Written by Convera’s Market Insights team

Politics shifting US yield curve

George Vessey – Lead FX Strategist

US Treasury bonds slipped, meaning yields rose to a 1-month high after the US Supreme Court ruled that Donald Trump has some immunity from criminal charges for trying to reverse the 2020 election results. There’s growing talk about a potential Trump presidency leading to a steeper yield curve as growth will likely slow and inflation quicken under such a scenario. The US dollar could enjoy an extended period of long-term strength assuming upside inflationary risks posed by a Trump presidency will force the Federal Reserve (Fed) to keep rates high for longer.

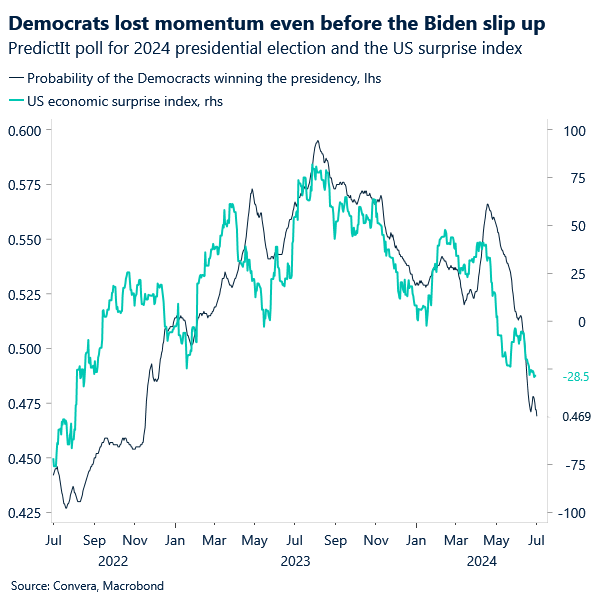

Even before the presidential debate last week, the polls were moving against the Democrats. From around mid-April, there was just less than a 60% probability of Biden winning the election according to PredictIt poll. That probability has tailed off alongside US macro data, with the economic surprise index falling to its lowest since 2022. Accordingly, with rising expectations of a Trump presidency, bolstered by last week’s debate, and its resulting expansionary fiscal policy outlook, long-dated Treasury notes and bonds have been pressures, flattening the curve’s current inversion. The yield on the US 10-year Treasury note rose past 4.45%, its highest in about four weeks.

In the meantime, data from the ISM showed that the manufacturing sector was generally weaker than expected in June, with misses on the headline reading, employment, and prices paid. It was the third straight month of falling manufacturing activity and the weakest reading since February. As well as one of the Fed’s preferred labour market indicators – JOLTS job openings today, investors are also positioning ahead of comments from Fed Chair Jerome Powell in Sintra, which can bring hawkish central bank speak back into focus.

USD/CAD climbs to a 2-week high

Ruta Prieskienyte – Lead FX Strategist

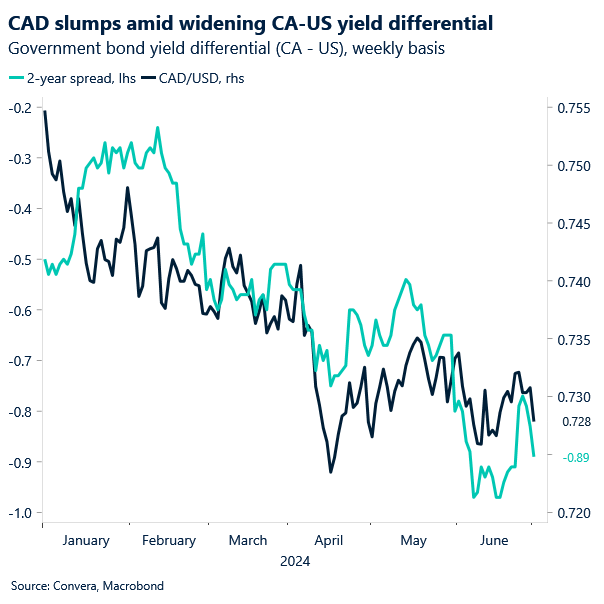

The Canadian dollar sank to a 2-week low against the Greenback, which was supported by a rise in US Treasury yields. USD/CAD rallied as much as 0.5% mid-session on Monday to touch C$1.3748. With Canadian markets closed due to a public holiday, the price moments were led by US markets reacting optimistically toward potential US Fed rate cuts. The increasing probability of a Trump’s projected victory has also supported the greenback.

