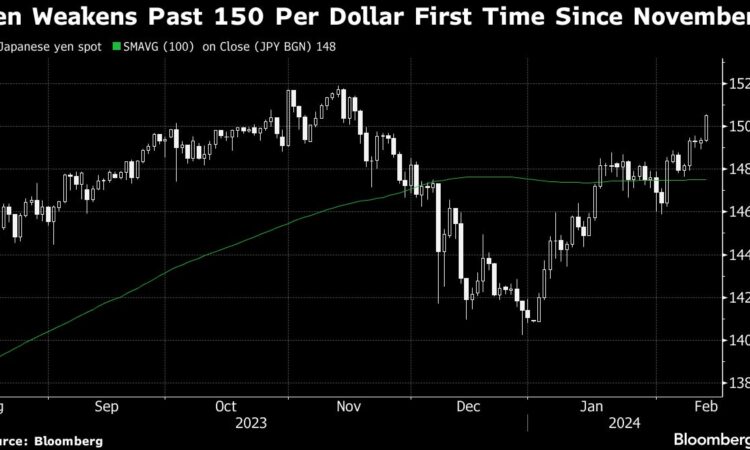

(Bloomberg) — The yen weakened past 150 per dollar for the first time since November, raising the specter that Japanese authorities will step in to prop up the currency, after hot US inflation data prompted traders to dial back their bets on interest-rate cuts and bid up the greenback.

Most Read from Bloomberg

The dollar soared against all G-10 currencies, reviving the likelihood that authorities in Tokyo will ramp up verbal warnings to stem the yen’s decline after it slumped past a key level that spurred previous interventions. Finance Minister Shunichi Suzuki said on Friday that Japan will continue to closely monitor foreign-exchange developments.

The yen — which hit a session low of 150.80 on Tuesday, down almost 1% — has come under renewed downward pressure after BOJ Deputy Governor Shinichi Uchida last Thursday said it’s hard to see the bank raising its policy rate continuously and rapidly even after negative interest rates end.

Uchida also said that financial conditions will remain accommodative even after the bank ends its negative rate given current outlook for the economy and inflation, sharing the same view as Governor Kazuo Ueda.

“The market’s really geared up for yen bullishness on expectations of the Bank of Japan exiting its negative interest rate policy, but they’re not gonna be in a hurry to do it and they’re not going to rush into a prolonged normalization cycle,” said Tom Nakamura, a portfolio manager at AGF Investments Inc. Expectations for yen strength based on actions by the country’s central bank should start to unwound, Nakamura said.

Year-to-date, the yen has tumbled more than 6% versus the dollar, the biggest loser among G-10 currencies. It has fallen more than 3% versus the euro, also the worst performance among developed-nation peers.

Japanese authorities stepped into the foreign-exchange market in September and October of 2022, in their first efforts to prop up the currency since 1998, and spent around ¥9 trillion ($60 billion).

The move in the dollar after the CPI report also triggered declines of 1% or more in the Australian dollar, Norwegian krone, Swiss franc, New Zealand dollar and Swedish krona.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.