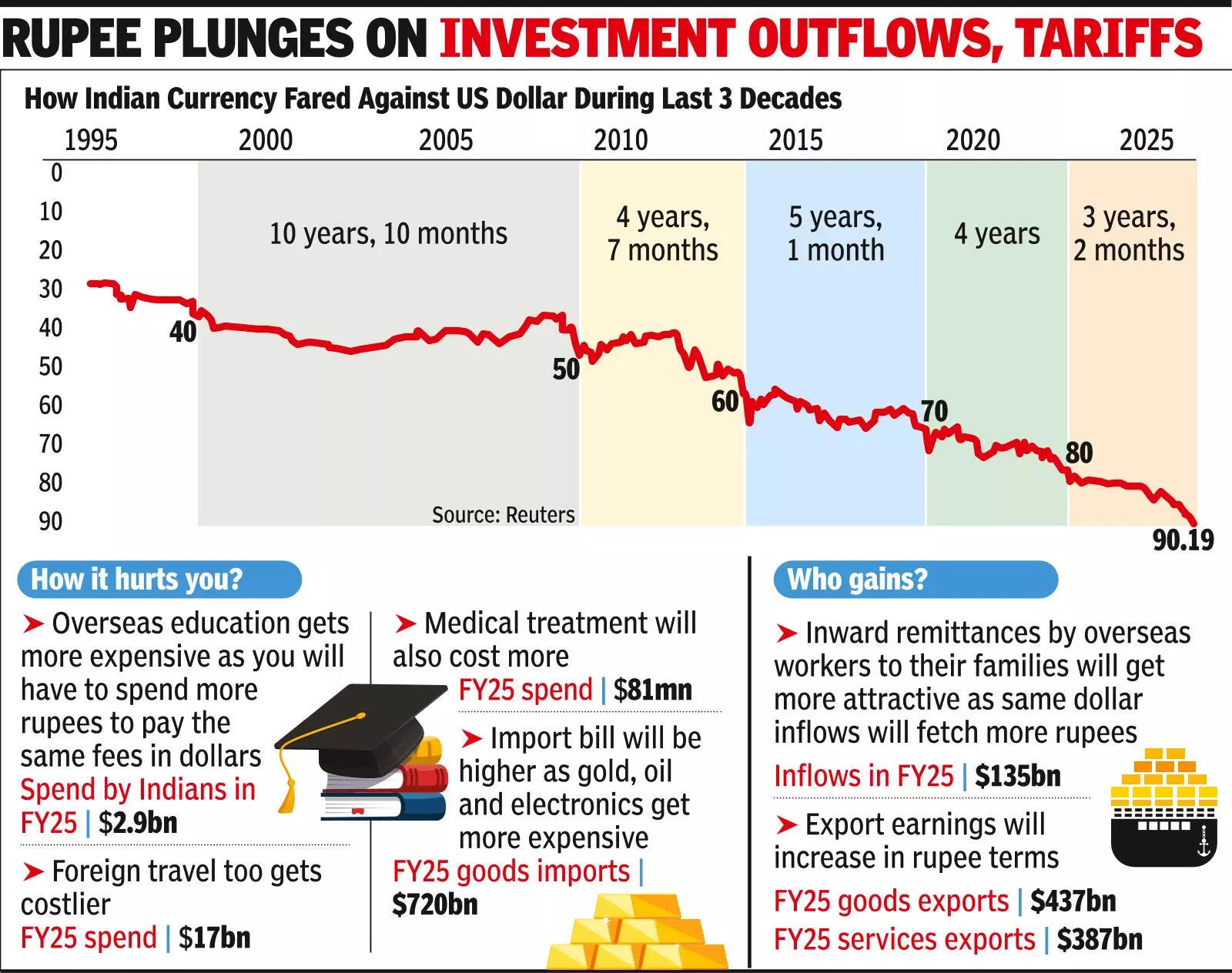

MUMBAI: The rupee, which slipped from 87.85 to 88.72 against dollar between Aug and Oct 2025 and now to 90.20 in Dec, remains fundamentally undervalued even as other emerging market countries register currency gains.The undervaluation reflects the manner in which foreign capital outflows continue to influence the rupee rather than a decline in domestic fundamentals.According to RBI’s Real Effective Exchange Rate or REER indices, the 40-currency basket stood at 97.47 in Oct, below the 100 parity mark, and has remained undervalued since Aug after a brief marginal overvaluation in July when the index touched 100.03. REER is the weighted average of a country’s currency in relation to an index or basket of other major currencies.“…the onset of the trade war has pulled it below the 100 level, as the rupee lost more ground compared with other emerging market currencies. Since April 2023, rupee has declined around 10% and the REER reached the lowest level 97.40 in Sept 2025, which is seven-years low since Nov 2018, when it was at 99.60. Further, the latest RBI REER data as on Oct 2025 indicates rupee is undervalued for the 3rd straight month, which reflects softer currency and lower inflation,” SBI research said in a report.

Even As Some Emerging Market Economies Log Currency Gains Since Aug 1

Most emerging market currencies have strengthened since Aug 1, with the South African rand up 5%, the Brazilian real up 3.7%, and the Malaysian ringgit up 3.4%. Currencies in countries including Mexico, China, Switzerland and the euro area have also appreciated in a range of 3.1% to 0.4%.The rupee’s 2.3% slide in the same period contrasts with steeper losses in Asia. The Korean won weakened as an export slowdown, a growth forecast cut to 1.8%, and expectations of a Bank of Korea rate cut drove foreign outflows, while yen contagion and uncertainty over US trade talks pushed US dollar/Korean won to a six-month low near 1,439.The Taiwan dollar fell to 30.70 after a $2.38 billion equity sell-off on Aug 20 and softer China and Europe demand and tariff concerns, with central bank interventions slowing but not reversing the decline. The yen softened as a 0.4% Q3 GDP contraction, PM Takaichi’s backing of ultra-loose policy, and fading Bank of Japan hike expectations outweighed verbal interventions, taking US dollar/Japanese yen above 154 to a nine-month high.The REER staying below 100 while the rupee weakens against the dollar is consistent with economic conditions. The undervaluation supports India’s export competitiveness, but it raises inflationary pressure at the same time.