Market scorecard

US markets soared higher last night, like an African fish eagle after a successful catch. The S&P 500 closed at its highest level in almost two years and all three major indices are on track for their seventh straight week of gains. These moves followed indications from the Fed that they are ready to cut rates in 2024. Their new dovish stance was an early Xmas present for equity investors.

In company-specific news, Apple (NASDAQ:) reached a new closing high of $197.96 per share. Next stop, $200! Elsewhere, Bank of America (NYSE:) and Goldman Sachs responded well to the shifting interest rate outlook, and both rose more than 2%. Lastly, Pfizer (NYSE:) was the worst performer on the day, dropping 6.7% after issuing a revenue warning due to waning demand for Covid vaccines.

At the closing bell, the JSE All-share was a tiny 0.03% higher, the powered up by 1.37%, and the climbed by 1.38%.

One thing, from Paul

This is our final Vestact newsletter of the year. We’ll be back in your inbox on Monday the 8th of January 2024.

Our office in Rosebank will be closed from tonight until then. The picture below shows my current view, across the desk, of my colleague Bright. He’s in good spirits!

The team will disperse to various holiday locations, but we’ll be online regularly, and happy to respond to any queries that you may have. The markets are open other than on public holidays, and so are the banks.

If there are portfolio adjustments that you’d like to discuss, let us know. If you run out of spending money, give us a shout!

Email us on support@vestact.com, the mailbox that comes to all four of us. We will get back to you promptly.

Let’s hope that the remaining market trading days in 2023 go well, and that the US market reaches new all-time highs. The S&P 500 is very close to that mark now. It closed last night at 4,707 points. At the very end of 2021 it was at 4,796 points. We can do it!

Byron’s beats

I heard someone say that no one takes December holidays more seriously than South Africans. Having a hot summer southern hemisphere holiday is a great tradition. We celebrate with family and friends after a long, hard year.

It’s good to step away from the daily grind and have a proper mental recharge. I urge you to take advantage of the slowdown if possible. Spend time with your loved ones and try and explore our beautiful country. Plus you get to support the tourism industry. There are many affordable self-catering options all over the country. If you have not booked a stay away, why don’t you hop in a car and do a road trip?

If you are like me, with young children, you can take your real break in January when they go back to school.

Bright’s banter

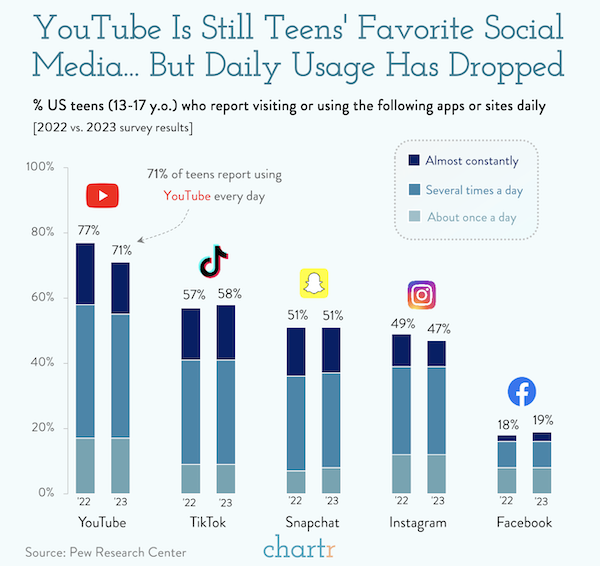

A recent Pew survey revealed that teenagers spend a significant amount of time on their phones, with almost half of those aged 13 to 17, stating that they are online “almost constantly.” This figure has doubled since 2014.

95% of teens reported having access to a smartphone. In terms of daily usage, the majority of teens engage with multiple social media apps, including 71% for YouTube, 58% for TikTok, and 51% for Snapchat.

Despite YouTube remaining a top choice for teenagers, with 93% using the platform, there was a slight decline in daily usage across various social media platforms, possibly due to the screen time limit feature on iPhones introduced in 2022. Notably, TikTok experienced growth, with 17% of teens identifying as “almost constant” users. Facebook (NASDAQ:) saw a modest increase in constant users, but its overall popularity among teens dropped from 71% in 2014 to 33% today.

We should encourage teenagers to take a break from TikTok during the festive season and explore other activities. Whether it’s trying out a new hobby, learning a craft, or engaging in outdoor activities, the holiday season offers a great opportunity to step away from screens and discover the joy of creating with their hands.

Signing off

Asian markets have joined in on the global rally this morning. Benchmarks rose in Australia, Hong Kong, India, and South Korea. Chinese property developer Country Garden (HK:) surged as much as 6.5% after news that they managed to repay a $111 million loan.

US equity futures are edging higher in early trade. The is now trading at around R18.56 to the Dollar, firming versus the greenback thanks to those Fed moves

Have a happy holiday, and let us know if you need us. Onwards to 2024!