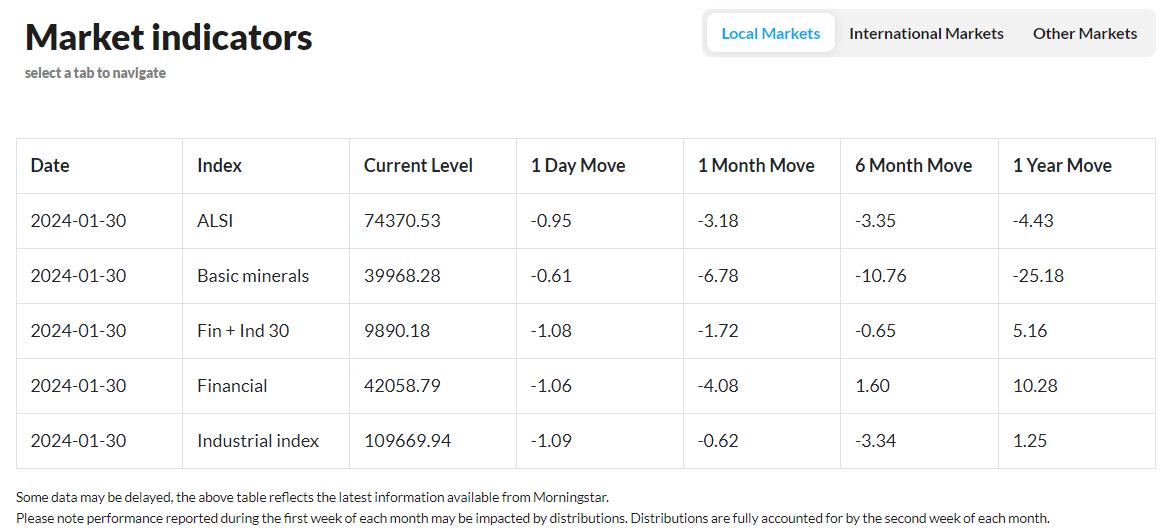

As traders prepare for the US Federal Reserve’s (Fed) , global markets were mixed and the local bourse began the week lower. It is anticipated that the Federal Open Market Committee (FOMC) will keep interest rates stable when it makes its first interest-rate announcement of the year on Wednesday evening. The FTSE/JSE All Share Index closed down by 0.95%, while the traded at R18.92 against the US dollar 21h30.

Wall Street was marginally higher at 22h30 as traders prepared for another earnings week, Wednesday’s interest rate decision from the Fed, and news on payrolls. The , which includes mega-cap tech firms like Microsoft (NASDAQ:), Apple (NASDAQ:), Meta (NASDAQ:), Amazon (NASDAQ:), and Alphabet (NASDAQ:), are reporting this week, making it the busiest week for corporate profits.

The rose 0.77% after a rally in all sectors. This week, investors will also be watching a plethora of Japanese economic data, such as numbers on consumer confidence, retail sales, industrial production, and unemployment. China’s also ended the day in the green as investors look ahead to major reports from the US this week.

As market participants braced themselves for a week that would see the release of Germany’s fourth-quarter GDP and inflation statistics, as well as crucial central bank meetings from the Fed and the Bank of England, the dipped to 16 942 points. Furthermore, trading in the tech industry remained on the cautious side as big US names like Microsoft, Alphabet, and Amazon are about to release their fourth-quarter earnings.

was trading in the red at $82.36 a barrel, while was in the green trading over $2 000 an ounce as demand for the metal increased due to its safe-haven appeal amid continued conflict in the Middle East.