Published as part of the ECB Economic Bulletin, Issue 7/2019.

This article begins with a review of the global trends in central banks’ foreign currency reserve holdings in terms of their size, adequacy and composition, and follows on to examine the ECB’s foreign currency reserves. Just as the reasons for holding reserves have changed over time and across countries, so too have the size and composition of those reserves. Views on appropriate adequacy metrics have also changed. Global foreign currency reserves grew markedly after the Asian financial crisis of the late 1990s, with emerging markets accumulating large reserves to self-insure against potential shocks. In some cases, the growth in reserves was a by-product of export-led growth strategies. While global foreign currency reserves have traditionally been invested primarily in US dollar-denominated financial assets, in recent years holdings have become more diversified in terms of both currency and asset classes.

The second section of the article describes how the ECB’s foreign currency reserves are invested in the light of its main purpose, which is to ensure that the Eurosystem has a sufficient amount of liquid resources whenever they are needed for its foreign exchange policy operations involving non-EU currencies. The investment framework includes three layers of governance, representing: i) the strategic investment policy; ii) medium-term tactical positioning; and iii) day-to-day portfolio management. The way in which the framework involves the national central banks (NCBs) of the Eurosystem in the active management of the ECB’s foreign currency reserves is both unique and intricate. The article describes this active management approach, the internal competition between NCB portfolio managers and the diversification of portfolio management styles that the framework fosters.

1 Trends in central banks’ foreign reserve holdings

Foreign currency reserves generally refer to readily available holdings in monetary authorities’ safe external assets. These authorities are, typically, the central bank, the Treasury or the Ministry of Finance of the country concerned. Total official reserves are the broadest definition of international reserves, including both foreign currency reserves and non-currency reserves. Foreign currency reserves, which comprise external assets generally controlled by national monetary authorities, consist of securities and deposits. They are established by way of foreign reserve policy decisions on, for example, foreign exchange market interventions or the management of reserve portfolios. Such interventions might involve shifts across currency denominations, asset classes and maturities. The other component of official reserves, which generally makes up a smaller share of total official reserves, includes monetary gold and claims on international financial institutions that can be rapidly converted into foreign currency reserves. These are special drawing rights (SDRs), the reserve position at the International Monetary Fund (IMF) and other reserve assets consisting of financial derivatives, loans to non-bank non-residents and others. While this article focuses on the main component of total official reserves, namely the foreign currency reserves component, it also includes a box describing gold developments.[1]

1.1 Main objectives of holding foreign currency reserves

Foreign currency reserves are an important element of the macro-policy toolkit. A number of countries developed the practice of holding foreign currency reserves in the mid-nineteenth century to back their liabilities and domestic currency with a view to supplementing their gold and silver reserves.[2] Since then, the reasons for holding foreign currency reserves have evolved over time and across countries. One possible use of foreign currency reserves, common to both advanced and emerging market economies, is to enable them to carry out foreign exchange interventions, if deemed necessary. In emerging markets, foreign currency reserves serve a broader range of purposes.

Foreign currency reserves are generally held for traditional operational purposes as well as for precautionary and non-precautionary policy objectives. Traditional operational purposes include facilitating regular international debt and import-related payments made on behalf of the government; smoothing out payment schedules; serving as collateral to relax external borrowing constraints; or underpinning monetary policy with respect to liquidity operations.[3] From a precautionary perspective, countries hold reserves as a buffer to absorb or self-insure against balance of payment shocks, including sudden stops in international capital flows; to provide foreign currency liquidity to banks in stressed situations; and to mitigate volatility in foreign exchange markets.[4] In countries with non-floating exchange rates, reserves act as a buffer to cover monetary liabilities. Countries with exchange rate flexibility need lower reserve holdings, as the exchange rate can act as a buffer and help absorb external shocks. However, exchange rate adjustment can also have adverse consequences, for instance if there are large currency mismatches or foreign currency exposures on the country’s external balance sheet. Foreign currency reserves can, in that case, play a stabilising role as they may discourage one-way bets during episodes of financial stress.[5] Other studies point to non-precautionary or mercantilist motives, suggesting that economies accumulate foreign currency reserves to prevent their exchange rate from appreciating, the aim being to maintain external competitiveness and promote export-led growth.[6]

As for the ECB, the main purpose of holding foreign currency reserves is to ensure that the Eurosystem has a sufficient amount of liquid resources, whenever needed, for its foreign exchange policy operations involving non-EU currencies. The euro’s external value is not a policy target for the ECB.[7] Against this background, the ECB’s rationale for holding foreign currency reserves is to be able to intervene in the foreign exchange market whenever needed, to prevent disorderly market conditions that could have an adverse impact on price stability in the euro area and at the global level. Such market conditions have been rare since the inception of the euro. The ECB’s foreign currency reserves were therefore only used to fund interventions in September/November 2000 and in March 2011.[8]

