While sharing certain similarities, Cryptocurrencies and Stocks are very different things

Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course.

Cryptocurrency vs Stocks

As more and more investors and speculators flock towards cryptocurrencies as an asset class, many have started likening them to stocks. While crypto and stocks do indeed share certain characteristics, they are fundamentally different.

Key Highlights

- While crypto and stocks do indeed share certain characteristics, they are fundamentally different.

- Similarities include risk and volatility, a similar transaction experience, a more and more common investor base, and the risk of being scammed.

- Differences include differences in supply, technology, purpose, and regulation.

- However, as the cryptocurrency market matures, it is possible that we will see more and more similarities between these two asset classes.

Cryptocurrency vs Stocks – Similarities

Let’s start by looking at the similarities between cryptocurrencies and stocks.

1. Risk and volatility

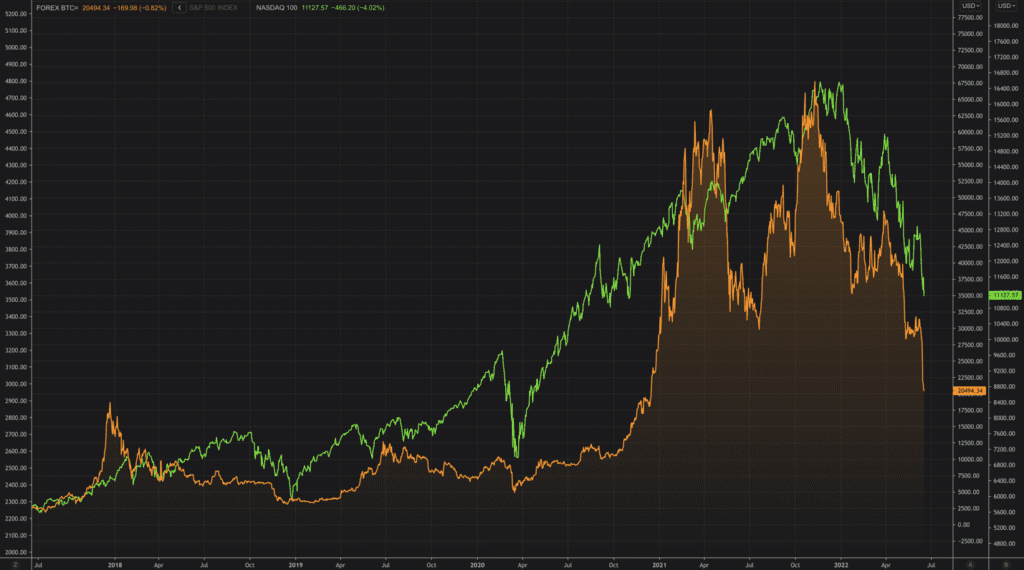

It should be no surprise that cryptocurrency asset prices have been quite volatile. In Figure 1 below, from the Refinitiv market data system, you can see that the price of Bitcoin (in orange) and the tech-heavy NASDAQ 100 stock index have experienced quite a lot of change over the last five years.

It means that both holders of Bitcoin or a basket of technology stocks would have experienced price changes over the past five years. But the degree of price changes with Bitcoin is significantly higher, as shown in Figure 2.

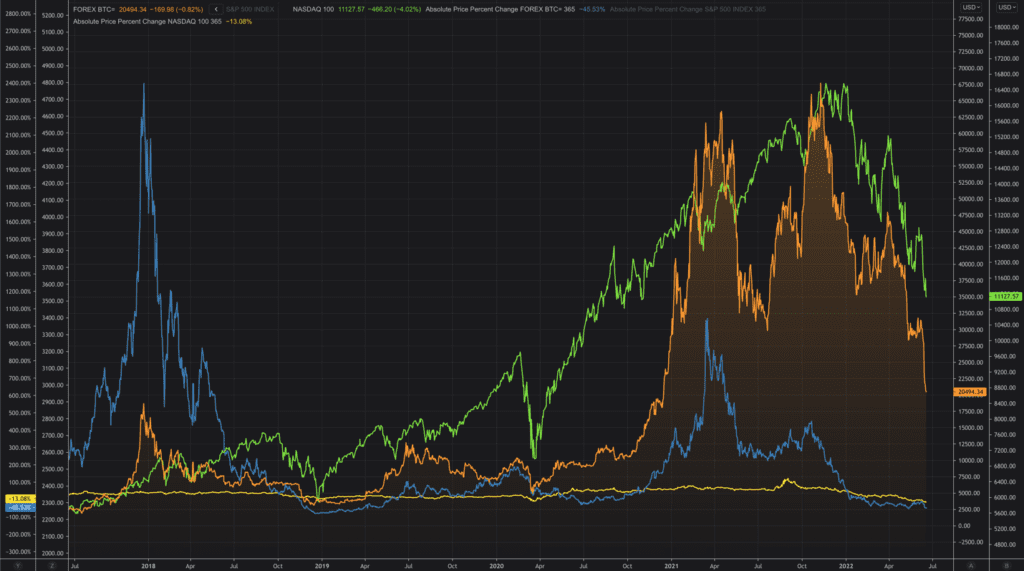

This chart has the same price history over the past five years but overlayed with the price change as a proxy for price volatility. The line in blue is the one-year percentage change in the price of Bitcoin, and the yellow line represents the same one-year percentage change in the NASDAQ 100 index. Here, you can clearly see that the volatility for Bitcoin is much higher.

