The global depreciation of the US dollar and the loss of competitiveness in Latin America: a temporary or a lasting phenomenon?

The appreciation of Latin American currencies against the US dollar has led to a significant increase in prices and domestic costs measured in US dollars and to a loss of competitiveness.

Throughout the region there is an understandable outcry from exporting sectors that see their profitability margins narrowing or even disappearing.

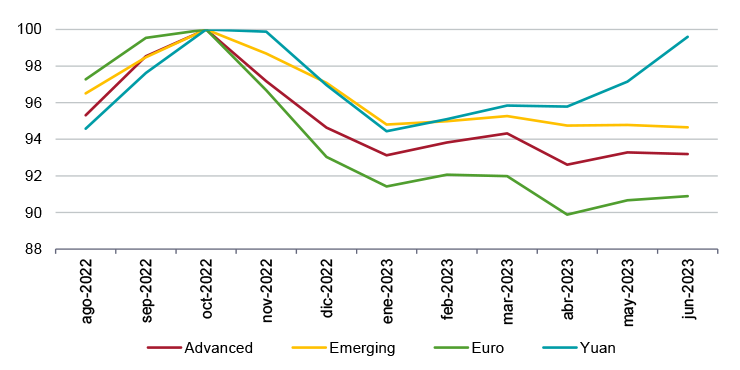

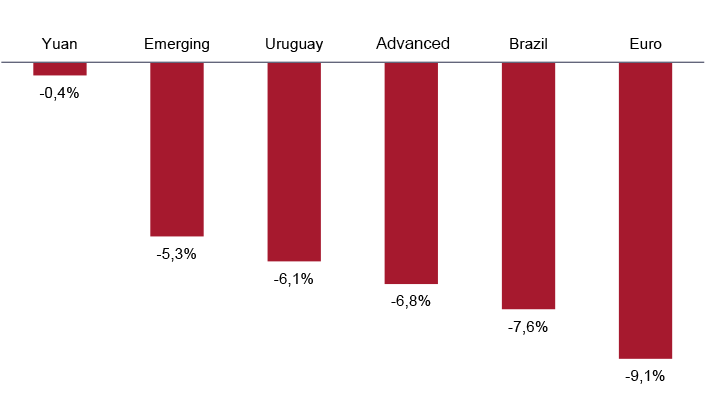

The truth is that since October 2022, when inflation began to ease in the US, the dollar depreciated very significantly at the global level with respect to the currencies of both advanced and emerging countries (Figures 1a and 1b).

The US dollar loss of value against the currencies of the advanced countries was greater than against the currencies of the emerging countries, and larger against the euro than with respect to the rest of advanced countries. Only China’s currency remained relatively stable against the US dollar, as access to its domestic capital market is restricted.

Figures 1a & 1b. Depreciation of the US$ vs currencies of advanced and emerging countries

Figure 1a. Nominal exchange rate to the US$: advanced and emerging countries (domestic currency per dollar; Index Oct 2022 = 100)

Figure 1b. Nominal exchange rate to the dollar: advanced and emerging countries (domestic currency per US$; variation Jun 23 vs Oct 22)

Source: FRED.

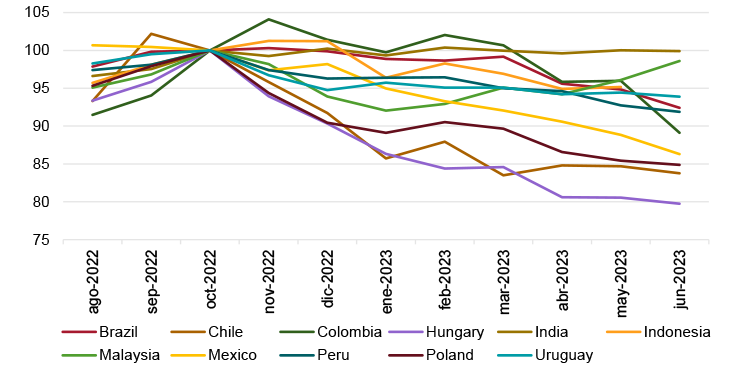

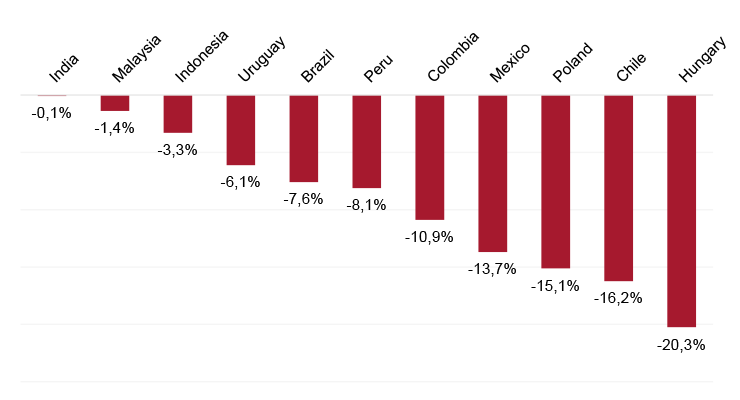

On the other hand, the appreciation of emerging countries’ currencies against the US dollar was generalised (Figure 2a). The smallest appreciations occurred in emerging Asia and the largest in emerging Europe, with Latin American countries falling in between the two extremes (Figure 2b).