With the domestic calendar empty, forex movements will be largely determined by the shifts in market sentiment as well as the Fed Chair Powell’s speech later this morning. Elsewhere, EUR/CAD rallied to a near 3-week high as the first round of the French parliamentary elections has Marine Le Pen’s far-right party in the lead, but at a smaller margin than feared. The relief rally is showing signs of fading optimism as the picture going into the second round is anything but clear.

With the cadence of top tier data releases slowing this week, we expect the realised volatility to remain subdued. The key domestic data releases this week are the balance of trade report for May, June PMIs and, most importantly, the labour market report due on Friday. The short-term market sentiment and positioning is getting increasingly more CAD bearish. The 1-month USD/CAD risk reversals is the most bullish in the past 2-months.

Euro optimism could soon fade

Ruta Prieskienyte – Lead FX Strategist

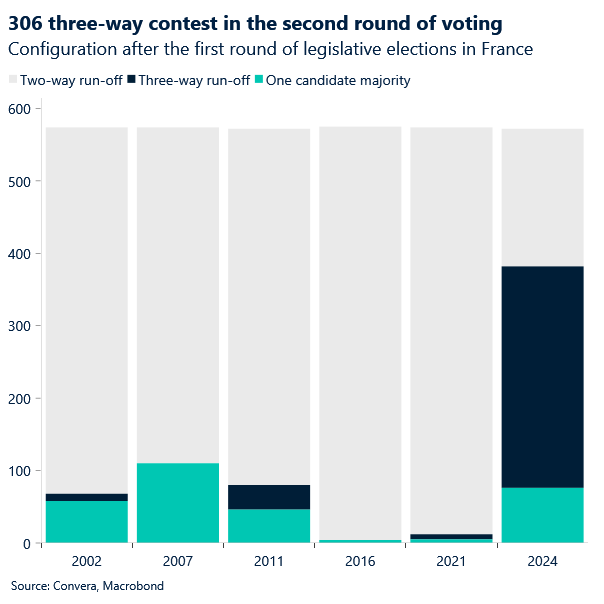

The European markets take a deep sigh of relief as the first round of French parliamentary election are behind us. the euro outperformed its G10 peers on signs that Marine Le Pen’s far-right party won the first round of France’s legislative election, but with a smaller margin of victory than expected going into the weekend. The OAT-Bund 10-year spread tightened to 74bps, the narrowest in two weeks, and the French equity index CAC 40 soared as much as 2.8% in the early trading hours.

Yesterday’s knee-jerk reaction is more of indicative of markets pricing out the tail risks of a left-wing win and perhaps is somewhat premature given that uncertainty over political risks remains intact. Once the initial jitters settle, we expect markets to revert to a wait-and-see mode as it is still unclear about the composition of the French parliament. Over 300 constituencies are now facing potential three-way run-off in the upcoming second round of voting scheduled for the upcoming second round of voting, the largest count in 21st century. All candidates through to the run-off have until today evening to decide whether to stand down or run in the second round.

