Carry Trade Out of Danger Zone But Watch Yuan, Citi Quants Say – BNN Bloomberg

(Bloomberg) — China’s yuan is more at risk of being squeezed by the unwind of global carry trades as positioning in the yen is not extreme, according to Citigroup Inc.

So-called funding currencies like the Asian pair, which are borrowed and used to buy higher-yielding assets, are still crowded trades, unlike many of their targets, quantitative strategists including Dirk Willer and Alex Saunders wrote in a note to clients. But the yuan especially stands out, they said.

There are “more positioning worries on the funding side of the carry trade, and in particular the yuan, rather than on the long carry side,” the Citi team said. The Chinese currency was “swept up in the popular Trump trades, where the threat of tariffs was supposed to lead toward higher dollar-yuan.”

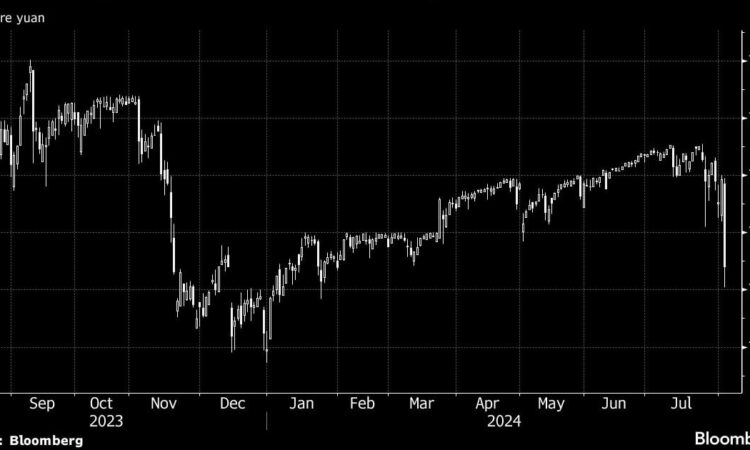

The yuan has strengthened as the global carry trade unwind buffets markets around the world and is close to erasing losses for the year as traders exit short positions. The rebound is welcome news for the People’s Bank of China as it may allow it to ease monetary policy further to boost a sluggish economy.

Yen-funded carry trades became popular when the Bank of Japan’s interest rates were low, but traders have been unwinding short yen positions given the hawkish rhetoric from the BOJ and fears of an economic slowdown in the US.

“Overall, positioning in carry is not clean yet, but it is below the danger levels that we monitor,” the strategists wrote.

©2024 Bloomberg L.P.