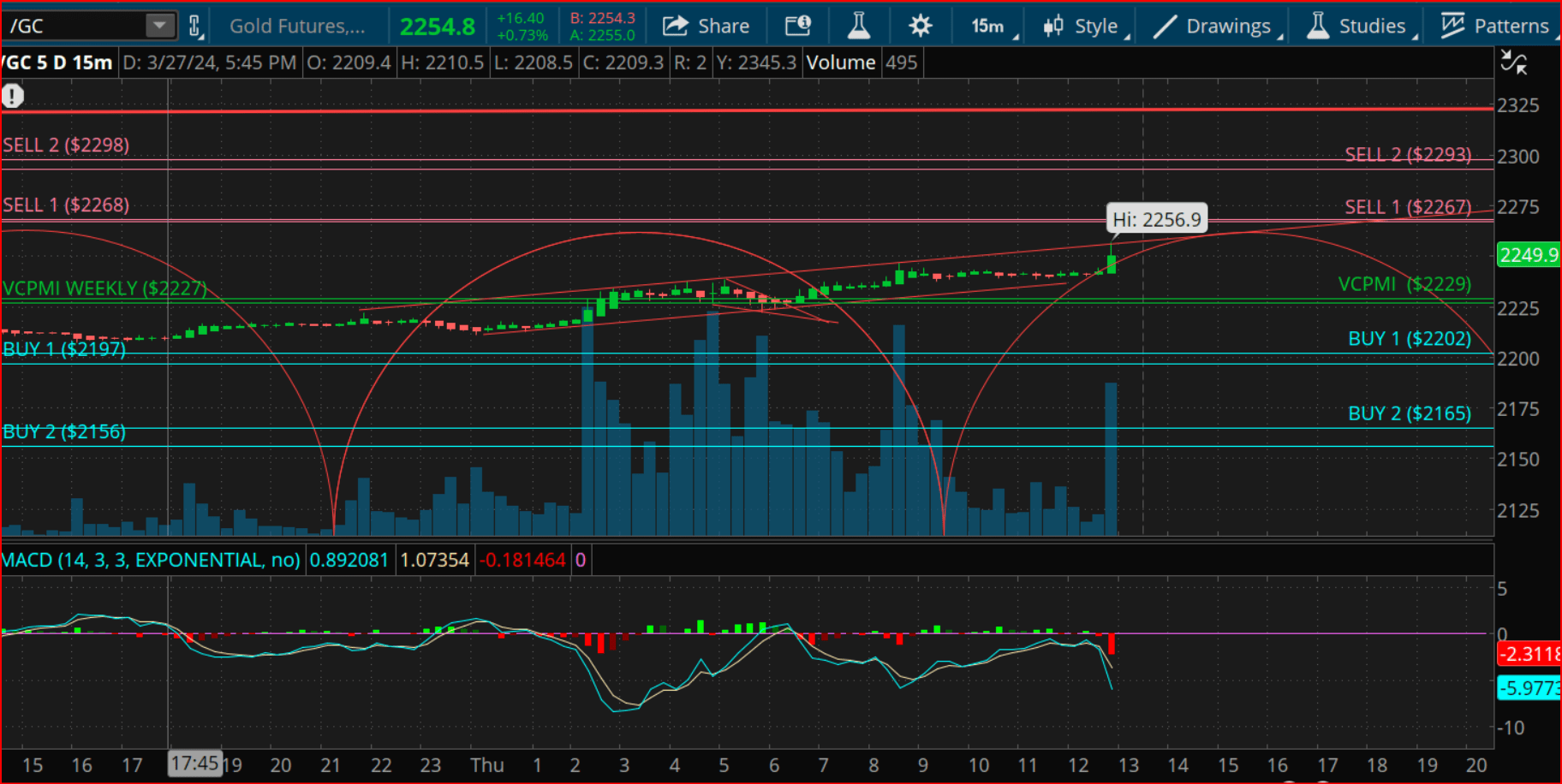

weekly gold (TOS)

The gold futures market is showing a strong upward trend, as indicated by the recent close at 2238, which is well above the 9-day Simple Moving Average (SMA) of 2130. This position above the SMA suggests a bullish weekly trend momentum. Should the market close below the 9-day SMA, this would shift the weekly trend from bullish to neutral.

In terms of weekly price momentum, the closure above the VC Weekly Price Momentum Indicator at 2227 further confirms the bullish momentum. A market closes below this indicator would change the assessment of the weekly bullish short-term trend to neutral.

For traders, the current conditions suggest a strategy of taking profits on shorts during corrections at the levels between 2197 and 2156, while considering entering long positions on a weekly reversal stop. For those already holding long positions, it’s advised to set a weekly Stop Close Only and Good Till Cancelled order at the 2156 level. Profit-taking for long positions is recommended as the market reaches the 2268 to 2298 levels within the month.

Looking ahead, the next significant date for the gold futures market is April 15, 2024, marking the upcoming cycle due date. The strategy for traders holding long positions includes taking profits between the 2268 and 2298 levels, capitalizing on the current bullish momentum in the market.