1.2 Size of global foreign currency reserves

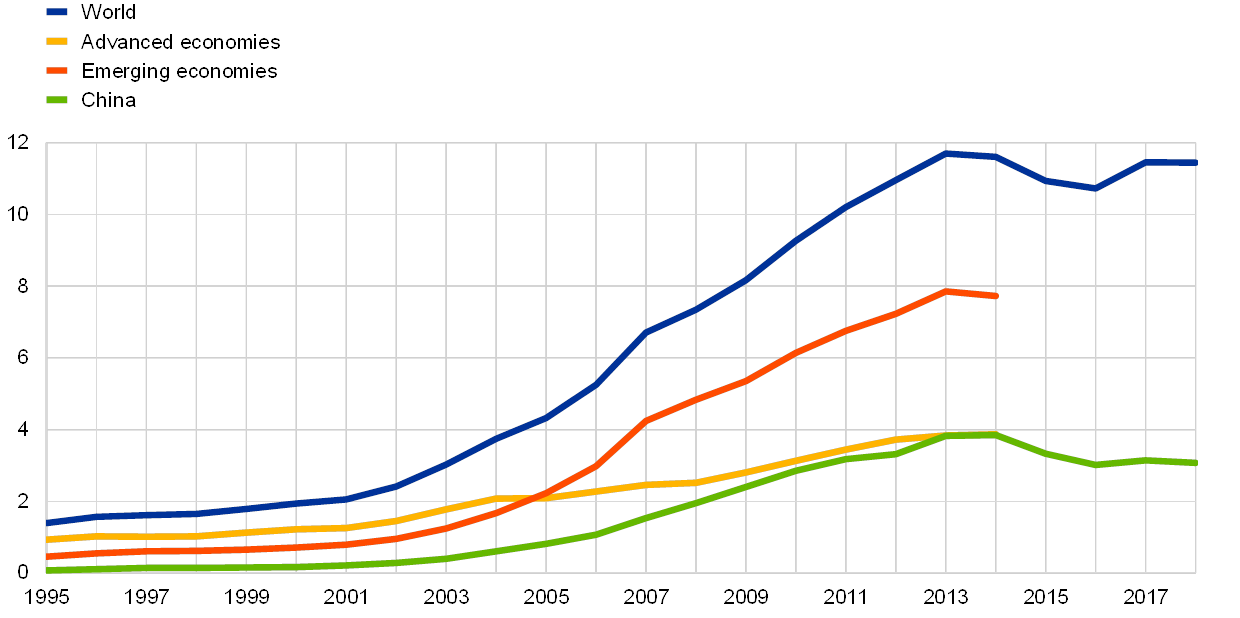

Total foreign currency reserves held globally increased to over USD 11 trillion at the end of 2018, a tenfold increase compared with 30 years ago. Around two-thirds of global foreign currency reserves are held by emerging and developing economies. After the Bretton Woods system was brought to an end, global foreign currency reserve holdings grew sharply, particularly among advanced economies, despite the fact that it was widely expected that the shift to floating exchange rates would reduce the appeal of holding foreign currency reserves.[9] Following the Asian crisis, emerging market and commodity-exporting economies also began accumulating sizeable foreign currency reserves, with China accounting for the largest share of that increase. Commodity-exporting countries saw an even more rapid accumulation of reserves after 2005, as surging commodity prices contributed to their large balance of payment surpluses. The increase in foreign currency reserve holdings was widespread, with advanced economies’ holdings also increasing, albeit modestly. Global foreign currency reserve holdings continued to grow in the wake of the global financial crisis, as some countries were reluctant to use their reserves, fearing that doing so might send a negative signal about potential exchange rate pressures.[10] More recent developments suggest that foreign currency reserves have levelled off since 2015 (see Chart 1).[11]

Research suggests that the significant accumulation of foreign currency reserves by emerging markets since the turn of the millennium has been driven by both precautionary and non-precautionary motives. Most studies provide two main explanations. One is that precautionary motives encourage countries to hold foreign currency reserves to manage situations of financial distress, mainly sudden stops in capital flows, as discussed in Section 1.1. The lessons of the financial crises of the late 1990s led many emerging market countries to accumulate foreign currency reserves when opening up their economies to global trade and finance. Moreover, some of the Asian economies sought to self-insure to avoid requesting external IMF financial assistance. Other studies point to additional drivers of reserve accumulation related to potential vulnerabilities and market failures in the international monetary and financial system. These include uncertainty about international liquidity availability in a financial crisis, capital flow volatility or global imbalances.[12] However, several studies have found that precautionary motives alone are not enough to explain the magnitude of the reserve accumulation of the 2000s. Non-precautionary or mercantilist motives, whereby economies accumulate reserves to maintain external competiveness and boost exports, have also played an important role.[13] There are, however, also costs associated with reserve accumulation, particularly when this accumulation is excessive.[14]

Chart 1

Global foreign currency reserves

Developments in global holdings of foreign currency reserves and breakdown by main country groups

(USD trillions)

Sources: IMF COFER, Haver Analytics and ECB calculations.

Note: The breakdown between advanced and emerging economies is no longer available since China started reporting data for the IMF COFER.

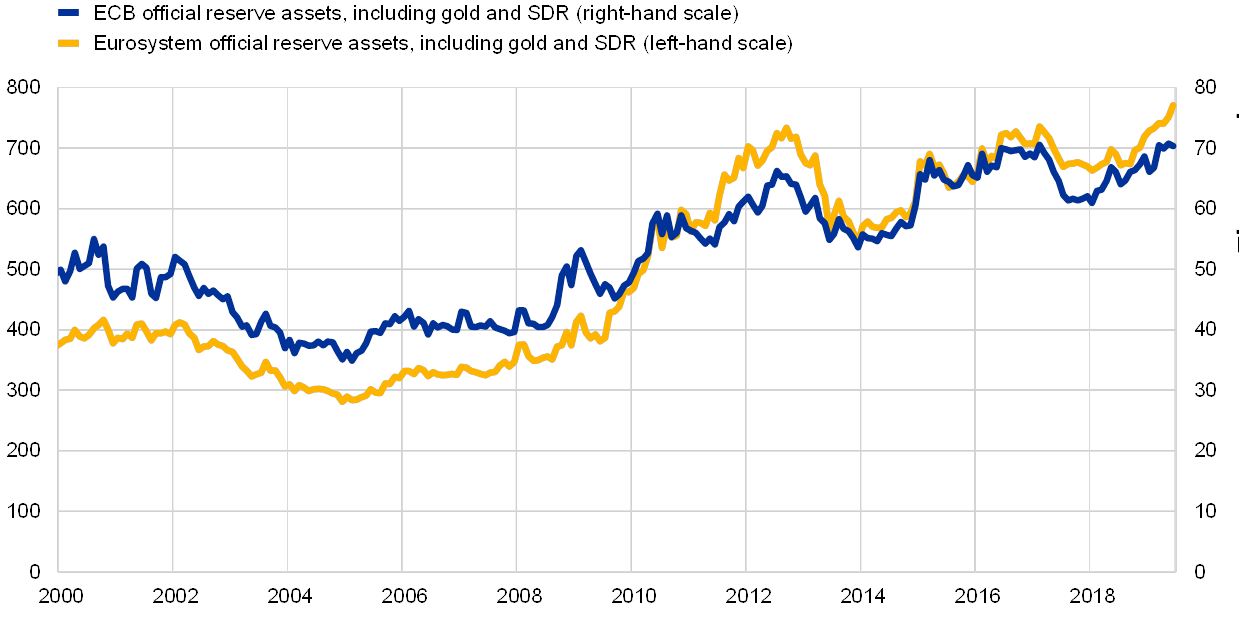

In the case of the ECB, its total official reserve assets, including both foreign currency and non-foreign currency reserves, were equivalent to around EUR 68.6 billion at the end of 2018.[15] These reserves comprise around EUR 49 billion in foreign currencies (US dollar, Japanese yen and onshore Chinese renminbi) and around EUR 18.2 billion in gold, with the remaining assets held in IMF SDRs. Official reserves were initially transferred to the ECB by the NCBs of those EU Member States that had adopted the euro,[16] in proportion to their share in the ECB’s capital subscription[17].

At the end of 2018, the entire Eurosystem held EUR 719 billion in total official reserve assets, including the ECB’s official reserve assets. As this figure indicates, the NCBs hold significant additional official reserves on top of those held by the ECB. The NCBs have full autonomy over the management of their official reserve assets in terms of asset allocation, risk/return profile and management style and have multiple investment purposes for the assets. While the ECB’s official reserve assets can be regarded as the Eurosystem’s most liquid tranche that would be used as the first reserve pool to fund any foreign exchange interventions, the official reserves held by the NCBs can be seen as separate and autonomous investment tranches. Nevertheless, according to the Statute of the European System of Central Banks,[18] a part of these reserves should be readily available for intervention purposes at short notice, if necessary. Chart 2 illustrates the development of these official reserves, whose market value has changed over time to reflect inflows and outflows, investment income and fluctuations in the market prices of investments and exchange rates.

