After Monday’s plunge, Tuesday offered a glimmer of hope with a broad-based rebound for global equities. However, then came Wednesday, bringing a mid-session reversal, warning that further losses could be on the horizon for key indexes as the fallout from the global carry trade unwinds triggered by the Bank of Japan keeps pushing ever higher.

While technology stocks have struggled, with the dropping 3.5% since the start of the week, the and saw smaller declines of 2.7% and 2.4%, respectively.

This highlights a broader market rotation away from major tech stocks towards a more diverse range of sectors, particularly those with a higher value proposition. As a result, leading tech stocks, including the Magnificent Seven and fast-moving AI stocks, may continue to lag.

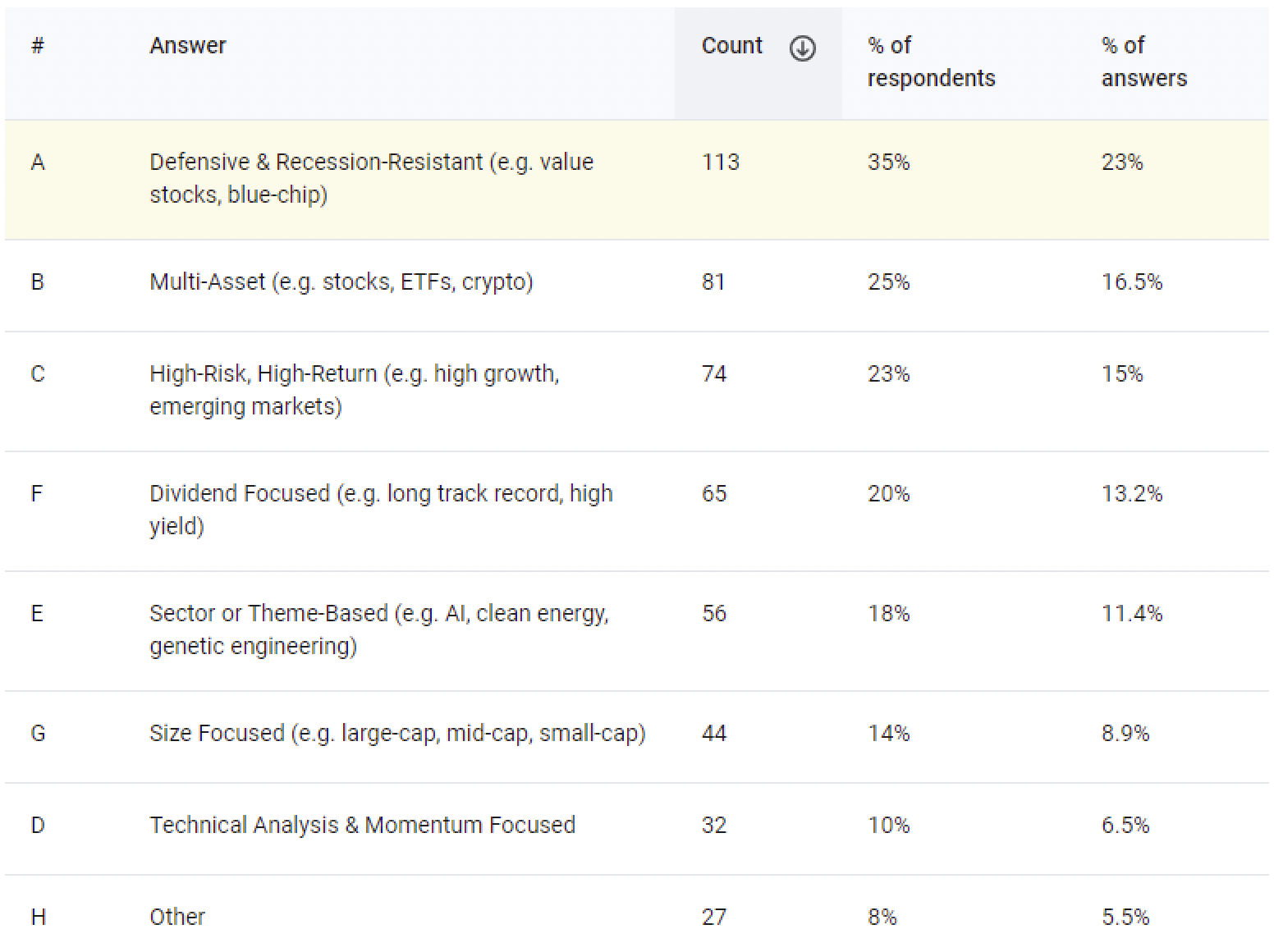

A recent survey from Investing.com with a selected number of users showed that these concerns also prey on our users’ minds. When asked which strategies our users have deployed more broadly in the past 12 months, the answer was loud and clear: recession-resistant, undervalued value plays.

