(Bloomberg) — The yen dropped to its weakest level against the dollar in almost three months, reviving concern that Japanese officials may act to support the currency if it keeps on depreciating.

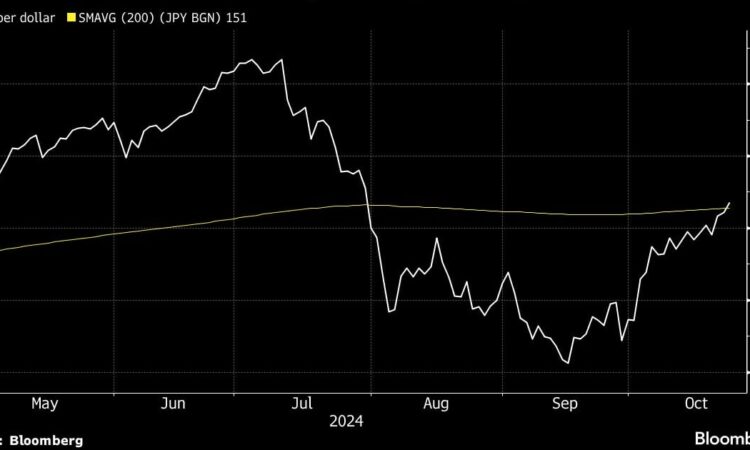

Japan’s currency slid as much as 1.4% to 153.19 per dollar on Wednesday, the weakest since July 31. The drop led the pair to breach the key technical level of about 151.38, its 200-day moving-day average, which analysts say opens the door for further declines.

The yen’s slump comes on the back of a broadly stronger dollar amid a jump in US yields as the Federal Reserve has signaled caution about cutting interest rates. Speculation the next US administration may pursue more inflationary policies after the presidential election has also boosted the greenback.

“Given the current momentum, it’s likely that the yen will weaken further and the dollar will strengthen further,” said Yukio Ishizuki, senior foreign exchange strategist at Daiwa Securities Co. in Tokyo. “If the yen continues to weaken, it is likely that the authorities will step in to restrain it.”

For Nomura International Plc, if the yen weakens further after this weekend’s general elections, this will not only raise the prospect of intervention, but may also prompt the Bank of Japan to flag at its policy meeting next week that it could raise interest rates as early as December. The risk is that Japanese Prime Minister Shigeru Ishiba’s party loses its coalition majority.

“The yen seems to be working as an adjustment valve at the moment, to ease everything that is pressuring Japan macro,” said Yusuke Miyairi, a currency strategist at Nomura.

Japan’s bonds joined the drop in US Treasuries on Wednesday, with the 40-year sovereign yield briefly rising to 2.535%, the highest since 2008. That’s still much lower than the rates on 10-year and 30-year Treasuries.

“US yields are unlikely to fall and the dollar is unlikely to be sold off until the impact of the US presidential election has worn off,” said Marito Ueda, head of the market research department at SBI Liquidity Market Co.

The yen lost more than 6% against the dollar in October so far, on path to have the worst month since April 2022. All currencies in the Group of 10 have fallen against the US dollar this month as traders are gearing up for the US election on Nov. 5 and the Federal Reserve is seen to ease monetary policy slower than earlier expected.

“If you believe, as I do, that US yields are heading higher still, then it is hard to go against this dollar-yen move,” wrote Tom Fitzpatrick, managing director of global market insights at R.J. O’Brien.

–With assistance from Winnie Hsu, Naomi Tajitsu, Aline Oyamada, Anya Andrianova and Carter Johnson.

(Updates prices and adds comment in last paragraph)

©2024 Bloomberg L.P.