(Bloomberg) — With less than a year to go, currency traders are beginning to bet on greater volatility around the Nov. 5 US presidential election.

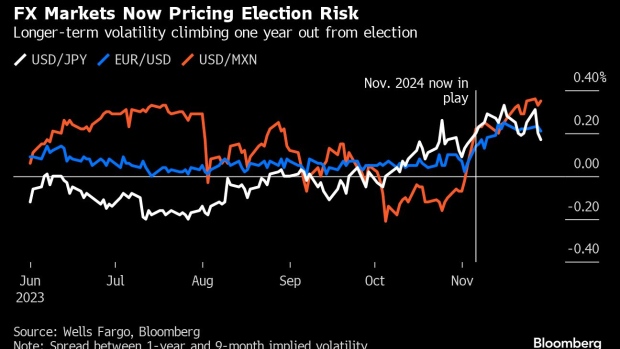

Year-ahead pricing in foreign-exchange volatility markets has begun to pick up relative to shorter-dated tenors now that next year’s election has swung into view, currency strategists at Wells Fargo & Co. and JPMorgan Chase & Co. cautioned clients in recent notes.

This month, the difference between one-year and nine-month implied volatilities for the Mexican peso — one of the currencies most sensitive to potential changes in US trade policy — reached its highest point since January 2020. The currencies of other large trading partners, namely the euro zone and Japan, are similarly susceptible to potential US tariff pressures. The same spread for yen volatility is also near four-year highs, while the gap for the euro as well as a broader JPMorgan gauge of Group-of-10 peers has risen to their strongest since 2021.

Read more: Wall Street Icons Lament Biden, Trump as Top 2024 Choices

Options on yen and euro futures expiring just after the US election results, meanwhile, include a 20 basis point volatility premium compared to ones expiring in October; peso futures carry a 30 basis point premium, implying traders expect swings in the aftermath of the results.

Erik Nelson, a currency strategist at Wells Fargo, said the increase in volatility is only a harbinger for more market-moving events to come in 2024. “We’ll see two big waves, one around the primaries, and the second again in October and November,” Nelson said in a Wednesday interview.

The sharply-contested 2016 and 2020 elections primed currency markets to trade more aggressively in response to campaign news than previous cycles; 2024 will be no different, Nelson added.

Read more: JPMorgan Says 2024 Election to Boost Dollar on Trade-War Tension

At JPMorgan, the growing likelihood that incumbent President Joe Biden will face off against former president and Republican front-runner Donald Trump means this will be an election in which a potential overhaul of trade policy — and the threat of protectionist tariffs — dominate headlines and drive currency movements.

As a response, JPMorgan sees the euro, Taiwan dollar and Chinese yuan as the best choices to trade around the election, given peso volatility is already elevated.

“Calendar structures that tightly sell pre- and buy post-election options are the traditional go-to structures for liquid exposure to the election event,” wrote JPMorgan’s Meera Chandan and Patrick Locke.

©2023 Bloomberg L.P.