Chart 2

Official reserve assets of the ECB and the Eurosystem

(EUR billions, monthly data)

Source: ECB

1.3 Adequacy of foreign currency reserves

Whether the level of foreign currency reserve holdings is deemed to be adequate hinges on several factors. These include both the rationale for and the cost of holding reserves; the level of domestic financial development; the credibility of monetary policy and the exchange rate regime; whether the economy is (unofficially) dollarised or euroised; its trade and financial openness; and the range of instruments available for domestic monetary operations. There is therefore little consensus in the academic literature on a single measure of reserve adequacy that would capture all of these dimensions.

Several metrics of adequacy have been developed over time. They primarily focus on increasing a country’s resilience, particularly to sudden capital flow reversals, and therefore have tended to focus on emerging and developing economies. As a result, they may be less relevant to advanced economies. One traditional rule of thumb relates to the number of months that imports can be sustained should all financial inflows in reserve currencies, arising for example from export revenues and external financing, dry up. It is commonly argued that reserves should cover at least three months of imports.

As global financial integration has progressed, another metric that has become widely used is the “Greenspan-Guidotti rule”, which suggests that reserves should cover 100% of short-term external debt to insure against rollover risk in the event of a sudden stop in foreign financing.[19] More recently, it has been argued that reserve adequacy should be judged in relation to the risks of both external and internal drains (“twin drains”) – that is, the risk that capital outflows reflect not just non-residents withdrawing capital but also residents seeking to move funds out of the country. As a result, countries with open financial markets should hold foreign currency reserves proportionate to the size of their banking systems. One common metric used in this context is that foreign currency reserves should cover at least 20% of broad money to account for capital flights.[20] Still newer approaches use stylised modelling assumptions and calibrations. The IMF has also developed a risk-weighted reserve adequacy metric to capture potential losses of reserves as a result of a decline in external demand, terms-of-trade shocks, rollover risk or capital flight risk, thus encompassing drains on reserves from various sources.[21] These metrics and models notwithstanding, assessments of reserve adequacy often tend, in practice, to rely mainly on comparisons with a country’s closest peers, leading to a competition in reserve accumulation – the “Machlup problem”, or “keeping up with the Joneses”, a motive for reserve accumulation. This may, in turn, amplify accumulation or discourage economies from drawing on their reserves when the need arises.[22]

Advanced economies, particularly major reserve currency issuers, have a less pressing need to hold reserves. Given the free-floating currency regime, the traditional metrics mentioned above, developed essentially for emerging market economies, are less suited to assessing reserve adequacy in advanced economies. Although it is difficult to assess the optimal level of foreign currency reserves to be held for conducting effective foreign exchange interventions, recent research has found that the average daily intervention volume in the foreign exchange markets (of 33 emerging and advanced economies) equals around 0.02-0.05% of a country’s GDP, depending on the currency regime (higher for narrow-band regimes, lower for floating regimes). Under floating currency regimes, the baseline success rate of the foreign exchange interventions is around 60%, considering the intended objective of the intervention as identified.[23]

Policy signalling and the availability of funding arrangements are also relevant factors when considering the amount of reserves that advanced economies would need to enable them to conduct foreign exchange interventions effectively. For most advanced economies the exchange rate is not a target of monetary policy, but rather an endogenous variable affecting the main target variable(s) of monetary policy (e.g. inflation expectations). Therefore, foreign exchange interventions and their communication should typically be consistent with the main objectives of monetary policy. When a central bank publicly announces its interventions, this strengthens the overall policy message it wants to convey, which likely lowers the need for actual market operations. Foreign exchange intervention is found to be more effective if it is accompanied by verbal intervention, particularly in turbulent times[24]. Moreover, advanced economies may also have easier access to alternative means for funding possible currency intervention. For example, they can use foreign exchange swaps without immediate depletion of foreign currency reserves. In the specific case of the Eurosystem, the ECB has the ability, when needed, to make further calls on NCBs for additional foreign reserve assets.[25]

1.4 Global trends in the currency composition of global foreign reserves

Global foreign currency reserves are mainly invested in US dollar-denominated financial assets, while the euro is the second most-used reserve currency. The US dollar continues to be the pre-eminent currency of issuance of safe assets, most notably in the large and liquid US Treasury market. Based on IMF Currency Composition of Official Foreign Exchange Reserves (COFER) data[26], at constant exchange rates, the US dollar’s share of globally disclosed holdings of foreign exchange reserves stood at around 62% at the end of 2018, against 69% in 2007 (i.e. immediately before the global financial crisis) and 71% in 1999 at the start of Economic and Monetary Union. The euro accounted for roughly 20% of global foreign exchange reserves at the end of 2018, against 22% in 2007 and 19% in 1999.[27] [28]

Global reserve managers have in recent years diversified their portfolios towards non-traditional reserve currencies, including Chinese renminbi. Before the global financial crisis, the US dollar and the euro accounted jointly for almost 90% of foreign currency reserve holdings. Since the crisis, however, the rise in the share of non-traditional reserve currencies such as the Canadian dollar, the Australian dollar and the Chinese renminbi in global reserves has been notable. Non-traditional reserve currencies now account for almost 8% of globally disclosed holdings, up from less than 2% before 2007. The share of the Chinese renminbi reached almost 2% of global foreign currency reserves at the end of 2018, double that of early 2017 (see Chart 3).

Chart 3

Currency composition of global foreign currency reserves

Developments in the shares of the euro, US dollar, non-traditional currencies and other currencies in global official holdings of foreign exchange reserves

(percentages; at constant Q4 2018 exchange rates)

Sources: IMF, Haver Analytics and ECB calculations.

Notes: Non-traditional currencies include the Australian dollar, the Canadian dollar, the Chinese renminbi and other currencies not included in the SDR basket. Other currencies (than the US dollar, the euro and non-traditional currencies) refer mainly to the Japanese yen, the pound sterling and the Swiss franc.

