Rs 88 to the dollar, but no panic: Inside India’s surprising currency story – Economy Explained News

It’s been a long, turbulent journey for the Indian Rupee (INR) in 2025. Amid a shifting global monetary backdrop, policy uncertainty in the US, and persistent domestic headwinds, the INR has found itself trapped in a perfect storm. The dollar, after a historically poor showing this year, appears poised at a critical inflection point. As we look ahead to March 2026 and beyond into FY27, the question emerges: where is the rupee really headed?

This isn’t just a currency story. It’s a broader narrative about shifting power dynamics in global markets, the return of political influence over monetary policy, and how central banks like the Reserve Bank of India (RBI) are learning from the past to navigate an uncertain future.

Let’s unpack what’s been happening and where the rupee might be headed as we move toward FY27.

The USD at a Crossroads, but Why It Matters?

To understand the rupee’s journey, we first need to talk about the US dollar. After all, in emerging markets (EM), local currencies don’t move in isolation — they orbit the gravitational pull of the greenback.

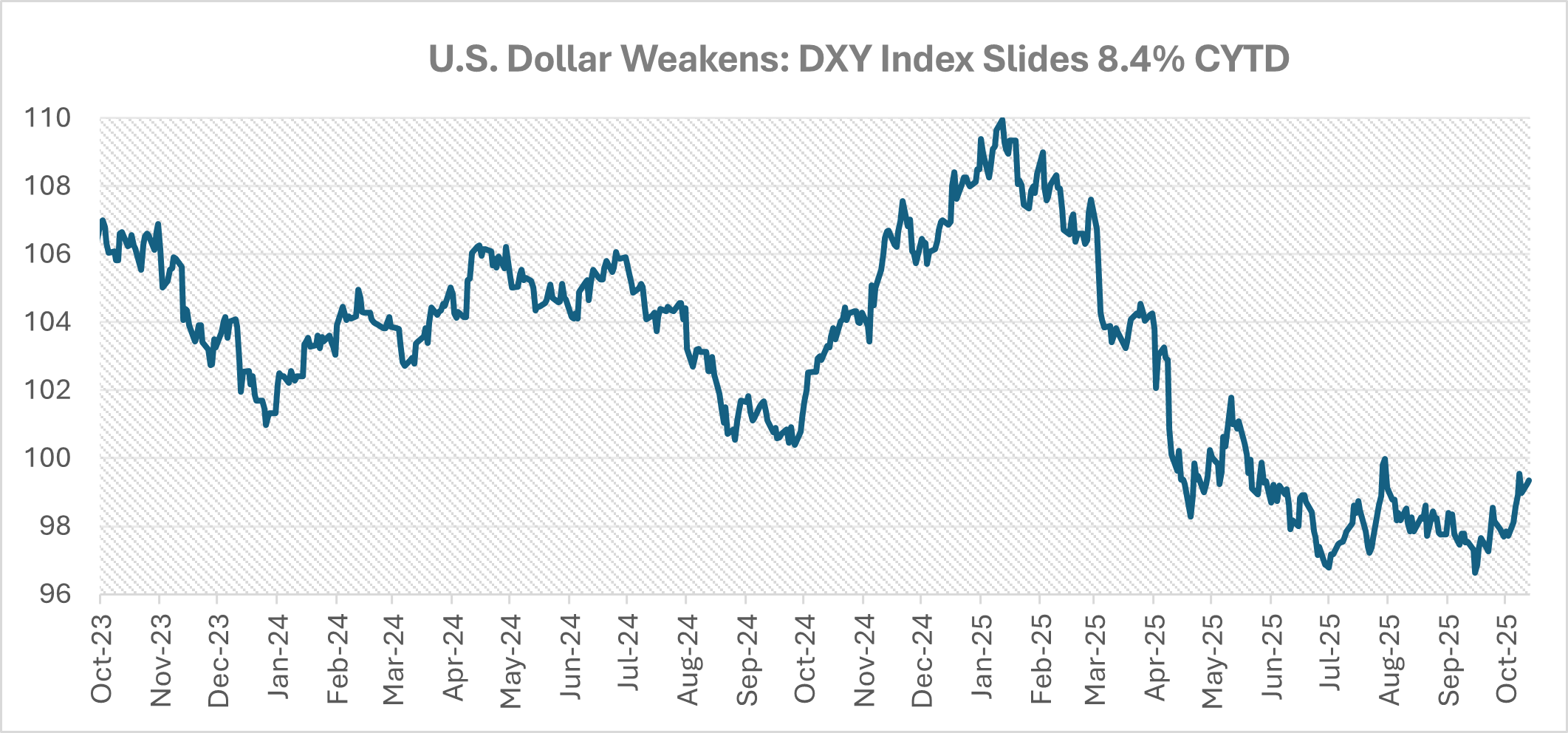

Chart 1: How the DXY Has Trended Over the Past Two Years

Now, the dollar stands at what feels like a crossroad.