2. How they are transacted

Another similarity between cryptocurrencies and stocks is the way that both assets are bought and sold. Platforms such as Robinhood, Wealthsimple, and SoFi have started blurring the lines between digital assets and legacy financial products. Users can access and trade their stocks and cryptocurrencies using the same frictionless platform.

3. Scams

Given the temptation of quick money, it is no surprise that both equities and cryptocurrencies suffer from fraudulent behavior. One of the most common is the “Pump and Dump” scam. Like we often see in penny stocks, unscrupulous parties artificially inflate the price of the cryptocurrency through false or exaggerated statements, celebrity “endorsements,” or simply investor greed (FOMO).

Once the price goes up, the fraudster unloads its holdings and, in most cases, disappears. Crypto data firm Chainalysis estimates that there were $2.8bn in crypto “pump and dump” scams for 2021.

4. More and more common investors

Despite the nascent nature of cryptocurrencies, more and more institutional investors are investing in cryptocurrencies, digital assets, blockchain technology, and decentralized finance (DeFI). These professional investors will require greater transparency, liquidity, and regulation in cryptocurrency assets, which can be viewed as a positive for the market as a whole.

Cryptocurrency vs Stocks – Differences

As we started by saying, there are still many fundamental differences between stocks and cryptocurrencies.

1. Supply

Some cryptocurrencies are limited in their supply, the most famous being Bitcoin. However, other cryptocurrencies do not have a ceiling on how much cryptocurrency can eventually be mined or minted. Stocks, on the other hand, tend to be less variable, as the amount of shares outstanding is controlled and ultimately backed by the operations of the issuing company.

Another thing to consider is the absolute size difference between global stock markets and cryptocurrencies. As of 2021, the amount of stocks outstanding globally was estimated to be $106 trillion, while the total size of crypto markets was only $2.6 trillion, a mere 2.5% of the much larger equity, or stock market.

2. Regulation

Equities, or stocks, are generally scrutinized by securities and other regulators in their country of origin. Additionally, for stocks that trade in an organized exchange, the exchange also provides oversight of the company and may delist the company should anything go wrong. While by no means does this provide a guarantee, it is certainly more than any safeguards when investing in cryptocurrencies.

Furthermore, cryptocurrencies are based on the concept of decentralization, which allows the trustless peer-to-peer exchange of value over the internet without any intermediaries. As a matter of fact, the appeal of cryptocurrencies for many is the fact that the identities of the sender and receiver of cryptos are hidden, unlike traditional stocks.

3. Purpose

Speaking of exchanging value, many cryptocurrencies were designed as transactional cryptocurrencies, which means that they are meant to be a sort of digital currency or coin.

On the other hand, when one purchases a stock, they are buying a fractional ownership share in the issuing company. However, when one purchases a cryptocurrency, they are not necessarily getting a fractional ownership of the blockchain – just a medium of exchange.

Yes, there are projects that are a token that may represent partial ownership and voting rights for a project. Still, for the most part, a cryptocurrency is closer to owning a currency or commodity, like gold.

4. Technology

The last and most important difference between stocks and cryptocurrencies is the blockchain technology that underpins all cryptocurrencies. Many cryptocurrencies allow for programming to be added, changing the nature of the crypto asset into ‘programmable money.

Other use cases can be built upon certain cryptocurrencies, such as smart contracts and other DeFi uses, like Dapps (decentralized applications). The only uses for stocks are capital appreciation, dividend cash flow, and voting rights.

Will the Two Assets Become More Similar?

While the market cap differs, certain changes bring the two asset classes closer together. As the cryptocurrency market becomes more mature, we are seeing the development of more financial derivatives and products that are commonplace in stocks.

For example, there are now Bitcoin and Ethereum futures that trade on reputable futures exchanges, such as the Chicago Mercantile Exchange (CME). These futures markets allow institutional investors to trade contracts, or agreements, to buy and sell cryptocurrencies at a pre-agreed later date in a developed and transparent manner via established exchanges.

It allows investors to not only buy a future claim to a digital currency but also take a negative view of that cryptocurrency and sell it short. These futures are cash settled, and by going through an exchange, trades are conducted on an established and regulated marketplace.

Cryptocurrencies have also taken a page from Stock Exchange Traded Funds, called ETFs for short, which now invest specifically in Bitcoin and other cryptos. An ETF is sort of like a mutual fund but is bought and sold over an exchange, so they have decent liquidity.

ETFs have been around for a long time and tend to be very lightly managed instead of tracking the performance of an asset or an index, and as such, they normally charge lower fees than a traditional mutual fund.

Speaking of funds, there’s another way that stocks and crypto markets are converging. For more sophisticated investors, there are dedicated hedge funds that specialize in cryptocurrency, digital asset, and/or DeFI investments that professionally manage money on behalf of investors. These funds generally require larger minimum investments upwards of US$100,000.

These companies can invest in single digital coins, crypto start-ups, exchanges, Initial Coin Offerings, Initial Exchange Offerings, and other blockchain assets. They charge their end investors a hefty fee in return for their professional management.

Related Articles

Thank you for reading CFI’s guide to Cryptocurrency vs Stocks. To keep advancing your career, the additional CFI resources below will be useful: