The joke’s on the BRICS de-dollarization agenda as the US dollar is wreaking havoc on their respective local currencies. Forget de-dollarization, BRICS countries have been unable to save their local currencies from the rising US dollar for over a month. Read here to know the major US sector that will be affected if BRICS completely ditches the dollar for trade.

Also Read: BRICS: Start of De-Dollarization, 52% Trade in China Settled in Yuan

Bloomberg’s Asia Index shows local currencies, which form a bigger part of BRICS falling 3% in a month. The Chinese yuan is the biggest loser among the lot as it shed 2% during the same period. Even the Indian rupee fell to a new low of 83.63 in late June but recovered briefly after the fall. Brazil’s real has dipped more than 10% this year and is finding it hard to sustain against the USD.

Also Read: China Advances De-Dollarization Agenda At the SCO 2024 Summit

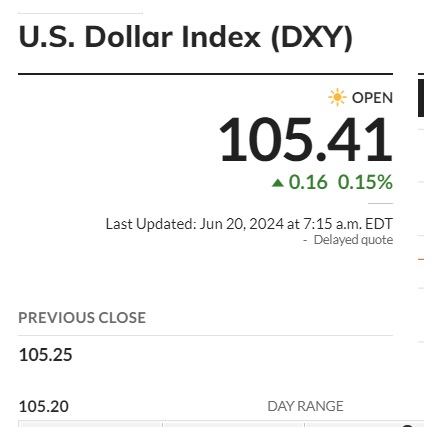

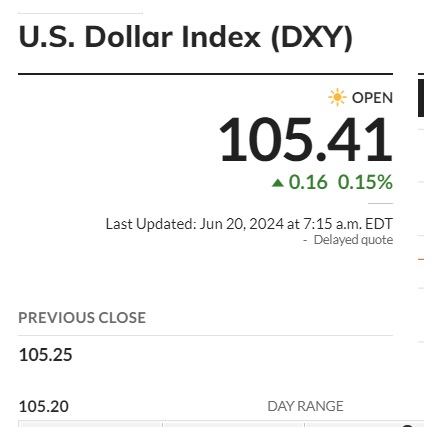

The DXY index, which tracks the performance of the US dollar shows the currency reaching the 105.41 mark. Another leg-up could push the currency above 106 and eventually reclaim its 107 price range. BRICS is unable to counter the US dollar’s dominance despite launching scathing de-dollarization initiatives that are going nowhere.

Also Read: Major U.S. Sector To Be Affected If BRICS Ditches the Dollar

BRICS: US Dollar Trounces All Local Currencies

The US dollar has also outperformed 22 out of 23 local currencies this year including that of BRICS countries. Only the Hong Kong dollar managed to stand its ground against the raging US dollar in 2024. A quick recovery for Asian currencies seems impossible currently as the USD is strengthening due to higher Treasury yields.

Also Read: SCO Summit: India Doesn’t Want To Replace US Dollar With Chinese Yuan

“The high-for-longer US rates environment is undermining recovery hopes for Asia currencies,” said Christopher Wong, FX Strategist at Oversea-Chinese Banking. “And now woes are piling on following the renewed weakness in the yuan and the yen. Central banks (of BRICS countries) may have to resort to stronger intervention to smooth volatility,” he said to Bloomberg.