Figures 2a & 2b. Depreciation of the US$ vs currencies of emerging countries

Figure 2a. Nominal exchange rate to the US$: emerging countries (domestic currency per dollar; index Oct 2022 = 100)

Source: FRED.

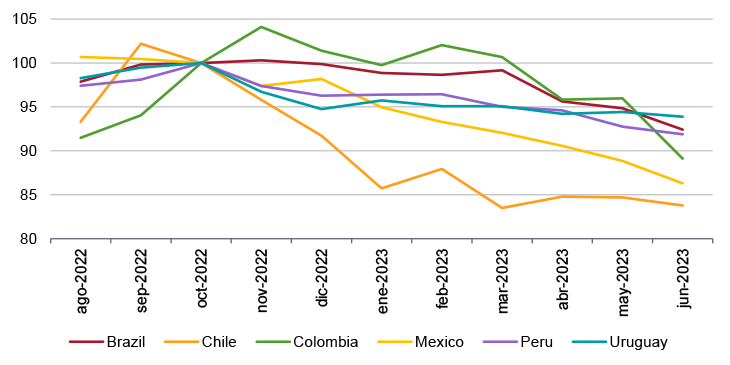

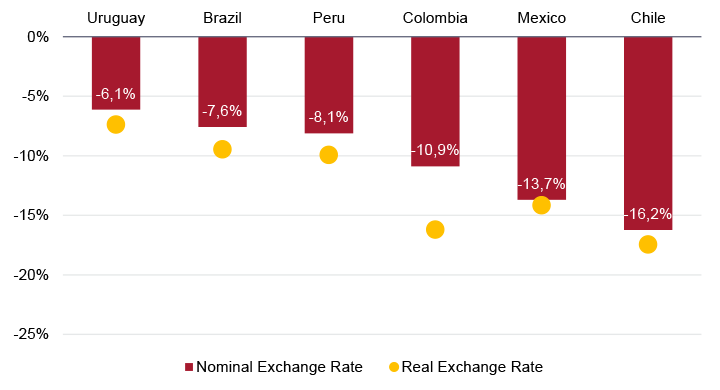

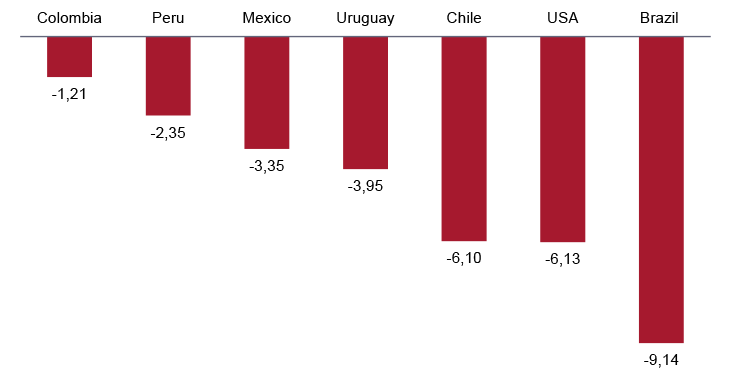

Among the currencies of Latin American countries, the largest appreciations were recorded in Chile and Mexico, while the smallest occurred in Uruguay and Brazil (Figures 3a and 3b).

Figures 3a & 3b. Depreciation of the US$ vs currencies of Latin American countries

Figure 3a. Nominal exchange rate to the US$: Latin American countries domestic currency per dollar; index Oct 2022 = 100)

Figure 3b. Nominal exchange rate to the US$: Latin American countries (domestic currency per US$ dollar; variation Jun 23 vs Oct 22)

Source: FRED.

We are therefore facing a systemic phenomenon of loss of value of the US dollar and the consequent loss of competitiveness in both emerging and advanced countries. Latin America has been no exception.

The causes

What is the reason for this fall in the value of the US dollar?