Other than the aftermath of French elections, the preliminary German inflation numbers for June were also published, which slowed more than expected after two months of acceleration. The annual inflation rate fell to 2.2%, down from 2.4% in the previous month, driven by a persistent disinflation in energy costs, while goods eased and services, under particular scrutiny now, were unchanged at 3.9%. The HICP rate came in at 2.5%, down from 2.8% in May and also below expectations. Separate reports on Friday showed inflation also moderated last month in France and Spain. Collectively, the evidence points to a mounting risk of a downside surprise in the Eurozone wide gauge due today. Despite that, the data release was largely ignored by the markets. Bund yields rose across the curve and money markets trimmed ECB rate-cut wagers to 39bps (-4bps vs Friday) as haven demand is unwound, suggesting traders are still preoccupied with political developments in France. Once that’s out of the way, we expect traders to price back in additional easing to the near-term ECB rate cut bets, which would be euro negative.

In FX, EUR/JPY briefly rallied to a fresh record high above 173.40 as speculation eased that France is headed for a radical policy shift. Similar unwound of safe haven demand was also visible in EUR/CHF cross, which gained close to 0.7% on the day to climb to a 3-week high. Although not denying that the result was an overall euro positive outcome, the magnitude of the reaction might be somewhat overcooked. Although bearish sentiment eased and hedging costs retreated, 1-week options in the euro crosses are still overpriced by more than 200 basis points. In addition, the risk reversals on the 1-month tenor and shorter maintain their bearish bias in the G10 space. The abundance of market risks this week suggests the euro could soon turn south yet again, or at least remain under pressure relative to longer term spot levels going into the weekend.

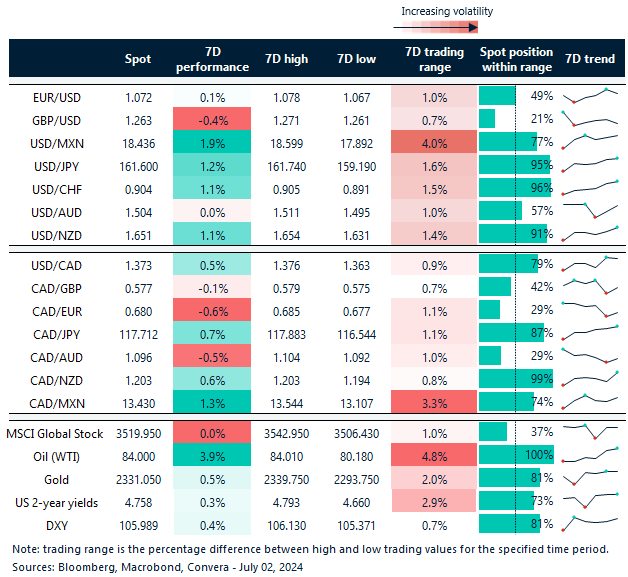

Euro rebounds across the board

Table: 7-day currency trends and trading ranges

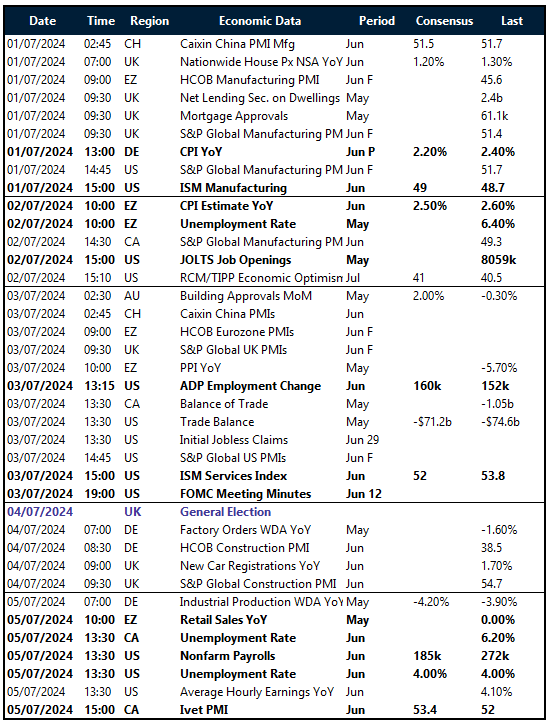

Key global risk events

Calendar: July 01-05

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.