Latin American Currencies Slide as Global Rate Decisions Loom – BNN Bloomberg

(Bloomberg) — Latin American currencies led losses in emerging markets as traders brace for a swath of central bank decisions in both developed and developing economies on Wednesday.

Mexico’s peso was among the worst performers Tuesday, extending a six-day slump that marks the longest losing streak since September. The Colombian peso was also among the laggards, falling 0.3% while Brazil’s real fell before trimming the day’s losses.

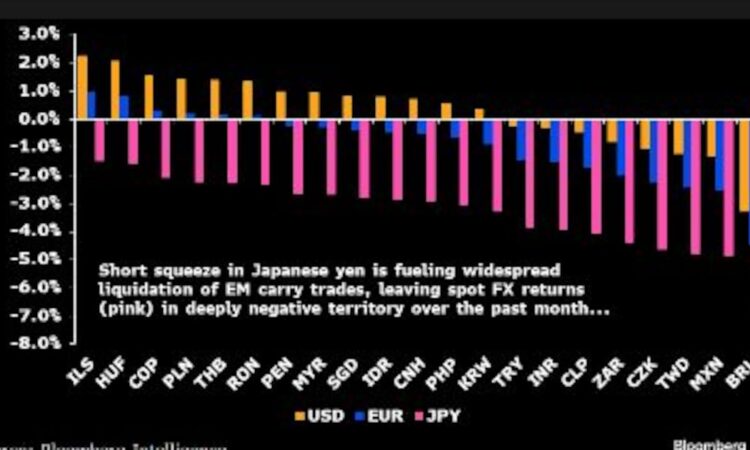

Recent market volatility and an appreciation in funding currencies such as the Japanese yen have damaged the popular carry trades in the region, which typically involve traders borrowing at lower rates in developed markets to invest in higher-yielding assets in the emerging world.

“Carry trades in Latam continue to suffer amid a wave of strength for ‘carry-funders’ and sour overall sentiment,” wrote JPMorgan strategists including Tania Escobedo Jacob and Gisela Brant.

A number of central bank decisions in developed economies like Japan and US, along with those in emerging markets like Brazil, Colombia and Chile, have further exacerbated the risks. Policymakers in all five nations will decide on monetary policy on Wednesday. The Bank of England will follow on Thursday.

“Although volatility may decrease in August following the central bank meetings, the appeal of carry trades remains weak,” Barclays strategists including Themistoklis Fiotakis wrote in a note to clients. “With ongoing market noise, investors are expected to limit their carry trades to tactical opportunities rather than committing to longer-term positions.”

Mexico’s currency has also been hurt by signs that lawmakers from the nation’s ruling party will rush to pass a series of reforms embraced by the outgoing government before President-Elect Claudia Sheinbaum even takes office in October.

“This is leaving Sheinbaum with a very challenging panorama,” said Gabriela Siller, head of economic research at Grupo Financiero Base. “She is getting an economy where there is going to be a lot of caution because of these reforms.”

MSCI’s index for developing-world currencies ended the day with a small gain of less than 0.1%, while the stocks gauge fell 0.5%, led by a drop in tech shares including Tencent Holdings Ltd. and Taiwan Semiconductor Manufacturing Co. Ltd.

Venezuela’s government is engaging in a full crackdown on any resistance to President Nicolás Maduro’s self-declared victory, announcing 749 arrests and detaining prominent opposition figure Freddy Superlano. The country’s opposition said it can prove that Edmundo González won Sunday’s election, and called for “citizen assemblies” Tuesday. The nation’s sovereign bonds edged higher, recouping some of the losses seen in the aftermath of the vote.

Israel’s shekel weakened to session lows after the country targeted a senior Hezbollah commander with an airstrike on Beirut, before trimming losses. Israeli officials signaled they would not escalate the situation further.

Ethiopia’s defaulted eurobonds, meanwhile, jumped after the country secured a deal for a $3.4 billion program with the International Monetary Fund. The security maturing in 2024 jumped to its highest since November 2021.

–With assistance from Colleen Goko and Netty Ismail.

©2024 Bloomberg L.P.