Recent anecdotal and research-based evidence suggests that geopolitical considerations may also have an impact on reserve management decisions. Tentative evidence suggests that concerns about US/China trade tensions, Brexit and unilateral sanctions may support the diversification of reserves towards other currencies and asset classes.[29] [30] It is, however, difficult to assess the specific considerations underlying decisions by official reserve holders, in view, not least, of the limited public information on the currency composition of central banks’ reserve portfolios.[31] Anecdotal evidence aside, recent research on the role of economic and geopolitical considerations in the currency composition of foreign exchange reserves found support for both.[32]

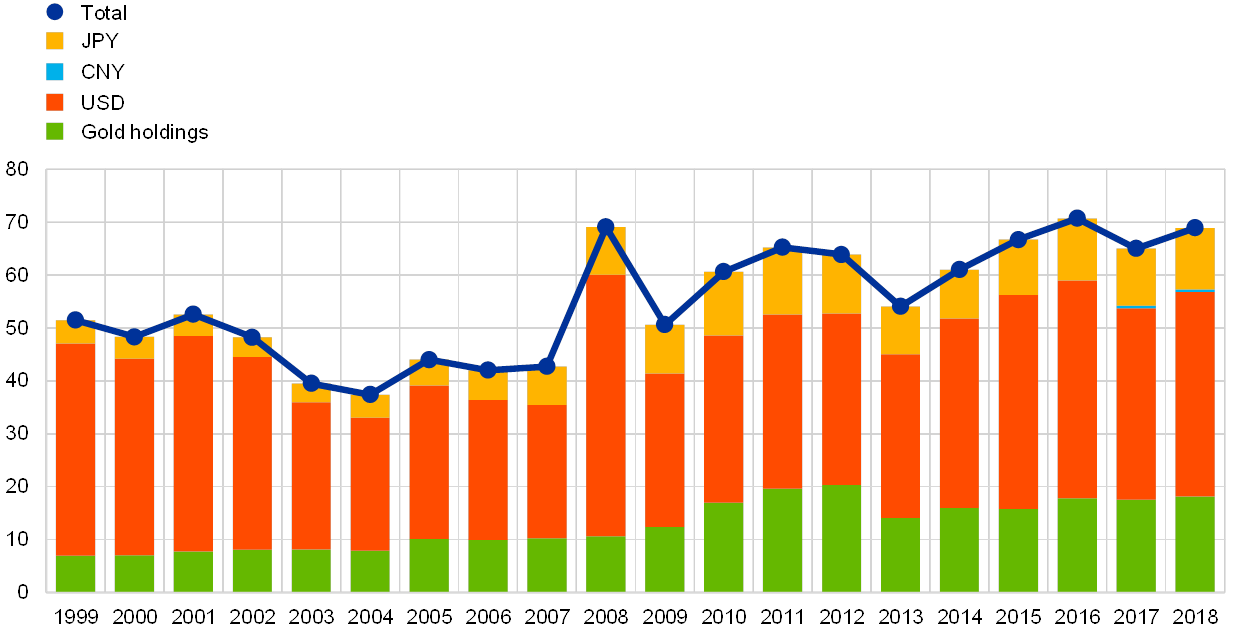

The ECB’s official reserves are currently invested in US dollars, Japanese yen, Chinese renminbi, gold and SDRs. The currency composition of the ECB’s official reserves reflects policy considerations, in other words, the ability to conduct and fund effective interventions in euro against other major currencies. From this point of view, the US dollar and the Japanese yen are the two most relevant intervention currencies (see Chart 4). The Chinese renminbi was added in 2017 after its inclusion in the SDR basket in 2016 and given its increasing international role and the importance of China as one of the euro area’s largest trading partners.[33] Where the ECB engages in foreign exchange transactions to adjust the composition of the foreign currency reserves, it is to ensure compliance with the Foreign Exchange Global Code (FXGC).[34] The FXGC is a set of global principles of good practice in the foreign exchange market that has been developed to provide a common code of conduct to promote the integrity and effective functioning of the wholesale foreign exchange market.[35]

The ECB’s current gold holdings represent about 26% of its total official reserves, compared with 15% in 1999. This increase is a result of the significant increase in the gold price over the past two decades. As a percentage of total reserves, the ECB’s gold holding is broadly similar to that of many other central banks in advanced economies. Box 1 discusses the main developments of the gold market during the 20 years of the Central Bank Gold Agreements.

Chart 4

Composition of the ECB’s official reserves

(EUR billions, annual data)

Source: ECB.

Box 1 The gold market during the 20 years of Central Bank Gold Agreements

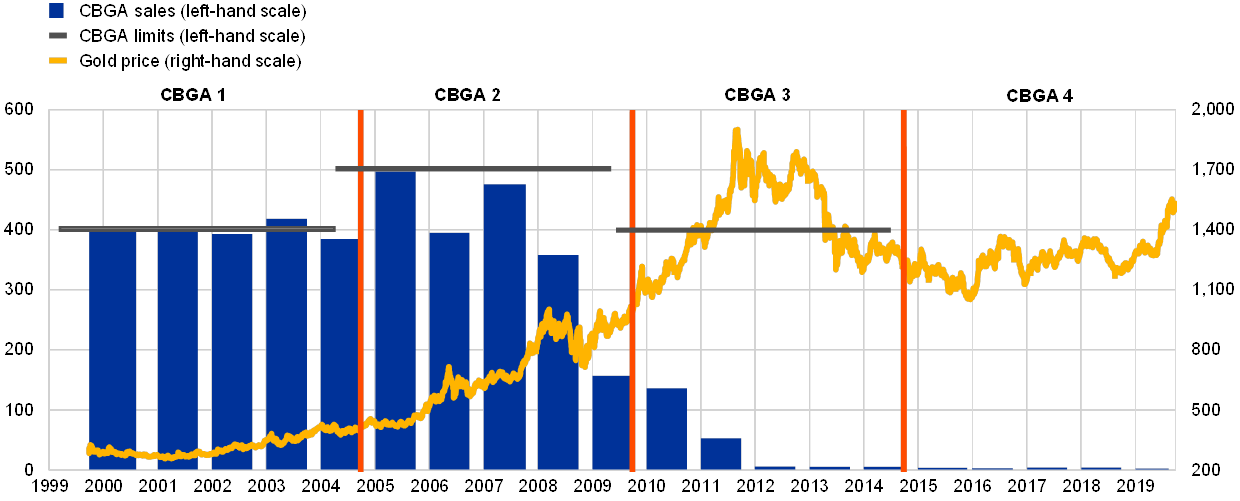

The last Central Bank Gold Agreement (CBGA) expired in September 2019 after 20 years of such agreements. The CBGAs’ signatories included the Eurosystem and the central banks of Sweden, Switzerland and – initially – the United Kingdom. The first CBGA[36] was set up in 1999 for a five-year period, when concerns about the negative market impact of uncoordinated gold sales by central banks were evident, and increasing, in the gold market. The goal of the CBGAs was to help stabilise the gold market by alleviating these concerns, relieving downward pressure on gold prices, and contributing towards more balanced supply and demand conditions by limiting and coordinating central banks’ gold sales. The Agreement was renewed three times, each time for a five-year period. The terms of the last two CBGAs became less and less stringent, reflecting the improving conditions in the gold market. This change in the terms mainly took the form of an adjustment of the signatories’ sale quotas and a relaxation of the constraints on the use of derivatives (see Chart A). Over the full CBGA period since 1999, the price of gold has increased around five-fold. The market impact on gold prices in CBGA announcements, including the one on the expiry of the last CBGA, was negligible. The exception to this was the initial CBGA announcement, which was a novelty and a surprise.

Chart A

Gold sales by CBGA signatories and gold price developments

(Tonnes; US dollar per troy ounce)

Sources: International Monetary Fund International Financial Statistics, European Central Bank, Bloomberg.