See the results below:

Interestingly enough, despite the AI bull market, high-risk, high-return strategies were not nearly the most sought-after by our users.

And they are right to do so. Adopting a value-oriented approach, which assesses the intrinsic worth of companies, is the most certain wait to earn solid, long-term gains, particularly amid high macroeconomic and geopolitical risks.

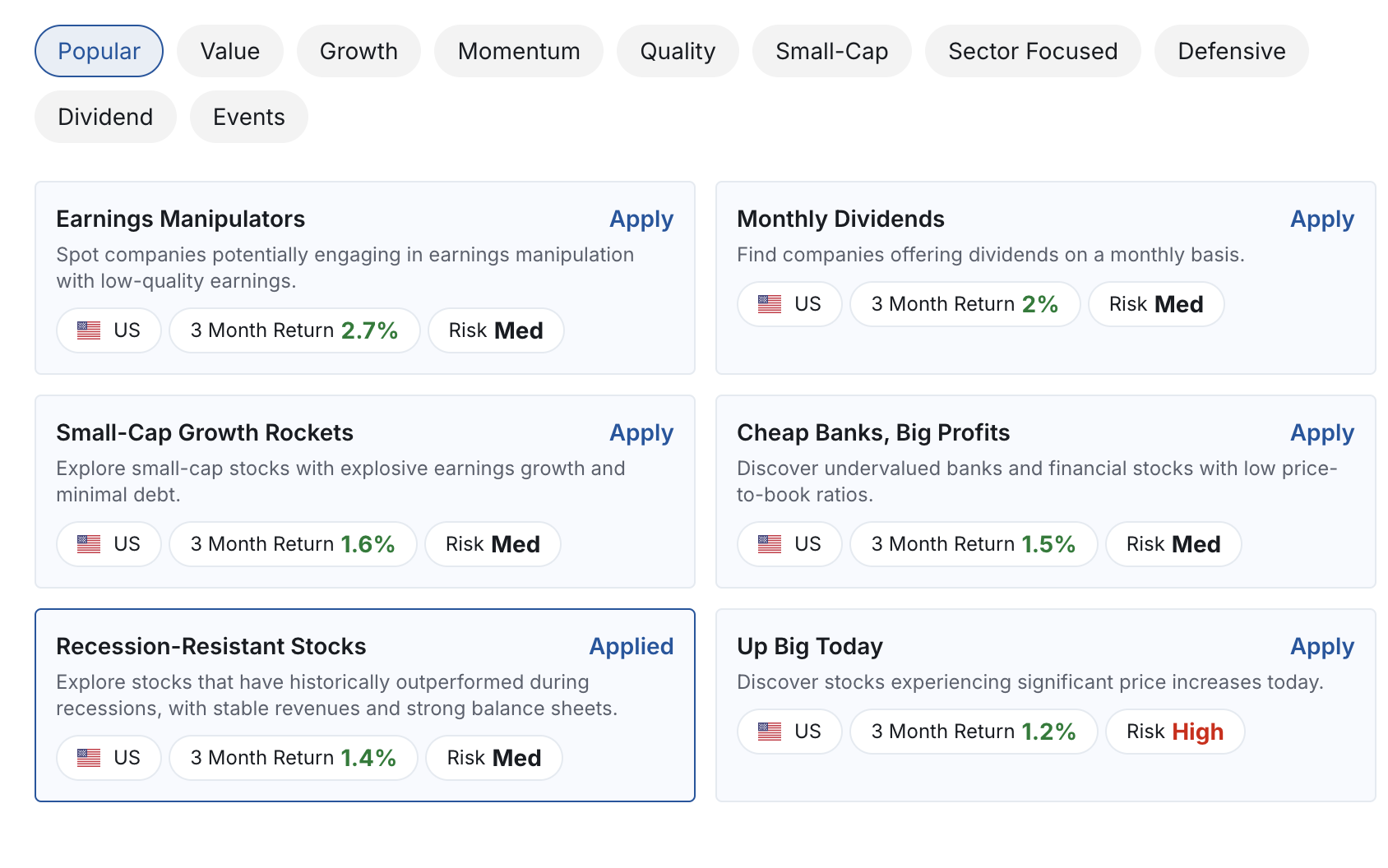

The new Investing.com free screener can be a big help with this. It offers several pre-configured thematic options, including a recession-resistant stocks category, which allows users who think like the ones we surveyed to find top-level opportunities that meet their criteria.

