Written by Convera’s Market Insights team

Markets quiet as BoC steps on stage

George Vessey – Lead FX Strategist, Ruta Prieskienyte – Lead FX Strategist

It was a quiet day in FX markets yesterday amidst a lack of key economic data or political developments. The main takeaway was the strength of the Japanese yen. GBP/JPY and EUR/JPY dropped around 1% and USD/JPY fell 0.7%. Having all hit multi-decade highs just a couple of weeks back, the yen is profiting from carry trade unwinds and bets that Bank of Japan will hike interest rates a couple of time this year.

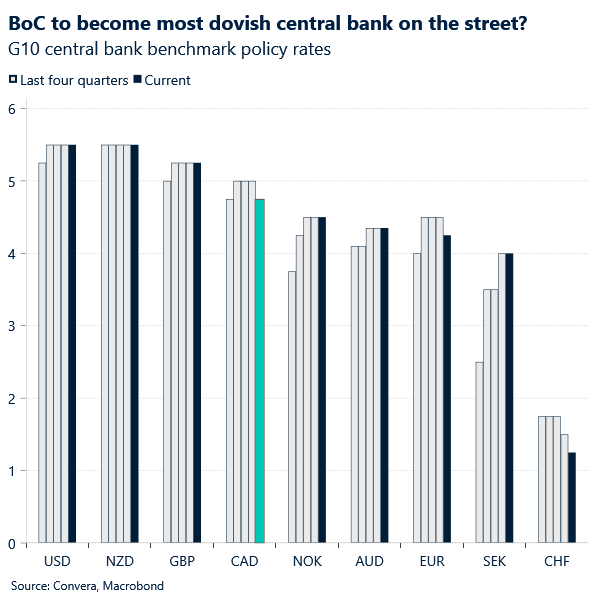

Sticking with central banks, investors are eagerly awaiting the Bank of Canada’s (BoC) interest rate decision today, where it is expected to deliver a back-to-back 25 basis point cut, making it the most dovish advanced central bank on the street. Like many other central banks, the BoC is currently in a data-dependent mode. Subdued economic growth, easing employment pressures, and lower inflation are the three key criteria for a back-to-back rate cut, but the decision may not be straightforward. On one side, a downside surprise in headline inflation and expectations of additional favourable news in the near term argue for more cuts. However, the disinflation process is no longer broadening, and services and core inflation measures are showing signs of stickiness.

The rate cut in Q3 has been priced in for a while, and speculative positioning is still overly CAD bearish, suggesting crowded positioning. Unless we see a stark slowdown in economic momentum or further guidance of near-term easing from the Governing Council than what is currently priced in by the markets, the damage to the CAD should be limited.

The final piece of the BoE puzzle

George Vessey – Lead FX Strategist

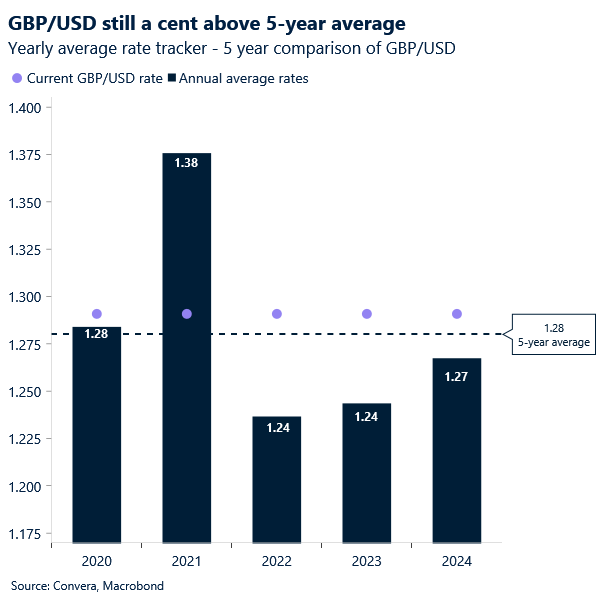

Today’s private sector output figures will be the last major data set for Bank of England (BoE) officials to digest before their meeting next week. The odds of a cut are almost a coin toss, so any major data surprises could shift the dial one way or another. GBP/USD didn’t last long above $1.30, but remains over one cent above its 5-year average of $1.28. Further gains may be harder to come by given the BoE is likely to join the Fed and other central banks in lowering interest rates this year.

