(Bloomberg) — Emerging-market stocks had their worst day since the selloff that tanked global markets in early August as tech companies slid, while developing-nation currencies were mixed after US data stoked bets on the Federal Reserve’s upcoming interest rate cuts.

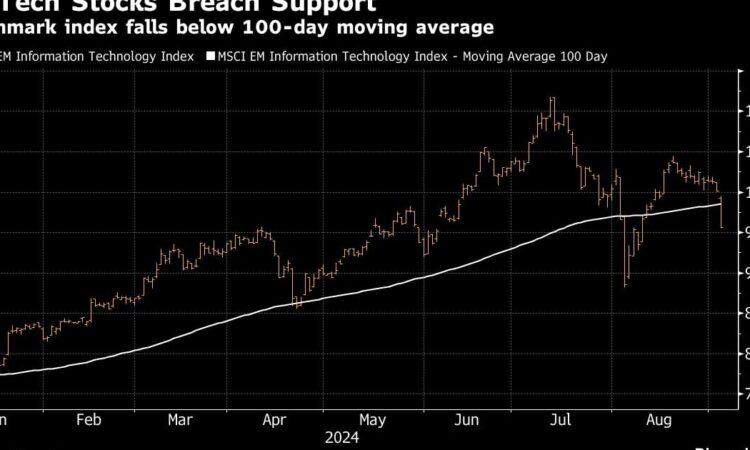

MSCI Inc.’s EM equity gauge fell 1.5%, its sixth decline in seven sessions, dragged lower by the sub index for information technology, which slumped 4.5%. The check on the frenzy over AI, which spilled over from Tuesday’s US session, comes amid concerns over Nvidia’s business outlook, as well as an antitrust probe.

Investors also digested US job openings that fell in July to the lowest since the start of 2021, consistent with other signs of a slowdown in the US labor market. Wednesday’s data — which comes just a few days ahead of the all-important US payrolls report on Friday — fueled a drop in US Treasury yields and pushed emerging-market currencies to reverse earlier declines.

US jobs data “should reinforce market views of forthcoming rate cuts, which is leading to a weaker USD — which inherently should support EM,” said Malcolm Dorson, senior portfolio manager of the Global X Active India ETF. On stocks, “today’s weakness is more about Asia following yesterday’s move in semiconductors.”

Developing nation equities have resumed losses after a quick rebound in August as investors remain nervous about the potential for a sharp slowdown in the world’s largest economy, weak consumer demand in China and potential volatility tied to US presidential campaign. Earlier, figures showed China’s economy continues to slow despite months of stimulus.

That’s prompted investors to rotate into bonds. The trend was visible on Wednesday, when some of the countries that saw a tech-stock rout posted the largest gains in the EM dollar-bond market. South Korea and China outperformed peers even as their equity gauges capped some of the deepest losses in the group.

In currency markets, the Mexican peso weakened against the dollar as investors digested the approval of a proposal to overhaul the country’s judicial system by the lower house of Congress. The reform seeks to elect all federal judges by popular vote, something that opponents say will put democracy at risk.

The Chilean peso also fell after the central bank cut its benchmark rate by a quarter-point, and signaled more reductions ahead — playing down the risks of sustained inflation. Policymakers cited weaker-than-forecast demand in the economy and on-target inflation projections, in the statement accompanying the decision.

Elsewhere in Latin America, a former Brazil central bank director said the country’s monetary authority needs to change course and increase rates by nearly two percentage points. Brazilian policymakers should start with a quarter-point rate boost this month to douse a heated economy and tame inflation expectations, former central bank International Affairs Director Fernanda Guardado said in an interview.

©2024 Bloomberg L.P.