Buffett Didn’t Simply Buy Big In Japan: He Left A Trail Of Investing Ideas For You

When market genius Warren Buffett decided to invest in five Japanese trading companies, he didn’t whip out a checkbook or pay for the stake with a shipping container full of cold-hard cash. Though he could’ve: Berkshire Hathaway’s sitting on about $100 billion. Instead, he issued bonds, priced in Japanese yen, to finance it. In the process, the Oracle of Omaha (now the Oracle of Osaka) was brilliantly taking advantage of Japan’s still ultra-low interest rates – and revealing a few portfolio opportunities to the rest of us. Here’s a look.

Why not just pay in Benjamins?

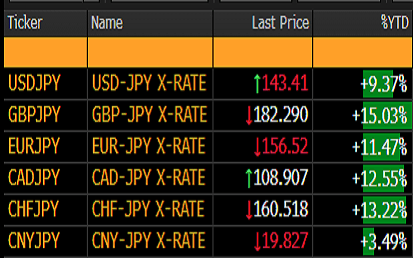

This is something currency traders know well: if you borrow in currencies with low interest rates and invest in ones with higher rates, you can make a fair bit of money. It’s what’s known as a “carry trade”. Now, the yen has the lowest interest rate of any major currency. It’s also cheap: it’s been the worst-performing of all the major currencies this year, and has slid very close to lows that prompted Japan’s ministry of finance to intervene last year.

Here’s how the Japanese yen has been performing against other major currencies this year. Source: Bloomberg.

At the start of the year, economists broadly expected the yen to strengthen: the Bank of Japan, faced with the country’s first real inflation in decades, was expected to finally abandon its near-zero interest rates and actually announce some hikes. It was going to be a monumental shift for a country that’d been battling deflation for two decades, mostly with low interest rates. But those economists turned out to be wrong.

To understand forex (i.e. the currency market), it helps to understand two things. First: currencies trade in pairs, so the “value” of one rises when the other falls, and vice versa. And second: interest rates mean everything: they’re a key factor in what goes up and what goes down. For example, the yield on the two-year US Treasury is currently 4.72%. But in Japan, the yield on the two-year government bond is minus 0.07% (yes, minus!) – it’s how much you get paid to hold a bond. The difference between the two – right now that’s 4.79% – is the yield spread.

The USD/JPY currency pair (blue line, left axis) and the US-versus-Japan two-year government bond yield spread (white line, right axis). Source: Bloomberg.

Back in August of 2020, when Buffett first announced Berkshire’s 5% stake in five Japanese trading companies, the US dollar could fetch about 106 yen. Now, it fetches about 143. So, think about it this way, if Berkshire had sold some of its pile of US dollars and bought yen to pay for the purchase outright, it would have had to pay more US dollars for each yen. Issuing bonds meant paying off the purchase over time – and benefiting from the strengthening US dollar in the process.

So what’s the opportunity here?

Even if you’re not Warren Buffett (and there’s a goooood chance you’re not), you’re probably aware that there’s always risk when you’re betting that a currency will move in one direction or the other. A huge number of things affect the forex (or “FX”) market – macroeconomic data, stock and bond market moves, and trade figures are just a few.

And with the yen, there’s also the risk that the Japanese government might “intervene” in the forex market, using its own foreign currency reserves to buy up the yen and drive its price higher. This sort of thing is generally considered rare, but it happened twice just last year – once when the dollar was changing hands for 143 yen and again when it hit 152. See, a weak yen can increase inflationary pressure for Japan, as the cost of imported energy and food increases.

So with the Japanese currency again so weak, relative to the greenback, you might consider betting on a yen rebound. You can do that by selling the USD/JPY currency pair through your broker, or by buying the Invesco CurrencyShares Japan ETF (ticker: FXY; expense ratio: 0.4%).

The Invesco CurrencyShares Japan ETF and the USD/JPY currency pair. Source: Bloomberg.

As you can see from the chart, the USD/JPY currency pair (blue line, right axis) reached 150 last October just before Japan intervened and propped up the yen. At the same time, the Invesco CurrencyShares ETF dropped to $62, its record low. The ETF is trading now near $65, but if it falls to around $63, you might consider buying some.

But, look, even without a rare currency intervention, there are other catalysts that could cause a rebound in the yen. First, the country’s inflation, while still awfully mild compared to the rest of the world at 3.2%, is still too hot, and if that becomes sticky, it could prompt an interest rate hike from the Bank of Japan (BoJ).

And second, economists are increasingly expecting the BoJ to announce a change next month to its yield curve control, which is its guidance around short-term rates and the band in which its 10-year bond yield is allowed to float. A minor tweak probably wouldn’t impact the yen a great deal, but a total scrapping of the control could boost the yen a lot – Goldman Sachs estimates it would lead to a 4% to 5% fall in the USD/JPY currency pair.

Japanese banks could be a sound investment if interest rates move higher in Japan. The big ones like Mitsubishi UFJ Financial Group (MUFG) already benefit from higher interest rates in the US and would see an added boost from higher interest rates in Japan. It trades at an attractive 10x price-to-earnings ratio, a 0.67x price-to-book ratio, and has a 4% dividend yield plus share buybacks.