And how does it do that?

By applying top market-recognized financial criteria, our screener allows you to implement best-in-breed financial research at the click of a button. And the best part is don’t even have to resort to complicated metrics. Just click let our predesigned screeners do the heavy lifting for you.

To apply it, just click on “view all” on the main screen and scroll down among our best-in-breed list of 50+ free predesigned screeners.

Still haven’t found the stocks you’re looking for? Don’t worry; there’s more to out new screener – a lot more.

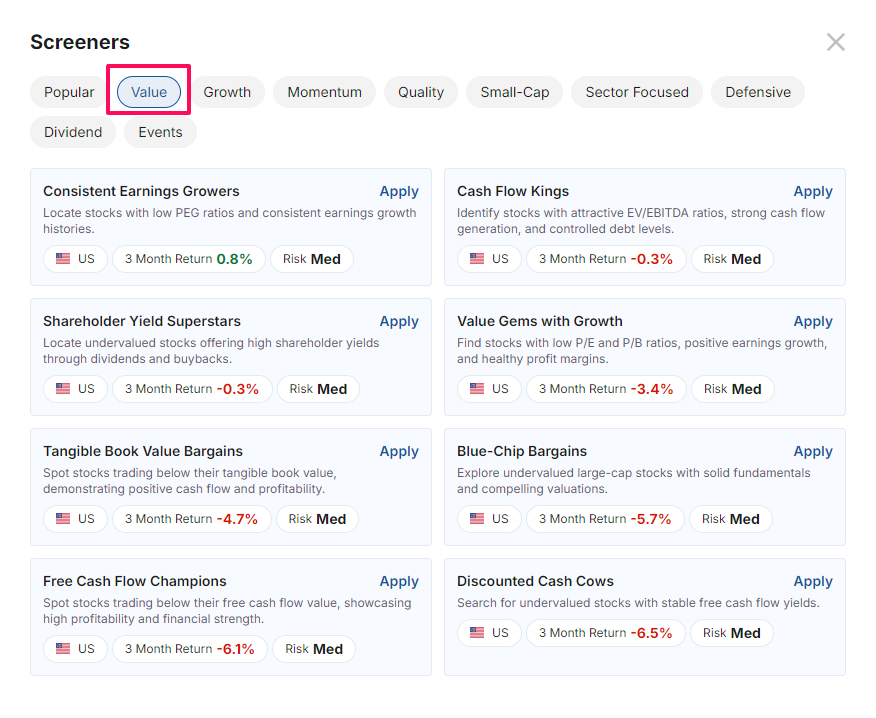

Try checking out the eight predesigned screeners in the “Value” category for even more undervalued plays:

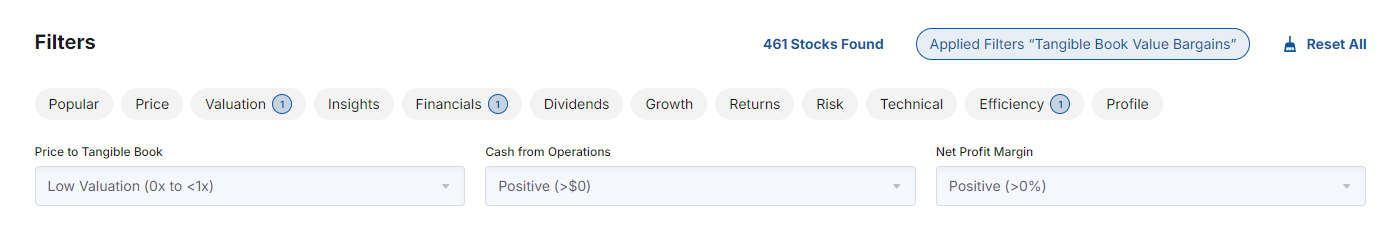

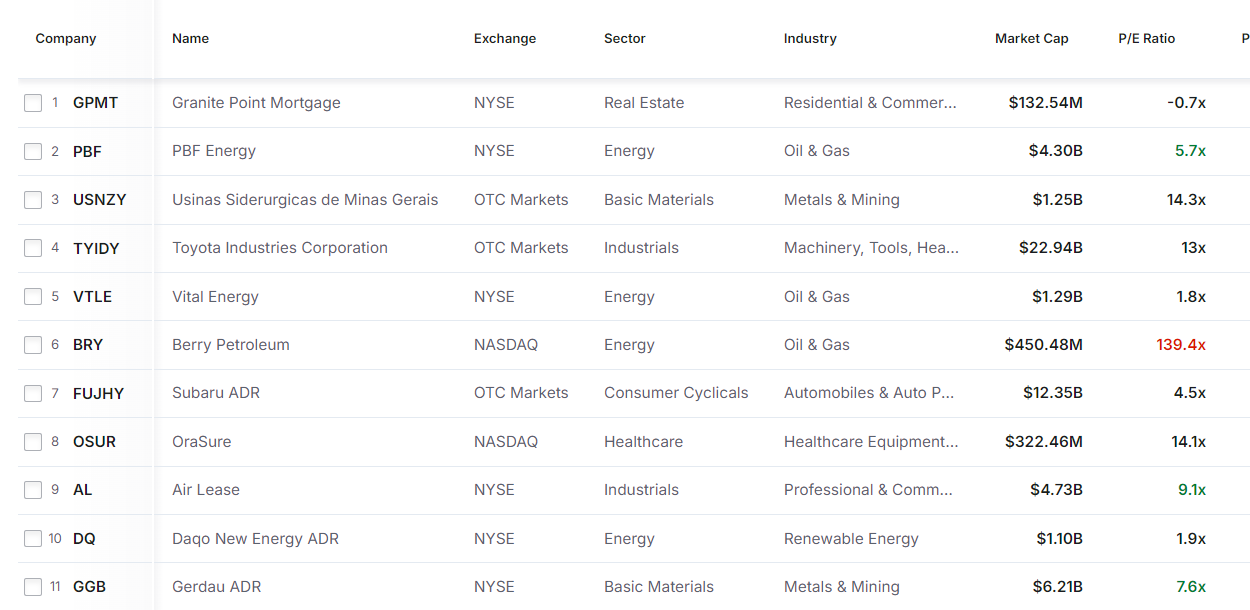

After accessing the free screener, one can apply the filter called ‘Tangible Book Value Bargains‘ and get a list of stocks that meet the following criteria:

We initially identified 461 stocks through a broad search. To refine these results, we focused on finding undervalued stocks with analysts predicting a potential upside of +18% to +50%.

Applying this criterion narrowed the list to 77 stocks. This more manageable set allows us to conduct detailed research, evaluating each stock individually to determine which ones to consider for purchase.

You can either go ahead and apply those filters yourself, or Click here for free access to the complete list of 77 stocks.

Another great option for finding top stocks in times of crisis would be to play around with the eight screeners in the “Defensive stocks” category.

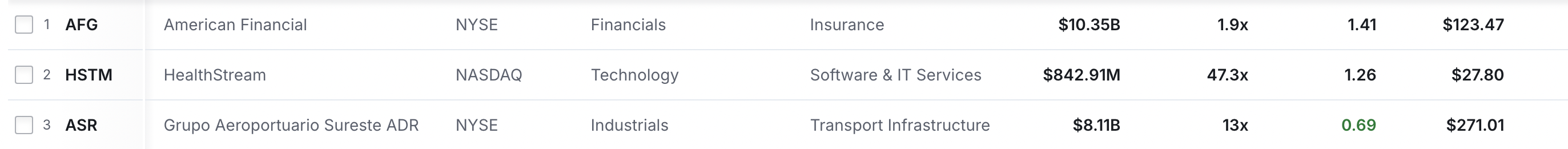

Among the options, I highly recommend checking out our flagship “Financial Fortresses” screener for a list of stocks poised for fantastic, yet stable long-term returns. Here are the top three results from that screener:

Conclusion

Despite the turbulence in the financial markets since the start of the week, investors who use the right tools and methods can still uncover valuable opportunities.

The Investing.com stock screener is a powerful tool that can help you identify undervalued stocks with strong technical and fundamental setups.

By registering for free on Investing.com, you can unlock the full potential of this tool and take your stock picking to the next level.

Start using the Investing.com stock screener today and discover the power of smart stock selection!

*To ensure the best possible user experience with the new screener, make sure to log in to Investing.com on all your devices.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.