Note: The vertical lines represent the expiry dates of the successive CBGAs.

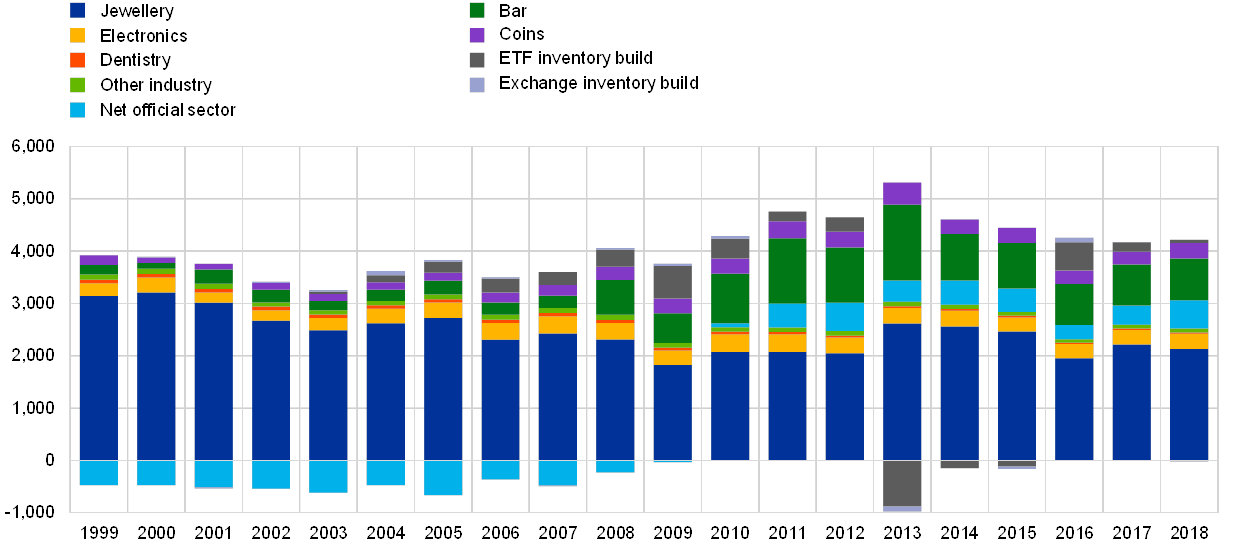

Since 1999 the gold market has grown and matured in terms of liquidity and investor base.[37] The structure of the gold market differs from that of other financial assets, as gold does not only serve investment purposes, but also has practical uses. At the time of the first CBGA, the diversity of demand for physical gold was low and concentrated in jewellery, while the contribution to demand from the official sector was negative. Over time, innovations in financial engineering facilitated the use of gold as a financial instrument, thanks to the development of exchange-traded products tracking gold prices and backed by physical gold. These flexible and liquid investment vehicles helped broaden the range of investors by easing the access of retail and pension funds to gold exposure.[38] Diversity in gold demand increased most visibly during and after the global financial crisis, driven initially by a surge in retail investment in gold bars and later also by demand from the official sector. More recently, the sources of demand have remained diverse and broadly stable (see Chart B). The higher investor involvement in the gold market since the first CBGA is reflected in the trading of gold products and derivatives, both on exchanges and in the over-the-counter (OTC) market.[39] Market liquidity and its ability to absorb large-volume gold transactions have improved continuously, thereby lowering the need for the CBGA.

Chart B

Structure of gold demand

(Tonnes)

Sources: Thomson Reuters (GFMS), European Central Bank.

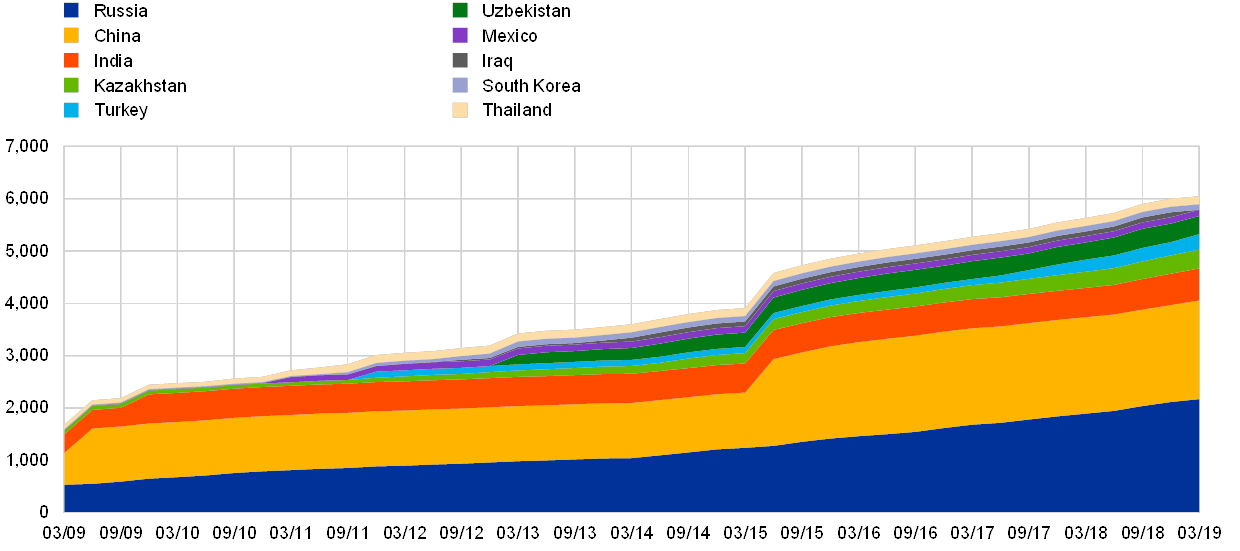

Central banks and other official institutions have become net buyers of gold over the current decade, mainly as a result of demand from emerging markets. The turning point came at around the time of the global financial crisis, when, after years of net selling, the contribution of the official sector to overall gold demand turned positive, with the stabilisation of CBGA signatories’ gold holdings and new buying activity by other central banks. Several factors may have supported this renewed interest in gold, mainly from developing countries[40] (see Chart C). First, gold has benefited from its status as a safe-haven asset with the ability to preserve wealth over the long term with no risk of default. Second, gold offers diversification benefits from a portfolio management perspective as, in general, it has a low correlation with other assets but a positive correlation with inflation and a negative one with real bond yields and US dollar developments. Other supporting factors are the low or negative interest rate environment in major reserve currencies, the reshaping of the global geopolitical landscape and the authorities’ efforts, in some countries, to back the national currency with physical assets.

Chart C

Gold holdings of selected central banks

(Tonnes)

Sources: World Gold Council, ECB.

