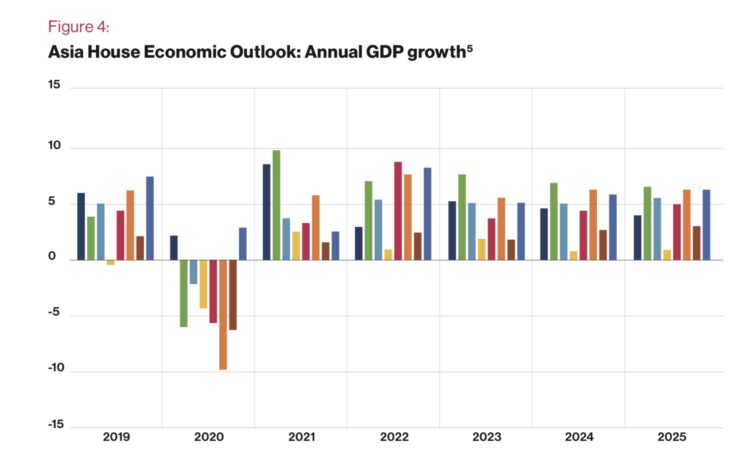

ASIA will continue its strong performance this year, with its economies expanding by an average 4 percent, exceeding the projected global average of 3.3 percent.

According to the Asia House Annual Outlook 2025, India, Vietnam and the Philippines will be the region’s “star performers,” with the latter’s economy, especially predicted to expand by 6.25 percent, “driven in large part by developments in its service sector economy and in private consumption growth.” Last year, the Philippine economy grew by 5.6 percent, less than the government target of 6-6.5 percent.

However, Asia House noted that no country in the region will be spared from the impact of higher tariffs imposed by the United States. Over the weekend, the Trump administration announced 25-percent import duties on Canadian and Mexican goods, and an additional 10-percent levy on goods imported from China. This could force China to dump its excess goods on its Asian neighbors, said the report, impacting on their domestic industries. Indonesian textile companies, for instance, have already closed due to cheaper fabric imports from China.

Preliminary estimates by the Philippine Statistics Authority showed $32.82 billion in imports from mainland China in 2024, while Philippine exports there reached $9.44 billion, for a trade deficit of $23.4 billion.

Higher inflation, higher interest rates

The US has a trade surplus only with Singapore among members of the Association of Southeast Asian Nations (Asean). It recorded its largest trade deficit with Vietnam at $110 billion in 2023, while it has a trade deficit of $4.4 billion with the Philippines.

“Trump despises trade deficits, and any steps he takes to reduce them in his second term could pose a threat to the outlook for Asia’s export-led economies….Higher US tariffs would make Asian goods relatively more expensive, leading to a fall in American demand, which would hurt Asia’s export-driven economies. [These also] would inevitably stoke inflation in the US and potentially trigger higher US interest rates and a stronger dollar, all of which would have consequences in Asia,” said the report, which was released before the new tariff policy was announced.

Whenever the Federal Reserve raises its key policy rate, the Bangko Sentral ng Pilipinas (BSP) matches this to stabilize the local currency, tame inflationary pressures, and prevent capital outflows by investors seeking higher returns in the US, as the BSP did in 2022.

Meanwhile, Asia House said investments in financial technology and telecommunications are currently propelling the Philippines’s digital economy, now contributing 9 percent of the gross domestic product (GDP), the sum of a country’s goods and services produced in a specific period of time.

PHL not a key FDI destination

It likewise noted the continued strength of remittances from overseas Filipinos, accounting for 8 percent of GDP, which provide stability and growth for the economy. Also, the Philippines’s successful US$2-billion global bond issue last year will aid its shift to renewable energy and adoption of climate mitigation strategies.

In a news statement, Michael Lawrence OBE, Chief Executive of Asia House, said: “The Philippines’ economic strength and focus on digital and green initiatives underscore its vital role in driving Asia’s growth in 2025.” Asia House is a London-based independent think tank; its Annual Outlook 2025 also includes a survey of some 50 businesses, and contributions from 40 experts to provide detailed forecasts and analyses of Asia’s economic landscape.

However, the survey showed a little over 30 percent of the respondents thought the Philippines offered attractive investment opportunities this year. They believed Vietnam (68 percent), India (66 percent), and Indonesia (64 percent) held the most appeal in terms of investments.

The BSP recently reported that foreign direct investments saw an 8.2-percent increase to $7.7 billion, year on year, a turnaround from the 17.5-percent drop to $6.5 billion in 2023 from the same period in 2022. (See, “BSP reports 8-month high in October FDI,” in the BusinessMirror, January 11, 2025.)