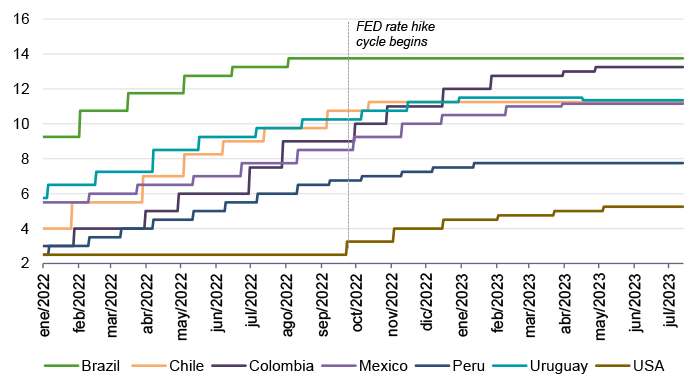

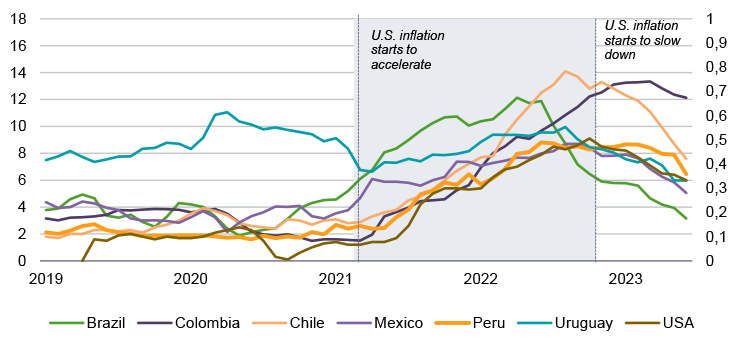

As shown in Figure 4a, Latin American countries started the interest rate hike cycle before the US Federal Reserve (FED). And they did so decisively as soon as inflationary pressures began to manifest themselves in mid-2021, so that there would be no doubt about the commitment of central banks to price stability, conquered by fire and sword, in a region with an inflationary past still firmly installed in the collective memory.

In fact, in Brazil inflation began to accelerate at the end of 2020 and its Central Bank initiated a contractionary monetary policy and a cycle of interest rate hikes a year before the FED.

Figure 4a & 4b. Synchronised monetary policy

Figure 4a. Monetary policy interest rate: Latin America and the US (in %)

Figure 4b. Policy interest rate differentials vs US policy interest rate (in %)

Source: Central Bank of Brazil, Banco de la República de Colombia, Central Bank of Chile, US Federal Reserve, Central Bank of Mexico, Central Reserve Bank of Peru and Central Bank of Uruguay.

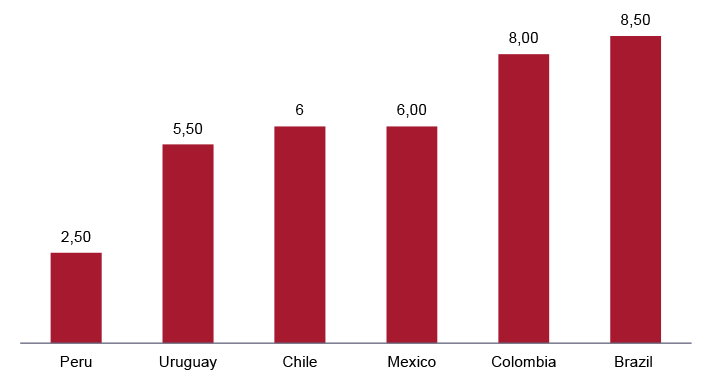

As a result of the restrictive monetary policy and the interest rate hikes implemented by all Latin American central banks, interest rate differentials with respect to the US have accumulated, currently ranging from a minimum of 2.5 percentage points in Peru to a maximum of 8.5 percentage points in Brazil.

With inflation easing in the US (Figure 5a), expectations of continued interest rate hikes by the FED diminished considerably. With inflation also easing in Latin America (Figure 5b), the expectation of interest rate cuts by Latin American Central Banks increased considerably.

Figures 5a & 5b. Synchronised inflation rates

Figure 5a. Inflation rate in Latin America and the US (year-on-year change in the Consumer Price Index)

Figure 5b. Inflation reduction in Latin America and the US relative to the peak in 2022-23

Source: Investing.

This led international –and certainly also local– investors to lock-in the juicy spreads between yields on domestic currency securities in Latin American countries and yields on short-term securities in US dollars, before interest rates began to fall and spreads to narrow. The latter generated a strong inflow of capital (supply of dollars) and led to a massive appreciation of Latin American currencies.

Conclusions

What can we conclude from this observation?

That if the success in containing inflation consolidates, the emblematic case being that of Brazil, where inflation was reduced from a maximum of 12% per year in April 2022 to 3.2% in June 2023, the restrictive cycle of monetary policy in Latin American countries would be coming to an end.

As interest rates gradually begin to fall and the attractive spreads with US dollar rates begin to narrow, the capital inflows (supply of dollars) that are generating massive appreciations of Latin American currencies will also diminish.

The monetary policy of the FED relative to that of Latin American central banks will be decisive. The timing and speed of interest rate cuts will determine the spreads between dollar interest rates and local currency interest rates and will set the tone for what happens to the value of the dollar in the region.

Elcano Comments

This is a new initiative of the Institute that aims to offer analyses by experts on topics that are within the scope of our research agenda. They are published on no regular basis but as opportunity arises in accordance with the advice of the broader academic community in cooperation with the Elcano Royal Institute.