- Looking at the EUR/USD chart, a double-bottom formation seems to be forming.

- This comes amid the ECB avoiding talk of further cuts.

- At the end of the week, important data from the US can spark moves in the pair.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

With expectations of interest rate cuts in the Eurozone fulfilled in the ECB’s last , the pair has been moving within a downtrend since the beginning of the month, finding a local bottom around the 1.0670 level.

But despite the seemingly dovish positioning by the ECB, Christine Lagarde & Co. have not followed through with concrete statements on future decisions. This, combined with the discounting of political risks in France (parliamentary elections and the probable victory of the National Unity), has caused the declines to slow down.

The double-bottom formation in the aforementioned area indicates the possibility of at least a short-term rebound, which is likely to be confirmed or negated with the release of important data from the US economy at the end of the week.

Will the ECB Continue to Cut Rates in Its Next Meeting?

The 25 bps cut declared at the European Central Bank’s last meeting is not yet part of an official cycle of interest rate cuts, as ECB officials have emphasized, suggesting that the bank will remain flexible and responsive to incoming data.

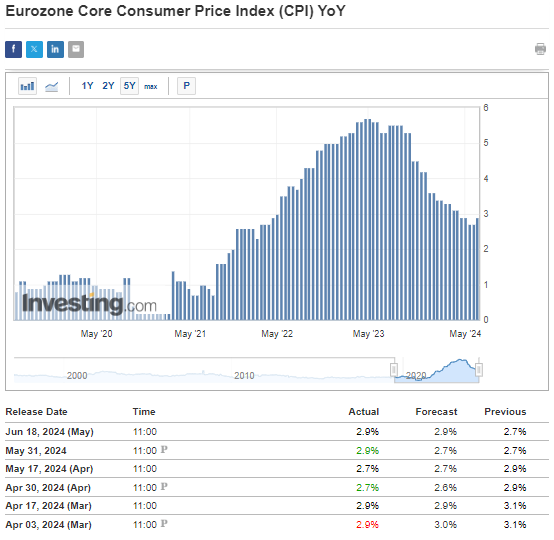

On one hand, meager growth for the zone as a whole supports the cuts, with euro oscillating just above zero. On the other hand, the ECB’s leeway is hindered by inflation dynamics, as both consumer and core inflation have risen in recent readings and still have not reached their target.

This means that in the coming weeks the factors driving the declines may move into the background, and this paves the way for a possible deepening of the northward rebound. For that, however, a boost is needed from the dollar side, which could come with possibly higher-than-forecast GDP and Inflation readings.

How Will US GDP, PCE Inflation Affect the EUR/USD?

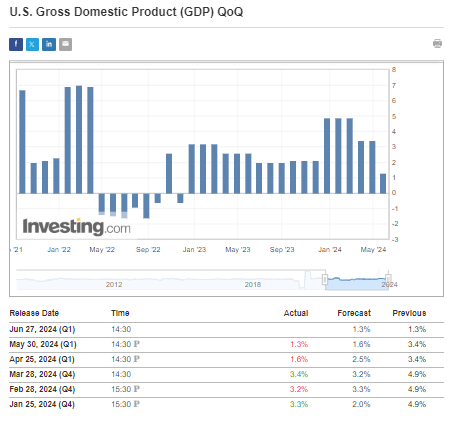

Thursday and Friday will bring the publication of other important data from the US economy: Q1 revision and the Fed’s preferred measure of inflation.

For the former, any positive surprise should work in favor of the U.S. dollar, as it allows the Federal Reserve more room to keep interest rates higher and dismisses the specter of recession.

In the case of PCE inflation dynamics in y/y terms, a slight upward trend has emerged. If this trend continues, it will provide another argument for the demand side on the EURUSD.

Therefore, the main currency pair should position itself accordingly, at least in the short term, depending on how these readings develop.

Technical View: EUR/USD Rebounds From Local Demand Zone

The main currency pair has found support in the demand zone around 1.0670, where a double-bottom formation is taking shape.

A breakout above 1.0760 will signal a potential rally, paving the way for higher levels with the first significant resistance around 1.09. However, incoming macroeconomic data from the US should confirm such a movement.

The analogous scenario involves negating the indicated formation by breaking through the level of 1.0670 and attempting to attack this year’s lows near the round level of 1.06.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.