With regard to market functioning and gold market governance, a number of initiatives were taken to promote “a robust, fair, effective and appropriately transparent market”. First, the London Bullion Market Association (LBMA)[41] published a Global Precious Metals Code (Code) that was adopted by the main precious metals market participants.[42] The Code sets out the best practices expected from market participants in the global OTC wholesale precious metals market. Its achievement in this respect is similar to that of the FXGC for the foreign exchange market. Second, to foster greater transparency, the LBMA began to publish new trade data[43] and other statistics for the precious metals market.

2 The management of the ECB’s foreign currency reserves

The investment framework for the management of the ECB’s foreign currency reserves is designed to ensure that they are readily available for policy purposes.[44]

2.1 From high-level objective to concrete investment principles

The main investment principles for the portfolio management of the ECB’s foreign currency reserves are, in order of importance, liquidity, security and return. The liquidity of the investments has priority in order to fulfil the main purpose of the ECB’s foreign currency reserves, which is to ensure that the ECB can, at any time, conduct foreign exchange operations, if needed. This means that it must be possible to convert the portfolio into cash balances in a short time frame and at minimal cost. To achieve this, a large share of the foreign reserves is invested in US and Japanese government bonds with a relatively short residual maturity. These are regarded as the most liquid instruments available in their respective currencies. Moreover, the high creditworthiness of the issuers and the relatively short duration of the portfolios serve the second investment principle: the preservation of the capital of the ECB’s foreign currency reserves. Subject to the principles of liquidity and security, the investment framework is designed to maximise investment returns. To this end, the Eurosystem: i) applies active portfolio management with incentives to make use of an allocated risk budget; and ii) allows the use of investment instruments that yield a spread over government bonds or facilitate the expression of investment views. These include supranational and agency bonds, money market and bond futures, commercial bank deposits, repos and reverse repos, foreign exchange hedged swaps and interest rate swaps. Investments in each of these instruments are subject to risk management limits.

2.2 The organisational structure of foreign reserve management

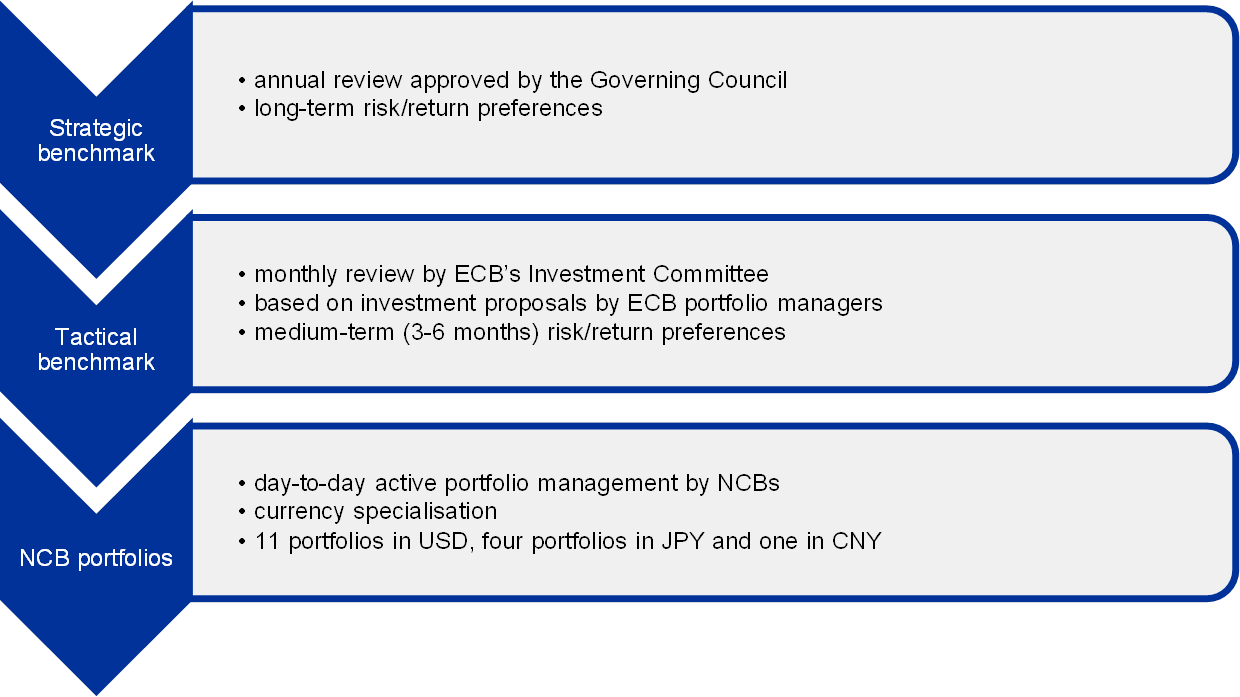

The management of the ECB’s foreign currency reserves is organised in three layers: i) a strategic benchmark; ii) a tactical benchmark; and iii) day-to-day portfolio management by NCBs (Figure 1). The main rationale for this three-layer structure is that it ensures that investments are made in accordance with the long-term risk/return preferences of the Governing Council, while providing the flexibility to actively benefit from investment opportunities over a shorter investment horizon.

Figure 1

The three layers for the management of the ECB’s foreign currency reserves

Source: ECB.

The strategic benchmark is designed to reflect the ECB’s long-term risk/return preferences, given the principles of liquidity and security. The strategic benchmark allocation is based on a modelling framework developed in-house which translates the ECB’s risk/return preferences into a multi-objective function incorporating the investment principles presented in Section 2.1. The ECB’s portfolio optimisation process for the strategic benchmark consists of two components. A “through-the-cycle” component identifies efficient portfolio allocations based on long-term expectations of risks and returns through the economic cycle. A “point-in-time” component complements the long-term perspective by reassessing the utility of the through-the-cycle efficient portfolios, taking into account financial variables and the current and projected state of the economy. Once the Governing Council approves the key characteristics of the strategic benchmark portfolios (e.g. modified duration, allocation per maturity bucket and asset class) for each currency, the ECB’s risk management unit translates those characteristics into an investment portfolio, providing security-level detail.

The tactical benchmark is the first active layer aiming to outperform the strategic benchmark. It is designed to allow for adjustments to the risk/return characteristics of the strategic benchmark on the basis of medium-term (three to six months) investment views, taking into account prevailing financial market and macroeconomic conditions. The degree of freedom to express such views is laid down in internal investment guidelines, while the management responsibility for the tactical benchmark is assigned to an Investment Committee (ICO). This committee has members from the investment, risk management and compliance units of the ECB.

The ICO discusses and assesses proposals by the ECB’s portfolio managers and, on a monthly basis, submits the final recommendations for approval by the Executive Board. To give a concrete example of how this is done, the analysis of the economic outlook, monetary policy developments, bond market valuation and other relevant variables might lead ECB portfolio managers to expect that yields in one of the relevant bond markets will increase in the coming three to six months. Rising yields would imply declining bond values. This expectation might lead portfolio managers to propose to the ICO that the benchmark should be adjusted in such a way that the tactical benchmark excludes some of the bonds included in the strategic benchmark. Instead, the tactical benchmark could hold a larger share of the invested funds in short-term money market investments, thereby reducing the interest rate sensitivity of the tactical benchmark by comparison with the strategic benchmark. If the ICO and the Executive Board accept this proposal, the adjustment is made. The change to the tactical benchmark is then communicated to the NCBs’ portfolio managers with some lead time to allow them to prepare the implementation of this benchmark adjustment in the actual portfolios.

