Why Even The Most Cynical Bitcoin Bear Should Consider Investing And How To Get Started

With Volatility Comes Opportunity

Cryptocurrencies saw one of their most volatile months in March only to reverse course in April. Federal governments around the world are responding to the Coronavirus outbreak with unprecedented stimulus efforts with no end in sight. This unprecedented response is just one more reason we feel digital assets should make up part of an asset allocation.

As an example, the Bloomberg Commodity Index, which is often used as an investable allocation to commodities for inflation hedging purposes, was down almost 25% primarily due to crude oil trading down almost 43%. Meanwhile, Gold and Bitcoin are up 11% and 22% respectively.

Bloomberg.

A Bullish Case for Digital Assets

I believe there are a number of narratives justifying a bullish move higher for digital assets. The two primary long-term justifications are:

- as a potential store-of-value, and

- as a currency.

The third and slightly more obtuse reason to appreciate cryptocurrencies is the volatility they offer to speculators. With volatility comes the speculators who bring liquidity, and price discovery, this inflow of capital and speculators then tempers volatility for the next wave of “investors”, point one above, and “users”, point two above.

Store of Value – Inflation Hedge

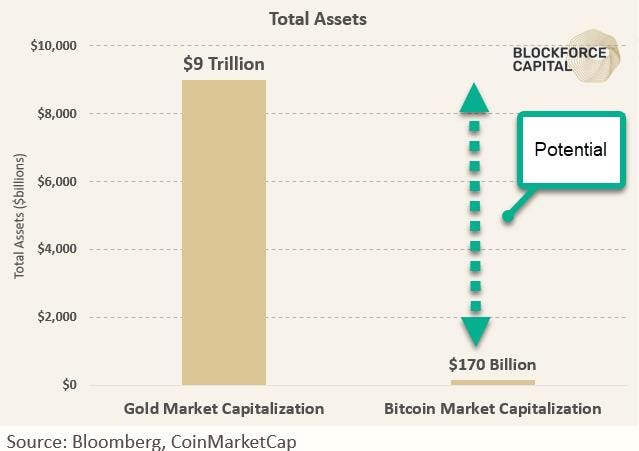

The store of value concept is prone to criticism at times due to the short-term volatile nature of bitcoin and other digital assets, however, for those looking to hedge potential inflation risk with a supply-constrained asset that can easily be traded for fiat currencies, the thinking behind bitcoin as a “digital gold” is very relevant. In fact, it is not difficult to make the case that bitcoin could be considered far more valuable than gold because of its enhanced utility. Bitcoin has the added benefit of being easier to acquire, transfer, and store than gold. Imagine how much more practical it would be for someone looking to carry all of their worldly possessions from one geography to another. They would be far better off using bitcoin than they would if they were to convert their wealth to gold or some other unwieldy metal. Taking that argument to the next logical step, the added utility should ultimately factor into the overall economic value. To put a finer point on this, as of March 2020, the total estimated market capitalization of gold was about $9 trillion USD. By contrast, the bitcoin market capitalization is around $170 billion. For those without enough room on their calculator, a $9 trillion dollar market cap would value a single bitcoin at well over $400,000 USD.

Gold vs Bitcoin

Let me say that again, $9 trillion vs. $0.170 trillion. If you are anti-bitcoin I appreciate your point of view, heck, I felt the same way when I first tumbled down the proverbial rabbit hole. You may very well be right, but isn’t it also conceivable that you might be wrong?

Pascal’s Wager

It is important to point out how rare it is to find an investment “hedge” with such an attractive asymmetry of payoffs. Put simply, a hedge is something you don’t think will likely payoff, but just in case the “ship hits the sand” it will be there for you protecting at some of the losses in the rest of your portfolio. Hedges, if done properly should have nominal “cost” and big payoffs if in the unfortunate event that they work out. Similar to Pascal’s ultimate conclusion, the risks of not believing in God were far greater than the “costs” of believing in God. Or, for the glass half full perspective. The potential rewards are significantly greater than the costs.

Considering an investment in digital assets should be quite similar. Significant potential payoff vs. relatively little cost, even a small allocation of 2%-5% can have a meaningful impact on performance. The upside could be life-changing, if sized appropriately, the downside could be the equivalent to a bad day in the markets. Couple that with the fact that this “hedge” is both uncorrelated to nearly everything else, and at the same time it lacks the term risk of most hedges, bitcoin doesn’t decay like options, or credit derivatives, etc.. Given this, even the “bitcoin bears”, owe it to themselves to slow down and consider investing a small amount in this asset class regardless of their point of view. If they are right and bitcoin goes to zero, they invested little and the loss is negligible. If they are wrong, the potential payoff could be many multiples of what they invested.

As a Currency:

The second most common narrative is, digital assets as a form of currency or medium of exchange. Equally as important as the store of value narrative, though possibly a bit harder to imagine for those of us with access to the traditional banking system. We tend to take for granted the utility that cryptocurrencies provide. I realize, it is difficult to think of digital assets as currency, but just remember, it is big world, not everyone has the access to banking products that we take for granted.

