Latin American Bond Market Has New Contender for King of Chaos – BNN Bloomberg

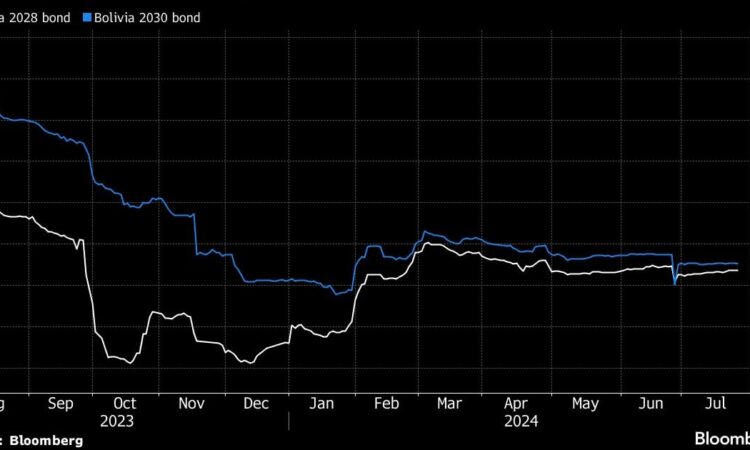

(Bloomberg) — A failed coup, a currency crisis, strikes and fuel shortages have made Bolivia’s bonds a new contender for the title of the riskiest sovereign debt in Latin America.

The extra yield investors demand to hold its bonds over similar US Treasuries has risen to about 21 percentage points from 17 points in March, according to JPMorgan data. The spread now exceeds that of serial defaulters Ecuador and Argentina by at least 553 points. Only Venezuela, which has been in default since 2017, is worse off in the region.

“It’s hard to find a beacon of light,” said Jim Craige, head of emerging markets at Stone Harbor Investment Partners. Even at current prices, “it’s difficult to say there’s a big upside relative to the downside trade here.”

Large current account deficits combined with a fixed exchange rate system have drained the country’s coffers of dollars, forcing importers to turn to the black market, where the greenback trades at over 10.5 bolivianos — 50% above the official rate.

The lack of dollars, combined with falling oil production, have made it increasingly difficult for the government to import the fuel that’s sold domestically at below-cost prices. Last month, Bolivia deployed its military to gas stations to curb the smuggling of subsidized fuel. Industry group Eastern Agricultural Chamber has warned that food supplies are in danger.

And now, “the heavy transport sector is threatening a national strike if the diesel availability problem is not solved,” according to Ricardo Penfold, managing director at the bank Seaport Global. “FX shortages continue to affect the supply of key products in Bolivia.”

The Divide

As the economic crisis deepens, an acrimonious split between President Luis Arce and former President Evo Morales is preventing any meaningful effort at reform. When Arce faced down a military coup last month, Morales, far from rallying to his side, said the president had staged it to boost his support.

The power struggle between the two, representing different fractions of the ruling socialist party, is such that congress won’t even approve loans from multilateral institutions including the World Bank, said Nathalie Marshik, an emerging markets sovereign analyst at HSBC Securities.

It also means Arce is likely to delay “the much needed devaluation of the currency until after the elections” in 2025, she said.

Things have got so bad that even the announcement last week of the biggest natural gas field discovery in Bolivia in almost two decade did nothing to reverse the decline in the bonds. The most-liquid notes, due in 2028, are trading around 56 cents on the dollar, handing investors a loss of 0.6% since the end of the first quarter, compared with the average of 1.2% across developing nations, according to a Bloomberg index.

“The gas discovery does not address the reason for bonds trading at these distressed levels,” said analyst Thomas Jackson at Oppenheimer & Co. Instead, the reason “is the near-term liquidity concerns with nonexistent usable international reserves and uncertainty surrounding available external financing sources.”

Still Growing

The government remains confident it can meets its obligations, citing global factors behind the market jitters.

“Bolivia’s economy continues to show encouraging signs, such as the constant expansion of production and price stability,” the Finance Ministry said in a response to questions, citing last year’s growth of 3.1%. “The government has honored all its debts in a punctual fashion, and will continue to do so.”

But it won’t be easy.

Bolivia’s foreign currency reserves stood at $1.8 billion in April, the latest available data showed, down from $15.5 billion in 2014. The central bank — which sold about half of its gold reserves in 2023, nearly exhausting the amount allowed — has just $139 million in cash, a record low.

Moody’s Ratings analysts including William Foster and Mauro Leos, downgraded Bolivia by two levels to Caa3 in April, citing “critical levels” of external liquidity pressures and heightened sovereign credit risks.

Fitch Ratings estimates Bolivia’s fiscal deficit will total 5.7% of gross domestic product in 2024, while Moody’s expects the shortfall to remain above 5% of GDP in the medium term.

The government “hasn’t given any indication that they’re planning to do anything to reduce that deficit,” said Barclays analyst Sebastian Vargas.

Redeeming Feature

There is just one factor playing in Bolivia’s favor for the moment — it doesn’t have to repay any of the principal on its debt until 2026.

Interest payments amount to just $54 million this year and about $109 million in 2025, before total payments jump to $434 million in 2026.

“Eventually Bolivia will go through a debt restructuring,” said Craige at Stone Harbor. “The timing is a bit uncertain of when that happens, but that’s likely to happen at some point.”

–With assistance from Maria Elena Vizcaino.

©2024 Bloomberg L.P.