In one scenario, the dollar sees a gradual weakening as the Fed resumes its cutting cycle and the economy cools – but avoids slipping into recession.

The outcome? A softer dollar, smoother adjustment, and supportive conditions for risk assets.

The other path? A sharper drop in the currency if rate cuts arrive faster than markets expect, or if political interference begins to erode confidence in the Fed’s independence.

The result? A more volatile decline, weakening in investor sentiment, and a potential turbulence across global markets.

At this point, the more likely scenario is a slow and steady decline in the USD. But either way, the direction is expected to be lower and that should, in theory, be good news for EM currencies like the rupee as it encourages capital inflows into EMs as investors seek higher yields, eases pressure on countries with dollar-denominated debt and boosts global trade and commodity prices thus benefiting EM exporters.

But it’s important to acknowledge that theory doesn’t always match reality…

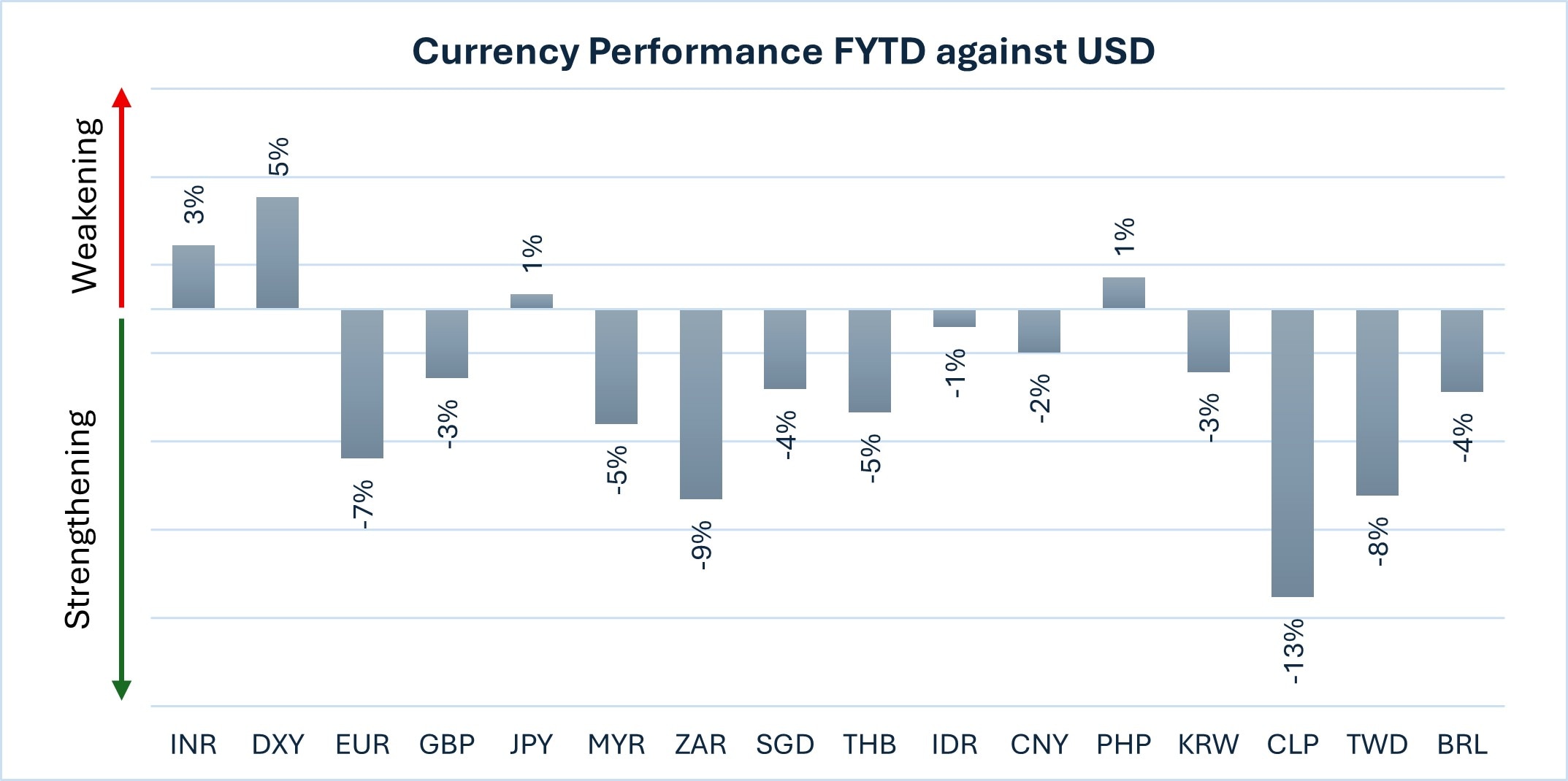

Chart II: How Global currencies have performed against USD during FYTD 2025

So Why Is the Rupee Still Under Pressure?