We think markets may be underestimating the prospects of UK rate cuts and although the growth outlook is brighter, and the real interest-rate differential is supporting, we think GBP is exposed to a bigger downside correction in the short-term. This is because there’s (potentially) more scope for dovish BoE repricing as policymakers appear to be moving away from relying on backward-looking indicators like services inflation and wage growth. Should the BoE deliver a rate cut next week, with markets pricing just a 40% probability of such a move, GBP/USD could find itself back below its key 200-week moving average (currently located at $1.2850).

Conversely, if the BoE keeps rates on hold, underscoring upside risks to inflation persistence, sterling’s retained yield advantage could see GBP/USD reclaim $1.30 and GBP/EUR move closer towards €1.20. Before the BoE though, all eyes are on today’s flash PMIs, which could inject some much-needed volatility into the FX space.

Euro on a back foot amid cautious sentiment

Ruta Prieskienyte – Lead FX Strategist

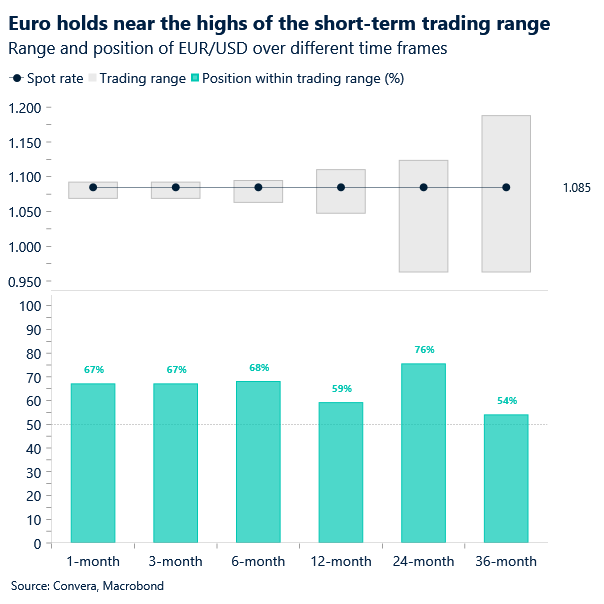

The euro was a casualty in a broad-based dollar rebound, which saw EUR/USD dip by over 0.3% day-on-day to a 12-day low of $1.085. The Euro index, which tracks the euro’s performance against a basket of leading global currencies, retreated by close to 0.3% on the day, driven by losses against the yen, the pound, and the US dollar. The performance of European stocks was mixed, with the Stoxx 50 adding 0.4% while the French CAC 40 underperformed. The European bond market continued to trend higher, with the 2-year German benchmark yield falling below 2.7% for the first time in over five months.

Data-wise, the flash Eurozone consumer confidence indicator surprised to the upside, rising to -13 for July versus -14 the month prior, marking the highest level since February 2022. The uptick in optimism can be attributed to the recent ECB interest rate cut in June as well as buoyant optimism about a further cut in September. Additionally, political concerns in France have lessened after parliamentary elections, with fears of one-party dominance giving way to legislative gridlock. Although the OAT-Bund 10-year spread remains elevated at a 65-70 basis points premium, investors are treating the current political situation in France as idiosyncratic rather than systematic risk.

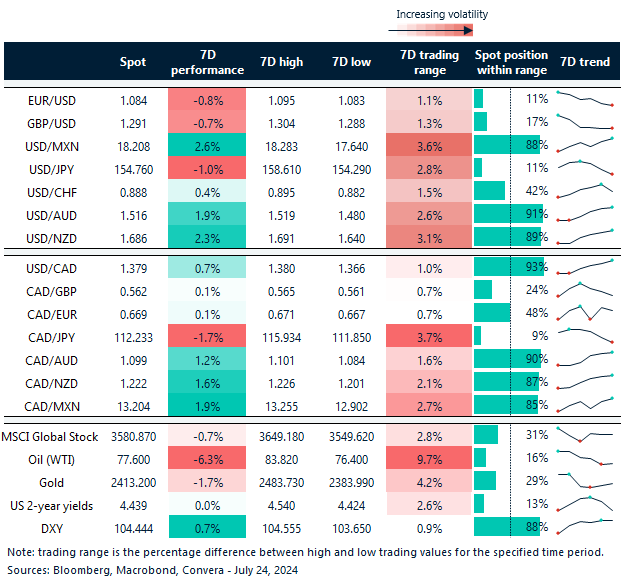

Japanese yen best performing G10 currency WTD

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: July 22-26

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.