The management of the ECB portfolio by NCBs constitutes the second active layer, the investment returns of which are measured against the tactical benchmark. Unlike the internally maintained strategic and tactical benchmarks, the actual management of the investment portfolios is organised in a decentralised manner within the Eurosystem. Subject to the rules set by a guideline governing the NCBs’ management of the ECB’s foreign currency reserves, the NCBs act as agents of the ECB. When NCBs carry out transactions for the ECB’s foreign currency reserves they disclose their agency status to their counterparties before entering into transactions, with the ECB acting as the principal for all counterparties. The Eurosystem has a dedicated working group which regularly discusses all issues related to the foreign currency reserve management framework and the actual management of the ECB’s foreign currency reserves.

All NCBs that manage a portfolio for the ECB have an identical mandate to manage the reserves prudently in such a way as to maximise their value within the internal investment framework decided by the Governing Council. The NCBs can make and implement investment decisions on a daily basis, applying the investment horizon that best suits their preferred investment style (covered in Section 2.3).

The ECB’s foreign currency reserves are currently distributed across 11 portfolios in US dollars, four portfolios in Japanese yen and one portfolio for the Chinese renminbi. This distribution reflects a currency specialisation by NCBs. At the inception of the euro, all NCBs were still assumed to manage portfolios in both US dollars and Japanese yen in proportion to their share in the ECB capital key. However, in 2006 a currency specialisation scheme was implemented. This scheme envisaged that NCBs would typically choose one currency portfolio according to their preferences, subject to the ECB’s aim of keeping a reasonable number of portfolios per currency.[45] The aim was to maintain an efficient framework, including by limiting the number of (small) portfolios, as more countries were expected to join the euro area, while facilitating more focused investment activities and leveraging NCBs’ different expertise and management styles. Since then, most of the new euro area NCBs have decided to pool “their” share of the ECB reserves with that of another NCB. Every three years the Governing Council reviews the allocation of portfolios and may decide to change the currency allocation.

2.3 The active management of the ECB’s foreign currency reserves – incentives and management styles

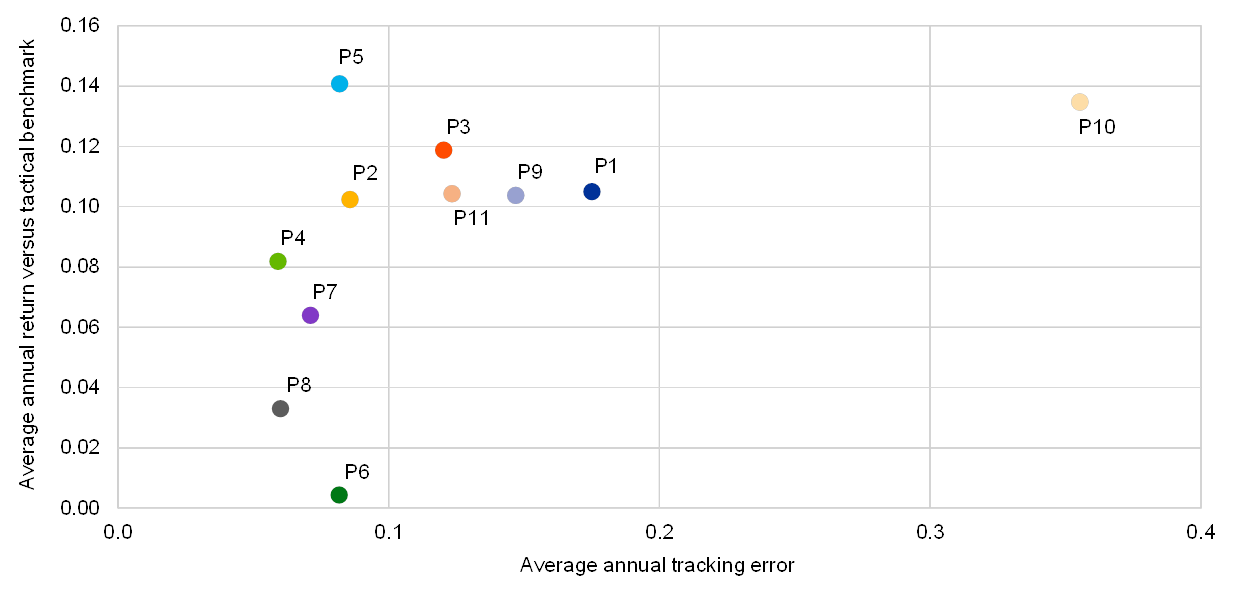

Active management, competition between NCB portfolio managers and diversification of portfolio management styles are key characteristics of the ECB’s foreign currency reserve management framework, which is intended to generate a steady stream of additional investment returns compared with the strategic benchmark. Over time, all active layers have made a positive contribution to the strategic benchmark returns for all reserve currencies. As illustrated in Chart 5, for the US dollar portfolios, all individual NCB portfolios have, on average, contributed positively. Chart 5 also highlights that the average tracking errors[46] of the individual portfolios range from approximately 0.05% to 0.4%, illustrating differences in the active risk-taking behaviour of the NCBs.

Chart 5

Risk and return in NCB portfolios for the USD portfolio

(percentage points, annual averages 2006-18)

Source: ECB.

Active portfolio management takes place within a specific risk budget for both the tactical benchmark and the actual portfolios. This budget is defined in terms of relative value-at-risk (VaR)[47]. The ECB’s independent risk management function is responsible for defining and maintaining the parameters within which portfolio managers can actively take risk. The risk budget allocated to the tactical benchmark typically exceeds that of the NCBs’ portfolios by a factor of 2. This illustrates that tactical management provides an opportunity to adjust the risk characteristics of the benchmark meaningfully if the ICO believes, for example, that an adjustment is required by developments in the economic cycle. The role of the NCB portfolio managers (anticipating day-to-day developments in markets) can be expected to involve more moderate risk adjustments, but with greater flexibility.

In addition, the investment framework includes incentives for the active layers to actively use the risk budget. At the tactical benchmark level, the incentive consists of an internal target, set by the ICO, for outperforming the strategic benchmark. The ICO sets this relative return target every year for each currency portfolio. The target is a prominent element of the overall annual performance targets for ECB portfolio managers preparing ICO proposals. This is in line with best asset management practices, which allow portfolio managers to better calibrate their positions in order to reach the target.

