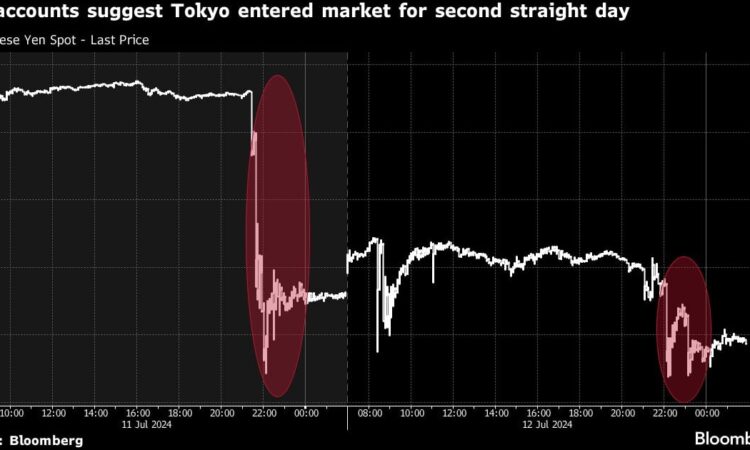

(Bloomberg) — Japan likely stepped into the currency market for a second straight day on Friday as it continued its battle to prop up the yen and keep speculators on the back foot.

Tokyo’s latest market entry was likely around ¥2.14 trillion ($13.5 billion), a comparison of Bank of Japan current account data and money broker forecasts shows. The Friday move is seen following a larger ¥3.5 trillion suspected intervention on Thursday, using the same calculation method.

The likely second intervention, if confirmed, would be a fresh example of the government conducting a follow-up move after a bigger operation the previous working day to keep traders on high alert. Earlier analysis indicated that a two-punch operation occurred in late April and early May.

The follow-up moves mirror the precedent of October 2022, when finance ministry figures show Japan intervened on two straight business days, but with a much larger second-day move in the yen.

“This suggests it’s highly likely intervention on a scale of ¥2 trillion took place,” said Hirofumi Suzuki, chief foreign-exchange strategist at Sumitomo Mitsui Banking Corp. “I think the strategy was aimed at stopping market participants from reading the move in advance.”

How to Tell If Japan Intervened to Prop Up the Yen: QuickTake

Japan’s authorities have been sticking to tactics of keeping traders on edge by declining to immediately comment on whether the government has intervened in the market, and leaving them in the dark. The follow-up move shows speculators need to stay on guard even after Tokyo has bought the yen.

The central bank data showed it expects its current account to fall ¥2.74 trillion due to fiscal factors on Wednesday, much bigger than a drop of about ¥600 billion estimated by Central Tanshi Co. and Ueda Yagi Tanshi. The large discrepancy points to likely intervention in the currency market.

The yen strengthened sharply by as much as 0.9% to 157.38 per dollar on Friday after producer price data in the US. The move came after a suspected intervention on Thursday night, when the government likely spent $22 billion to prop up the yen following weaker-than-expected US inflation data. The moves suggest Japan is targeting US data releases and speculators based overseas.

The move Friday nudged the dollar by around one-and-a-half yen, a much smaller move than the usual 4 yen or so seen in many of Japan’s interventions, an early sign that its repeated actions may be starting to lose impact.

Repeated moves also risk generating criticism from Japan’s allies, given the country’s commitment to letting markets set exchange rates. US Treasury Secretary Janet Yellen has warned against overuse of intervention.

“The moves in the yen market give the impression of being relatively small given the large amounts spent,” said Yosuke Takahama, chief manager at money broker Central Tanshi Co.

In further evidence that intervention took place, Friday proved to be one of the busiest days for Japanese yen spot trading since November 2016, according to CME Group, the world’s largest regulated currency market.

Some $49 billion was traded in the dollar-yen pair on CME’s spot EBS platform, close to Thursday’s $53 billion, a representative for the exchange said in an emailed response to questions.

For investors, the period leading up to July 31 is fraught with tension, as both the BOJ and the Federal Reserve will announce policy decisions that could significantly impact the currency’s trajectory. A potential rate hike by the BOJ and substantial cuts to bond purchases, combined with signals of rate reductions from the Fed, could provide further support for the yen.

Economists are divided on whether intervention to support the yen reduces the pressure on the central bank to raise rates in July.

Earlier this year, the government spent a record ¥9.8 trillion around the end of April and the beginning of May to support the yen after it fell to a 34-year low against the dollar.

Official monthly intervention data covering Thursday and Friday is expected on the last day of this month.

“Japan is tying to buy time until the Fed cuts rates,” said Tsuyoshi Ueno, senior economist at NLI Research Institute. “I don’t think they are exhausting the ammunition of foreign reserves but doing intervention so often raises a risk of backlash from the US as Yellen has said intervention should be rare.”

–With assistance from Isabel Reynolds, Issei Hazama, Daisuke Sakai, Saburo Funabiki and Brett Miller.

(Adds more details and analyst comments)

©2024 Bloomberg L.P.