After Scoring 60% Returns, Carry Traders Are Ditching Peso, Real – BNN Bloomberg

(Bloomberg) — Latin America is being replaced as the go-to trade for currency investors as politics turns double-digit gains into losing bets.

After minting outsize returns in currencies like the Mexican peso and the Brazilian real for much of the past two years, investors are turning to less risky alternatives such as the Australia and New Zealand dollars for carry trades, which involve borrowing in the currency of a low-yielding country to buy high yielders.

Developments in Latin America — from Mexico’s surprise election results to Brazil’s deteriorating fiscal outlook — are part of the explanation. But traders are also fretting about volatility tied to the US presidential race. They’re turning to developed-world destinations that have relatively attractive interest rates and may be less vulnerable to market turbulence as the November vote approaches — and the Australian and New Zealand dollars have emerged as prime targets, says Brad Bechtel at Jefferies.

“The appeal of Latin America has slipped,” Bechtel, the firm’s global head of foreign exchange, said in an interview. “Investors may want to shield themselves from the dollar and hide out in these developed-market currencies as we approach the fall and the election really starts heating up.”

Futures and options positioning illustrates the shift. Investors’ combined positioning in the Mexican peso and Brazilian real is around the least bullish it’s been since early 2022, while the collective stance on the Australian and New Zealand dollars is the rosiest since 2021.

The Australian and New Zealand dollars are poised to outperform global peers, buoyed by their central banks’ comparatively restrictive policies, while traders bet the US Federal Reserve will start lowering borrowing costs in the coming months. The Aussie and the kiwi were the top gainers versus the greenback among Group-of-10 peers last quarter.

Meanwhile, even after recouping some ground this month as Fed-easing bets boosted emerging markets, the peso and the real are still down roughly 5% against the US dollar from early June — when the landslide election victory for Mexico’s ruling party derailed the peso — through Thursday.

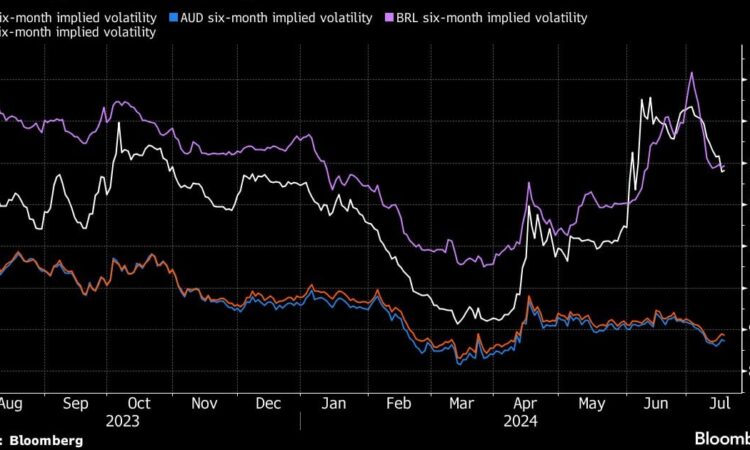

Volatility has picked up in the peso as well as in the real, which has weakened amid worries that the Brazilian government would miss its budget targets. The greater turbulence reduces the attractiveness of the lofty interest rates available in those countries. Investors in the carry trade prefer calmer currencies, which give them greater confidence that they can lock in returns in local assets.

So the appeal of New Zealand, where the benchmark rate is 5.5%, or Australia at 4.35%, has grown relative to that of Brazil or Mexico, where the benchmark rates are 10.5% and 11%, respectively.

Former President Donald Trump’s improved standing in the polls of late has also helped cap this month’s Mexican peso advance. That’s thanks to speculation he’ll ramp up talk of tariffs and immigration curbs as part of his campaign to retake the White House.

“The best days of the Latam carry trade are behind us,” said Mark McCormick, global head of FX and EM strategy at TD Securities. With markets pricing in a greater chance of a Trump victory, that “will place a risk premium on the Mexican peso.”

It’s a stark reversal for a region that has generated stellar returns for currency investors. In the 18 months through June, borrowing in the yen, where interest rates were negative until March, and buying the peso and real resulted in returns of almost 60% and 40%, respectively.

BNP Paribas SA strategists see another carry-trade target for investors ditching Latin America: the US dollar.

The greenback, as they see it, stands to benefit from the inflationary repercussions of protectionist trade policy should Trump win in November. They also see limited potential for the market to price in deeper Fed cuts this year. The central bank currently targets a range of 5.25% to 5.5%.

The coming months will likely “provide an attractive opportunity to re-load FX carry trades,” BNP strategists including Alex Jekov, wrote in a note last week. However, differently from the first half of the year, “the market may focus on long US dollar-carry trades rather than long emerging-market foreign-exchange positions.”

–With assistance from Carter Johnson.

©2024 Bloomberg L.P.