(Bloomberg) — The final week of 2023 is expected to be much quieter on Wall Street after a ferocious rally that put the US stock market within a striking distance of its record.

Most Read from Bloomberg

Equities barely budged on Tuesday, following the S&P 500’s longest weekly run since 2017. The Federal Reserve’s dovish pivot this month fueled risk appetite in a surge that brought the American stock gauge less than 1% away from its all-time high while leading to warnings about a pullback.

The so-called Santa Claus rally typically encompasses the last five trading sessions of the year and the first two of the new one. Overall, this trading period has a pretty strong record. Since 1969, the S&P 500 has averaged a gain of 1.3% over the seven-day period, according to the Stock Trader’s Almanac.

“The ‘Santa Claus Rally’ indicator officially started last Friday,” said Craig Johnson, chief market technician at Piper Sandler. “We expect any pullbacks will be modest and short-lived as investors follow the eight-week uptrend toward new highs.”

The economic calendar is thin this week, with data Tuesday showing home prices in the US rose for a ninth straight month, reaching a fresh record as buyers battled for a stubbornly tight supply of listings.

Treasuries were mixed ahead of a $57 billion sale of two-year notes at 1 p.m. New York time.

The US bond market booked a fourth-straight week of gains on building investor confidence that the Fed will begin cutting interest rates next quarter.

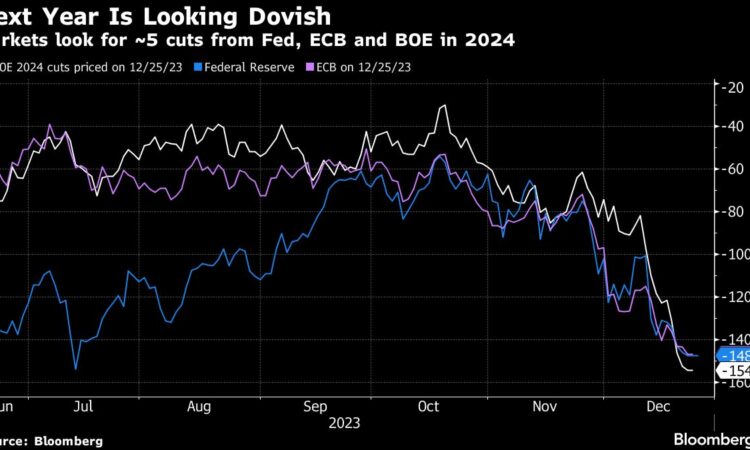

Swap contracts tied to Fed meetings imply an over 90% probability the US central bank brings down its current 5.25% to 5.5% target rate range down in March. Across 2024, traders are penciling in nearly 160 basis points of rate reductions — more than twice as much as Fed officials signaled earlier this month in their new round of quarterly forecasts.

In corporate news, the White House declined to overturn a sales ban on Apple Inc.’s smartwatches in the US, failing to offer a reprieve to the tech giant. Intel Corp. confirmed it will invest a total of $25 billion in Israel after securing $3.2 billion in incentives from the country’s government. Bristol Myers Squibb Co. agreed to buy radiological drug developer RayzeBio Inc. for about $4.1 billion.

Elsewhere, oil rose as tensions remained high over shipping disruptions in the Red Sea due to a spate of Houthi attacks against vessels in the vital waterway, and after US military strikes in Iraq. Iron ore rallied to its highest since June 2022.

Key events this week:

-

China industrial profits, Wednesday

-

Bank of Japan issues Summary of Opinions from December monetary policy meeting, Wednesday

-

Japan industrial production, retail sales, Thursday

-

US wholesale inventories, initial jobless claims, Thursday

-

UK Nationwide house prices, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.1% as of 9:30 a.m. New York time

-

The Nasdaq 100 rose 0.3%

-

The Dow Jones Industrial Average was little changed

-

The MSCI World index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.1% to $1.1023

-

The British pound rose 0.2% to $1.2715

-

The Japanese yen was little changed at 142.36 per dollar

Cryptocurrencies

-

Bitcoin fell 1.7% to $42,770.74

-

Ether fell 1.1% to $2,247.5

Bonds

-

The yield on 10-year Treasuries was little changed at 3.90%

-

Germany’s 10-year yield was little changed at 1.98%

-

Britain’s 10-year yield was little changed at 3.50%

Commodities

-

West Texas Intermediate crude rose 2.7% to $75.51 a barrel

-

Spot gold rose 0.4% to $2,061.24 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Esha Dey, Jessica Menton, Carter Johnson and Liz Capo McCormick.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.