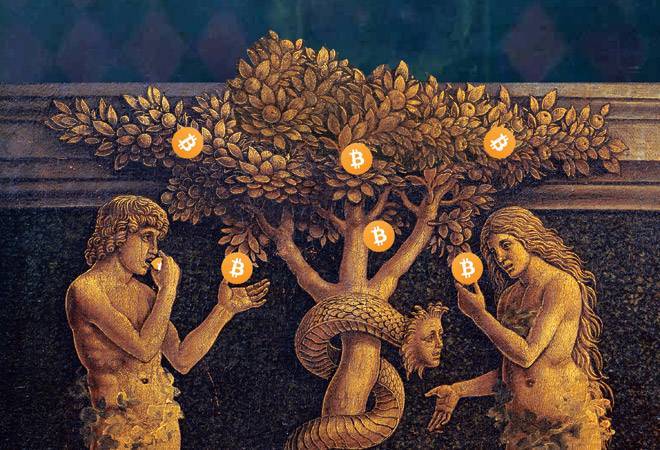

5 Bitcoin disasters of all time; why it’s never safe to invest in virtual currency

The frenzy around world’s biggest virtual currency, Bitcoin, has reached a level where it’s impossible for you not to think about investing in it. Every day Bitcoin is setting up a new benchmark, luring you to become a part of this unpredictable financial cycle. At the same time, some financial institutions such as JP Morgan Chase and Berkshaire Hathway have debunked the “bitcoin mania”, calling it a “fraud” and warning people against falling for the “Bitcoin trap”. Being the most popular and an unregulated, or independent currency, Bitcoin is vulnerable to online sharks – hackers – waiting for the right time to dig in their claws on your money. A recent examples: Hackers stole over $80 million in Bitcoins by breaking into Slovenian-based virtual currency marketplace NiceHash. The currency is so volatile that you can’t be sure when it is not your day. On Thursday, the virtual currency dropped 22 per cent to low of $15,262 after taking a $20,000-mark jump on last Sunday. Bitcoin fell below $13,000 on Friday on a Luxembourg-based coin exchange, Bitstamp. The crypto-currency has seen two sharp drops in the last two months.

As per Coindesk, a similar virtual currency exchange, one third of the two third Bitcoins mined are lost forever. Reuters says more than 9, 80,000 Bitcoins have been stolen from exchanges since 2011, roughly around $1, 57, 780, 04900 as per the current price. The reason for disappearance can be anything like hacking, or hardware failure.

So is Bitcoin a monetary revolution – and you think you must be a part of it – or should you keep a distance?

Bitcoin advocates swear by its anonymous founder Satoshi Nakamoto’s super complex algorithm called Blockchain, an online distributed ledger system that maintains the data related to every single Bitcoin transaction. Bitcoins are stored in an open online decentralised ledger where every single transaction is verified by the cryptocurrency miners spread all over the world, who are constantly competing with each other for a bitcoin reward. Every miner can access the ledger and the system reflects each small development. They say the system is impossible to hack as it’s not centralised like Federal Reserve Bank of the US, or any other central bank. The mainstream institutions pose the same argument saying since there’s no solid system to back it up if things go haywire, it’s not reliable. In entirety, it seems like a zero sum game. But before you take the plunge, read these five biggest financial disasters associated with Bitcoin that pose serious questions on its reliability.

Silk Road that was full of rocks

Ross Ulbricht, the pseudonymous proprietor of the website Silk Road, used Bitcoin for illegal transactions in drugs and arms. For two years between 2011 and 2013, Silk Road became a favourite online marketplace – completely anonymous from law enforcement agencies – for drug mafias, and a headache for authorities. People sold drugs worth millions on the website, and all transactions were done using Bitcoin. Drug mafias could easily buy any contraband imaginable at a single platform, just like Amazon or eBay. Within months, the website became the leader of the “darknet”, with over 900,000 users and the annual turnover of $1 billion. Ulbricht was arrested in October 2013, and the site was shut down. But soon, it was surpassed by similar “darknet” websites that operated secretively, using domain names like .onion. Ulbricht was convicted for life on drug trafficking, criminal enterprise, aiding and abetting distribution of drugs and money laundering.

