The is likely too entrenched to be seriously evicted from GRC status.

The de-dollarization threat looms as the assumes a more active role in international payments and as the BRICS block grows. But how realistic is it that another fiat currency could dethrone the dollar?

How Did the Dollar Become the Global Reserve Currency?

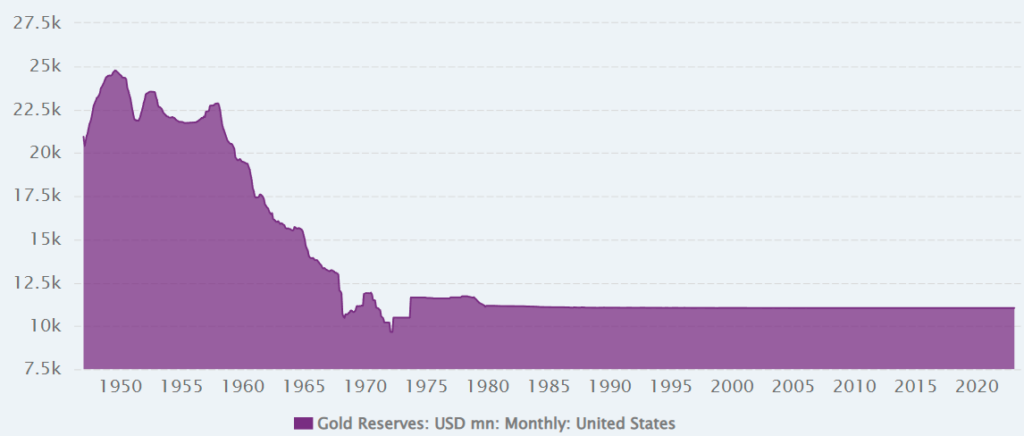

It took a unique historic confluence for the dollar to become the global reserve currency (GRC). Following the post-World War II consolidation, the leading role of the United States expanded into a new global monetary system. Having large gold reserves and natural resources but also directly untouched by WWII, the US took charge.

Even before WWII officially ended, in July 1944, the US hosted 44 allied countries in Bretton Woods, New Hampshire. It was here where the new world order was crafted. The Bretton Woods Agreement made it so that allied countries de-pegged from the gold standard and had their currencies pegged to the dollar instead.

In turn, the dollar was still pegged to the US gold reserves, serving as a proxy. Therefore, the allied countries’ central banks would maintain a fixed exchange to the dollar, redeemable for gold.

After 1971, when President Nixon ended direct dollar-gold convertibility, US gold reserves flatlined. Image credit: CEIC Dat

From that point onward, other countries began to accumulate US dollars. Their respective central banks could still regulate their own currencies by selling or buying them to make them weaker or more robust against the dollar.

Moreover, they started buying US Treasury securities (federal debt) as a safe haven store of value.

Dollar’s Role in International Payments

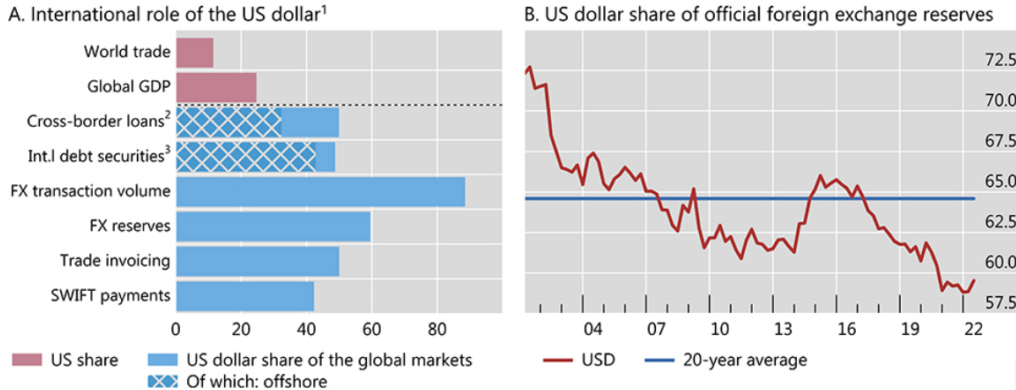

The International Monetary Fund (IMF) was another byproduct of the Bretton Woods Agreement. The organization operationally boosted the dollar’s reach by providing loans to member countries. According to IMF’s data for Q4 2022, the dollar holds 58.36% of the world’s total currency reserves.

For comparison, the Euro holds 20.47%, while the Chinese renminbi (with yuan as its unit) is only at 2.69%. This is over two times lower than the Japanese yen at 5.51%. Overall, claims in US dollars are at $6.47 trillion in Q4 2022, out of $11.96 trillion of total foreign exchange reserves.

Likewise, most international trade is conducted in dollars with no close second.

Image credit: Bank for International Settlements (BIS) as of December 2022.

Interestingly, according to World Gold Council data for Q1 2023, Western Europe is now the largest accumulator of gold reserves, at 11,776 tonnes. The US is a close second at 8,133 tonnes. Russia and China hold 2,326 and 2,068 tonnes, respectively.

Why Would the Dollar’s Global Reserve Currency Status Be Endangered?

On Monday, the IMF’s current managing director, Kristalina Georgieva, made it clear that the US dollar will remain GRC for the foreseeable future.

“And there I don’t see an alternative, I don’t see it coming any time soon”

Georgieva also noted that the only real competitor is the , while all other currencies are in the low single digits. However, Europe itself is closely tied to the US politically and economically, so it is a distinction without a difference.

With that said, the US triggered a domino by imposing unprecedented sanctions against Russia, the world’s largest country with abundant natural resources. Other countries now perceive that the US can no longer be counted as a neutral and reliable custodian of international finance.

Such perception mainly comes from the BRICS nations, which could expand to 24 countries if all the member applications are accepted. The new BRICS block would make up around 47% of the world’s population or 37% of the world’s gross domestic product (GDP).

With Russia, China, Saudi Arabia, United Arab Emirates, and Iran as major oil producers in BRICS tow, the pathway to dethroning the petro-dollar would open. These five nations contribute 36% to the world’s oil production, according to EIA’s data for 2022.

The first stepping stone in that direction would be Saudi Arabia’s shift in oil transaction settlements from the dollar to the Chinese yuan. The pivotal stepping stone yet to materialize would be the creation of a new BRICS currency supported by the member nations’ ample natural resources.

Is it Likely for Another Fiat Currency to Become a GRC?

Last week, it was reported that Argentina would start paying in yuan instead of dollars for Chinese imports, at around $1 billion, followed by monthly $790 million in imports. This would indicate the aforementioned de-dollarization trend at the benefit of the Chinese yuan.

However, looking at it closely, it becomes apparent that Argentina switched due to historic triple-digit inflation and dollar reserve shortage. More importantly, the Chinese yuan is effectively pegged to the US dollar.

This is evident by China-US imports and exports increasing to $690.6 billion last year, according to BEA. Likewise, China is the second-largest foreign holder of US debt, behind Japan, at $859 billion.

In other words, despite the weaponization of the SWIFT payment system by the US, the dollar remains the most convenient medium of exchange and a safe-haven asset compared to alternatives. This is to become even more dominant with FedNow coming online.

It also bears noticing that the US military budget, as de-facto dollar backing, is second to none. Yet, the US international policy opened the doors to de-dollarization. Likewise, the US national debt appears to have no limits, which makes holding US treasuries less attractive.

If both trends continue, the dollar’s GRC status will inevitably decline, but not in the foreseeable future.

Disclaimer: Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.