With regard to actual portfolio management, a performance-based internal ranking of Eurosystem NCBs provides for competition and has been an important tool in fostering risk-taking. On a monthly basis, the ECB compiles and distributes an updated ranking to the NCB portfolio managers, allowing them to monitor and benchmark each other’s performance. At the end of the year, the ranking is shared with the Governing Council, which ensures that strong performers are duly recognised. According to internal surveys, the ranking and its dissemination is seen to be an important motivation for risk-taking among portfolio managers.[48] In this respect, Scalia and Sahel (2011)[49] analysed the behaviour of NCB portfolio managers involved in the ECB’s foreign currency reserve management and found some evidence of risk-shifting behaviour by these managers, related to their year-to-date ranking. For example, some of the portfolio managers seemed to increase their relative risk-taking in the second half of the year if they had achieved a lower ranking in the first half.

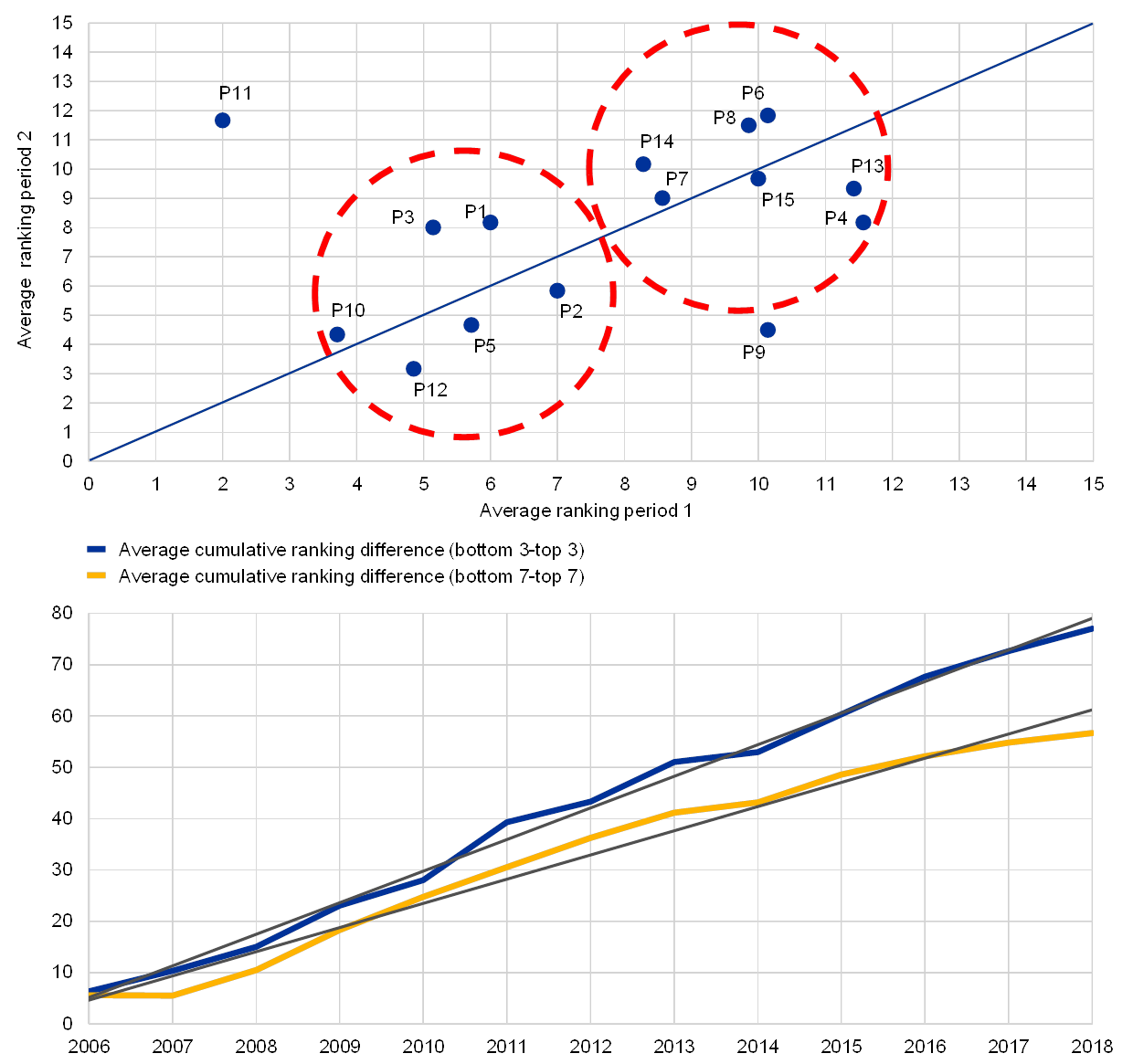

Even though the performance ranking gives portfolio managers an incentive to keep up with their peers, the relative performance of NCBs seems to exhibit persistence over time. For example, Chart 6 (upper panel) shows the average ranking of all NCB portfolios over the 2006-12 period on the x-axis, and the average ranking over 2013-18 on the y-axis. The chart shows that, broadly speaking, two groups of NCBs can be identified that ranked either relatively high or relatively low in both periods. Chart 6 (lower panel) illustrates the trend in the annual performance ranking, showing that the cumulative ranking difference between the top and bottom performers increased steadily between 2006 and 2018. These indications of persistence may be related to a number of factors, such as portfolio managers’ skills and NCBs’ portfolio management styles and risk appetite (as seen in Chart 5). Indeed, some NCBs take on positions that are, on average, small (in terms of outright duration and yield curve) and make relatively few positioning changes over time, while others take on relatively large positions and change them more frequently. These style differences point to the diversification effects of having several active portfolios.

Chart 6

Persistence in performance ranking for USD and JPY portfolios

(Period 1: 2006-12; period 2: 2013-18)

Source: ECB.

Conclusion

As the reasons for holding foreign currency reserves have evolved over time and across countries, so have the size and composition of those reserves. Global foreign currency reserves have grown markedly, especially since the Asian crisis of the late 1990s, with emerging markets accumulating large amounts of foreign currency reserves to self-insure against potential shocks but also, in some cases, as a by-product of export-led growth strategies. While global foreign currency reserves were traditionally invested primarily in US dollar-denominated financial assets, holdings have become more diversified in terms of both currency and asset classes.

As for the ECB, the main purpose of its foreign currency reserves is to ensure that, whenever needed, the Eurosystem has a sufficient amount of liquid resources for foreign exchange policy operations. The composition of the ECB’s foreign currency reserves has remained broadly stable over time, with the exception of the recent addition of the Chinese renminbi.

The investment framework of the ECB’s foreign currency reserves has evolved over time with a view to encouraging efficiency and creating incentives for the use of the available risk budget by active layers, while ensuring that the reserves are readily available for policy purposes. The decentralised management of the reserves by NCBs is a unique characteristic of the framework. It offers benefits, including information sharing and promoting best practice among portfolio managers. Active management, encouraged by the competition between NCB portfolio managers, and the diversification of portfolio management styles have been key characteristics of the investment framework and have contributed to generating a steady stream of additional investment returns above the strategic benchmark return.