Leading Asian currencies that threatened to uproot the US dollar as the world’s reserve currency are bleeding in the charts. Local currencies are facing difficulties in the forex markets as the US dollar is strengthening in the indices this week. This month alone, the US dollar trampled the Chinese Yuan, Indian Rupee, and the Japanese Yen in the currency markets.

Also Read: Iranian Drones Sink Asian Markets: Will US Stocks Crash Today?

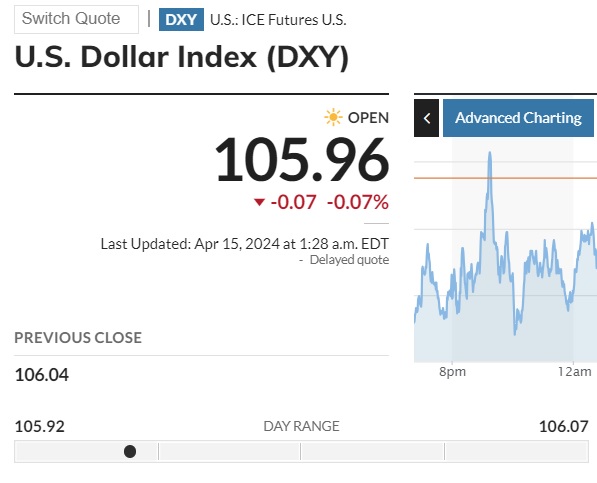

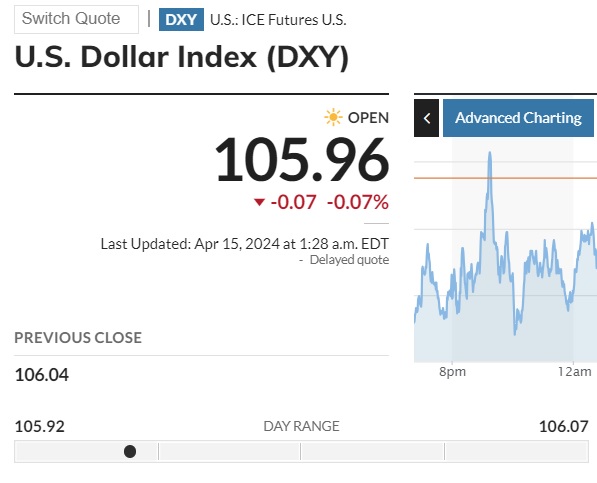

The DXY index, which measures the performance of the US dollar shows the currency hovering around the 105.96 price level. It had touched a day’s high of 106.07 before briefly retracing in price on Monday’s opening bell. Local currencies like the rupee, yuan, and yen have fallen to new lows this month against the US dollar.

Also Read: US Dollar Continues To Lose Purchasing Power Against Mexican Peso

US Dollar Makes the Chinese Yuan, Indian Rupee & Japanese Yen Fall To New Lows

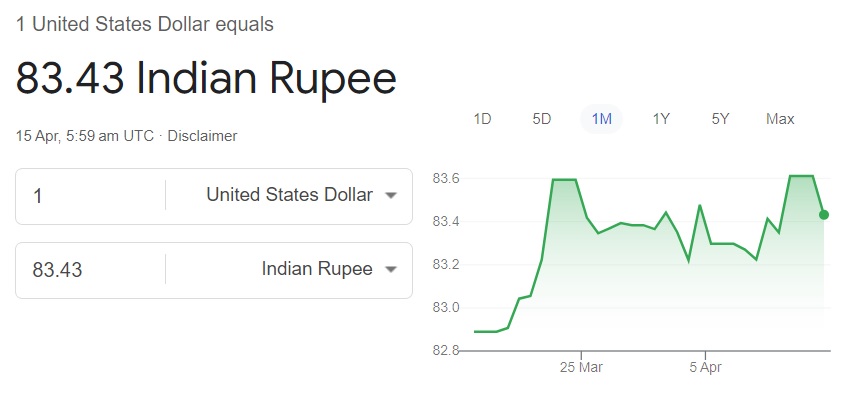

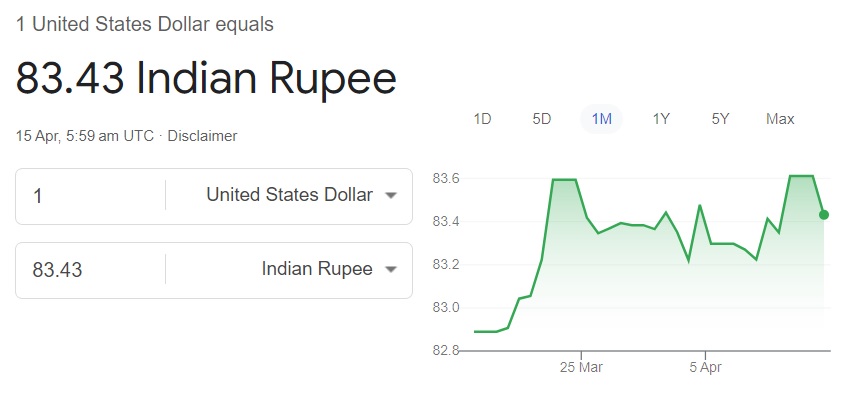

The Indian rupee fell to its all-time low of 83.61 on Friday’s closing bell against the US dollar. However, the Indian rupee briefly recovered to 83.43 on Monday’s opening bell.

Also Read: US Dollar Walks Proud, Stands Tall Despite Local Currency Threats

On the other hand, the Chinese yuan fell to its five-month low against the US dollar on Monday’s opening bell. The Chinese yuan is now trading at 7.2 per USD falling to its December 2023 lows. The yuan has already seen a decline of 1.9% in value this year in 2024 alone.

Also Read: Kenyan Shilling and East African Currencies Outperform the US Dollar

Simultaneously, the Japanese yen fell to fresh multi-level lows against the USD this month. The yen dropped to 153.82 and the currency remains bearish in the forex markets. Currency investors are also buying the US dollar at every dip in 2024 making it solidify all its resistance levels.

Also Read: Gold’s Increasing Price Momentum Spells Trouble For The US Economy

The escalating tensions between Iran and Israel are making the Asian markets lose balance in the financial sector. India, China, Japan, and the broader Asian stock markets dipped on Monday’s opening bell. Investors are worried that the drone and missile attacks could worsen leading to the market shed its value.