Yes, in the short run, arguing that digital assets are currencies and a medium of exchange opens the door to critics like Peter Schiff, and Roubini ranting about transaction fees, transaction confirmation times, etc. etc. however, once again, this “noise” obscures the point that bitcoin and other cryptocurrencies have the potential to offer even more utility as a form of money than traditional central bank currencies. Even Facebook recognized the fact that the antiquated bureaucratic, banking system is ripe for disruption, but even they were shut down by the incumbents who fear the loss of control rather than embracing the unlocked potential that free and open capital markets can offer.

The subtle but diminishing utility of the US Dollar

Like the boiling frog analogy, the United States Dollar has historically held a position as the world reserve currency because it offered a number of strong competitive advantages over the alternatives. It was easy to use and backed by a stable government committed to maintaining stability for the currency. Almost anyone around the globe could use and trust in this instrument of trade and commerce. However, over time, fiscal deficits, loose monetary policies and the onerous banking regulations have each steadily chipped away at the US Dollar’s stronghold as the world reserve currency. With the Bank Secrecy Act, the Patriot Act and many other banking regulations, it is becoming far more difficult for people and institutions to do business with the correspondent banking system. Anti Money Laundering (AML) and Know Your Customer (KYC) requirements steadily become more and more oppressive for even the most reputable people and institutions, this added difficulty encourages participants to seek alternatives. Cryptocurrencies offer an easier-to-use alternate form of payment for goods and services particularly when it comes to cross-border payments.

As an example, a merchant in Nigeria looking to buy construction equipment from a company in Venezuela, historically, would have found it easier to convert to US dollars and send funds via the Swift network. However now, neither company can open accounts with a bank connected to Swift because AML/KYC requirements automatically flag the clients as high-risk accounts creating extra work and risk for the bank to justify doing business with these clients. For the bank, there is no incentive to work with such accounts, only disincentives. These fear-based, “guilty until proven innocent” attitudes force merchants and individuals to seek more “useful” alternative monetary options like bitcoin and other cryptocurrencies. Relative to banks, Bitcoin offers an uncensorable, immutable monetary system which can process transactions on a peer to peer system without any intermediary deciding who may or may not participate.

Speculators are vital

Another very valuable and often maligned use case for cryptocurrency is the power of speculation. The speculative nature of bitcoin and other cryptocurrencies is an asset, not a weakness. Like all markets, speculators bring liquidity, adding even more utility to the “users” of a digital asset. Just like in the futures market for commodities, speculators and hedgers exist in a symbiotic relationship each bringing value to one another.

Until very recently, volatility for all asset classes was hovering at historic lows. Loose monetary policy from major central banks left capital markets desks flush with capital forcing them to compete to squeeze out arbitrage spreads from almost every nook and cranny of the markets. More adventuresome trading desks, in search of volatility, started trading cryptocurrencies over the past few years. The beneficial side effect of this was significantly more liquidity, tighter spreads, and more price discovery. As this first wave of institutions entered the market seeking the instability of wider bid-ask spreads and higher volatility, they ended up paving the way for the next wave of investors seeking more stability and confidence. The speculators pave the way for the investors (store of value camp) and the users (currency or medium of exchange camp) All three groups work together stabilizing and leaning on one another for added utility. Metcalf’s law is alive and well in the digital asset realm. The more users who find value in a network, the more valuable the network becomes, enticing more users and so on.

Cryptocurrencies are no different in this regard, though many would argue that cryptocurrencies are only good for speculation, let them rant. They do not understand the other subtle societal benefits cryptocurrencies offer, and to be frank, they don’t need to. As of May 4th, the market capitalization of cryptocurrencies was just over $240 billion USD. That is more than a mere experiment. Something very real is happening here, and those who ignore it are likely to face some significant regrets in the future.

The Time is NOW

If any of the points laid out above resonate with you, stop trying to pick your entry point, you never will. Prices will always seem too high and valuations will always be impossible to justify. One thing is certain, there will be moments of regret. The key to this asset class is that it will always deliver unrelenting punishing volatility. The intense feelings of FOMO (fear of missing out) and buyers remorse are almost too much to bear for any sane investor, so follow some simple strategies to make the journey easier.

- DO dollar-cost-average.

- DO think of this as a small piece of a larger asset allocation.

- DO tinker around and see what all the fuss is about. Try moving money from one account to another, send some to a friend, experience the freedom of not relying on a bank or intermediary. Be prepared to get frustrated because the UI/UX has a long way to go, just go with it, you are part of something revolutionary. Importantly, you will make mistakes so only venture in with a small amount of capital.

- DO NOT invest more than you can afford to lose.

- DO NOT invest everything at once, and

- DO NOT deviate from your plan.

Given those thoughts, if you are still wondering how much or when to invest, consider the Rule of Three.

- No more than three percent of your investment portfolio.

- Dollar cost average with three percent of your income.

- Have a three year time horizon.

So come on in, the water is warm, dip a toe in the shallow end. If you have any questions or would like to learn more about my team and I at Blockforce Capital navigate the volatility, please reach out for more information.