Despite the broad dollar softness, the rupee has underperformed in 2025, breaking above the psychological ₹88/$ in late August – a fresh all-time high.

This move understandably surprised the markets. It felt like déjà vu of the 2013 Taper Tantrum to some, when USD/INR spiked nearly 14% in a matter of weeks. But while the surface may look similar, the underlying dynamics are very different this time around.

Let’s break it down.

2025 vs. 2013: This Isn’t the Same Storm

Back in 2013, USD/INR volatility was driven by heavy option-related positioning. Indian corporates were short high-strike dollar calls, and when the rupee started slipping, these structures unraveled quickly… forcing a sharp, disorderly move higher in USD/INR. The RBI had little choice but to step in with aggressive intervention, rapidly draining its FX reserves.

To give some context, the RBI did offload ~ $14 bn (between June-Sept 2013) from its reserves at the time of the taper tantrum, and India’s forex reserves-to-imports cover had fallen to below seven months.

Fast forward to 2025, and the landscape has evolved.

We’ve just seen a break above the ₹88/$ level and yet markets haven’t panicked. And here’s why:

- Recent FX option data shows very limited positioning risk. Only 6.4% of USD/INR call options have strikes more than 4% above spot — compared to over 50% ahead of the 2013 spike. (DTCC publication)

- Put volumes are outpacing call volumes, suggesting some investors are actively positioning for a rupee recovery.

In short, we don’t see the same setup for a disorderly spike this time. That’s a win for the RBI and for rupee stability.

A Shift in the RBI’s Strategy for Managing the Rupee

There’s another critical difference: the RBI itself.

Unlike in the past, the central bank is no longer trying to hold specific levels at all costs. When USD/INR broke ₹88/$ on August 29, the RBI didn’t rush in with a heavy hand. Why?

Because it didn’t need to…

In August, RBI was estimated to have sold just ~ $3.9 billion in spot FX which is a light touch intervention compared to the past.

Over the March–July period, the RBI actually bought back over ~ $39 billion of reserves, rebuilding buffers after a heavy sell-off late last year.

The latest data shows the RBI has also been unwinding its forward book, creating space to intervene more flexibly, if needed.

Besides RBI’s dollar reserves are much higher than what it used to be back in 2013. And unlike the pace of intervention we saw in 2013 and in September 2022 (which brought down the exchange rate lower than ₹88/$), the pace of intervention now is much more calibrated.

This clearly indicates that the RBI has drawn valuable lessons from previous experiences. It is playing the long game… Focused on preserving reserves and allowing the market to absorb shocks, rather than trying to micro-manage every move.

That strategy we believe is paying off…

What’s Holding the INR Back?

With the dollar softening, and volatility under control, the natural question is, “why hasn’t the rupee strengthened yet?”

Here’s what’s weighing it down:

- Tariffs: The US imposed a new 25% tariff on Indian exports this year, followed by an additional 25% penalty tariff due to India’s imports of Russian oil. These actions raise concerns about India’s external balances and its long-term trade competitiveness.

- Equity Outflows: Moderating earnings and a slow dividend season have led to FPI outflows from equities, with CYTD outflows totaling approximately $16.6 billion and FYTD outflows around $3.0 billion. This has contributed to a reduction in FX inflows during a critical period.

- Lack of Pull Factors: Unlike some regional peers, India hasn’t seen a strong reform or investment catalyst emerge this year. However, we see some hopes of revival from the reforms introduced in the lending space and the GST 2.0. The structural story is still intact…but markets need more than long-term conviction right now.

Where is the Rupee Headed?

The near-term outlook for the rupee is likely to depend on three key factors:

- How fast and how far the Fed cuts rates

- Whether trade tensions worsen or ease

- India’s ability to attract capital inflows in a soft-dollar environment

Our base case scenario:

- March 2026: We see USD/INR modestly lower, in the 86 – 87 range.

- FY27: With global volatility easing and India regaining investor interest, USD/INR could strengthen further toward 84 – 85, assuming no fresh shocks.

But this isn’t guaranteed. Without strong domestic momentum – whether through capex revival, tech-led exports, or reform tailwinds – the rupee may continue to lag peers that have more compelling stories to tell.

The Indian rupee isn’t in crisis today, but it isn’t fully in control either. It finds itself caught between two opposing forces: a weakening U.S. dollar and domestic inertia.

On the positive side, the RBI has been managing the FX market efficiently. Risks that once posed serious threats now appear largely contained, with no signs of the panic as seen in 2013.

Still, the fundamental question remains: will the rupee merely float, or will it sail?

A softer USD gives the INR some tailwind. But unless India’s own fundamentals start pulling in the right direction, that wind might not be enough to change course.

Sneha Pandey is Fund Manager for Fixed Income and Multi-Asset Allocation Funds at Quantum AMC

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.