Instant rise and fall of BitInstant

The chief executive officer (CEO) of Bitcoin exchange, BitInstant, Charlie Shrem, a 27-year-old young ambitious entrepreneur was fascinated by the idea of having a currency with no third party control after he heard about it from a friend at the age of 19 in 2011. After he bought a couple of bitcoins – at a dirtcheap price at that time – he started Bitcoin exchange from his home and soon caught the attention of young investors like Winklevoss brothers who pumped in over $1.3 million in his company. It was a meteoric rise, and so was its fall. After he moved to a nice office with over 30 people working for him, the company partnered with giants like Walmart, Walgreens, and Duane Reade where anyone could buy Bitcoins through BitInstant. The business was good and growing with revenue reaching over $1 million in a month, but greed has no limit. Shrem started facilitating transactions on ‘darknet’ leader Silk Road, and soon he was in the FBI net. After he was arrested in 2016, he pleaded guilty in the court. He claimed he facilitated one customer, BTC King owner Robert M. Faiella, whose customers (or drug mafias) were using Silk Road. They both were accused of the sale of Bitcoins worth $1 million to Silk Road. Shrem was sentenced to two years in jail. This incident sent shockwaves in the Bitcoin world, and people started associating the virtual currency as a means to launder money.

Mt Gox’s $460 million ‘gift’ to investors

Tokyo-based Mt Gox was another large exchange company for the virtual currency that met the same fate as BitInstant. The company had already lost over 80,000 Bitcoins, as per the Daily Beast, when Mt Gox CEO Mark Karpeles bought it from Jed McCaleb in 2011, but Jed hid these details from Karpeles. Initially started as an online space for trading of cards for a game called ‘Magic: The Gathering’, Mt Gox soon shifted to Bitcoin trading. The company was in trouble from the start, but Karpeles kept the secret under carpet for long. February 2014 brought doom for Mt Gox when Karpeles informed the authorities that over 850,000 Bitcoins worth $450 million had disappeared; hackers must be super rich if you compare it with current Bitcoin price. After this, people across the world started believing that perhaps Bitcoin needs to be regulated like fiat currencies to rid such fiascos. Karpeles was found guilty of the improper use of electronic funds and embezzling a total of $2.7 million of customer funds.

‘WannaCry’ wreaked havoc in 150 countries

WannaCry virus hit computers of major corporations in over 150 countries in May this year. Panic spread across the world as message saying “Ooops, your files have been encrypted!” popped up on the compromised computers. The cryptocurrency faced another backlash when hackers demanded “ransom” money in Bitcoins to open the encrypted files. The hackers sought $300 ransom in Bitcoin from every compromised computer, giving people three-day time failing which they threatened to delete the locked files. Bitcoin allows users to make anonymous transactions and remain anonymous. This makes the system sophisticated to crack in case of such attacks, and equally favourable to cyberattackers.

$80 million Bitcoin heist at NiceHash

Bitcoin mining marketplace NiceHash reported on Wednesday that hackers stole nearly $80m in Bitcoins from the company. Ever since the company informed the law enforcement agencies, the operation has been stopped and users have been told to change password and other personal details. It was “a highly professional attack with sophisticated social engineering”, NiceHash head of marketing Andrej P Skraba told the Guardian. The company has so far lost around 4,700 Bitcoins worth about $80.02 million at current prices. The official website of the mining marketplace says the service is currently unavailable and that the matter is being investigated. “Clearly, this is a matter of deep concern and we are working hard to rectify the matter in the coming days. In addition to undertaking our own investigation, the incident has been reported to the relevant authorities and law enforcement and we are co-operating with them as a matter of urgency,” the company said in a statement.